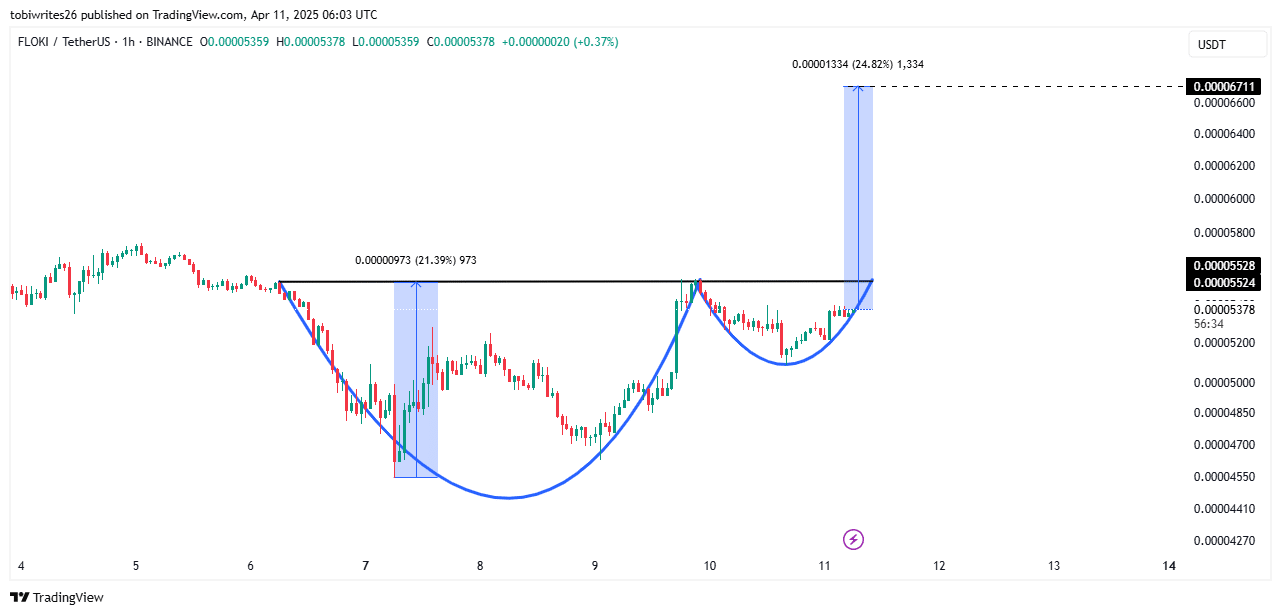

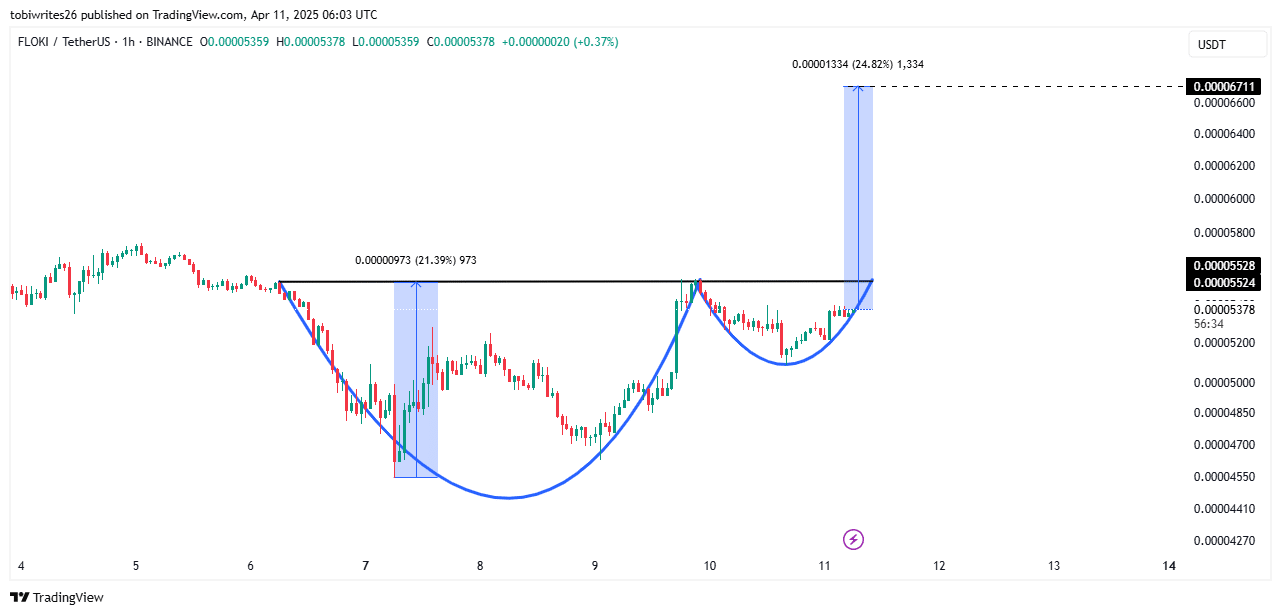

- Floki has formed an optimistic technical model known as the cup and sleeve – a sign of a rally

- A transversal gold pattern has also surfaced on the graph, with the accumulation of assets moving on the cash market

Floki (Floki) recently shown a level of bullish feeling on the market, with a 2.42% rally, gradually trying to challenge the drop in his expense month of 12.27%.

In fact, several bullish indicators have surfaced on the graph, revealing that the current step could extend more while market players continue to buy Floki.

The bullish motif could be a launchpad rally

The press time training of the cup and the handle motif on the graph seemed to be an indication of an incoming rally. Such a model generally precedes a major upward movement.

According to this analysis, this rally could be a potential launch for the main price gains of 24.82% to 0.00006711 from its press price level.

Source: tradingView

However, the rally would ignite completely once Floki is missing the black resistance line on the graph. Once he crosses the level, he could reach the target. Technical indicators have also highlighted a possible advantage. Two key tools – the average ribbon (MA) and the parabolic SAR – seemed to support this point of view.

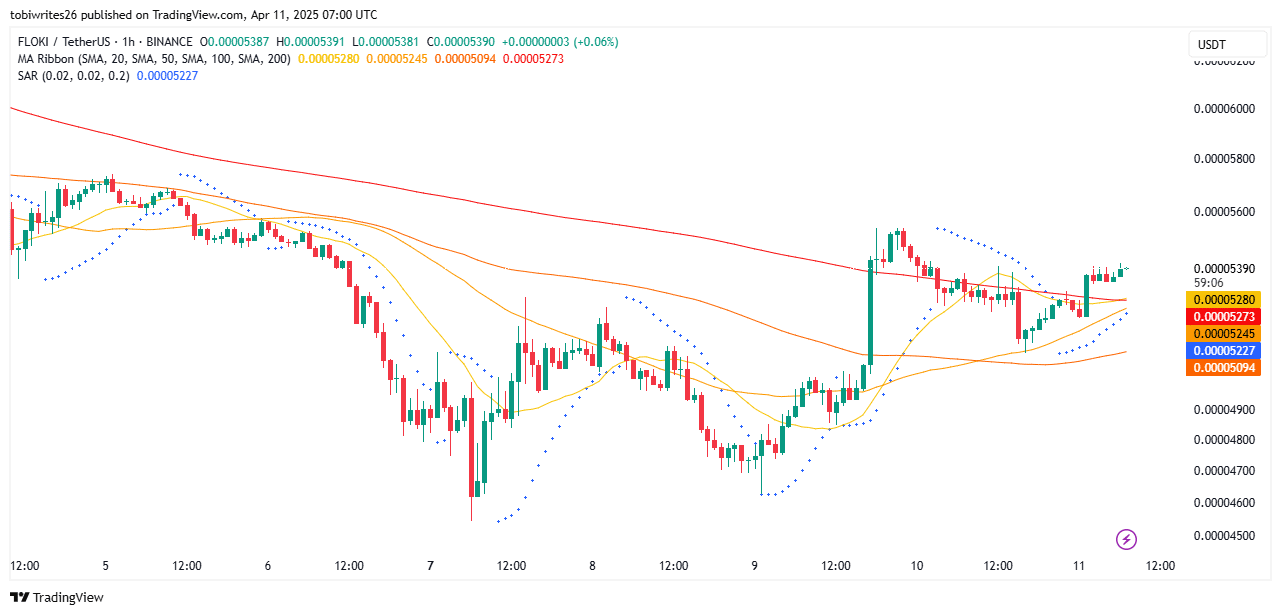

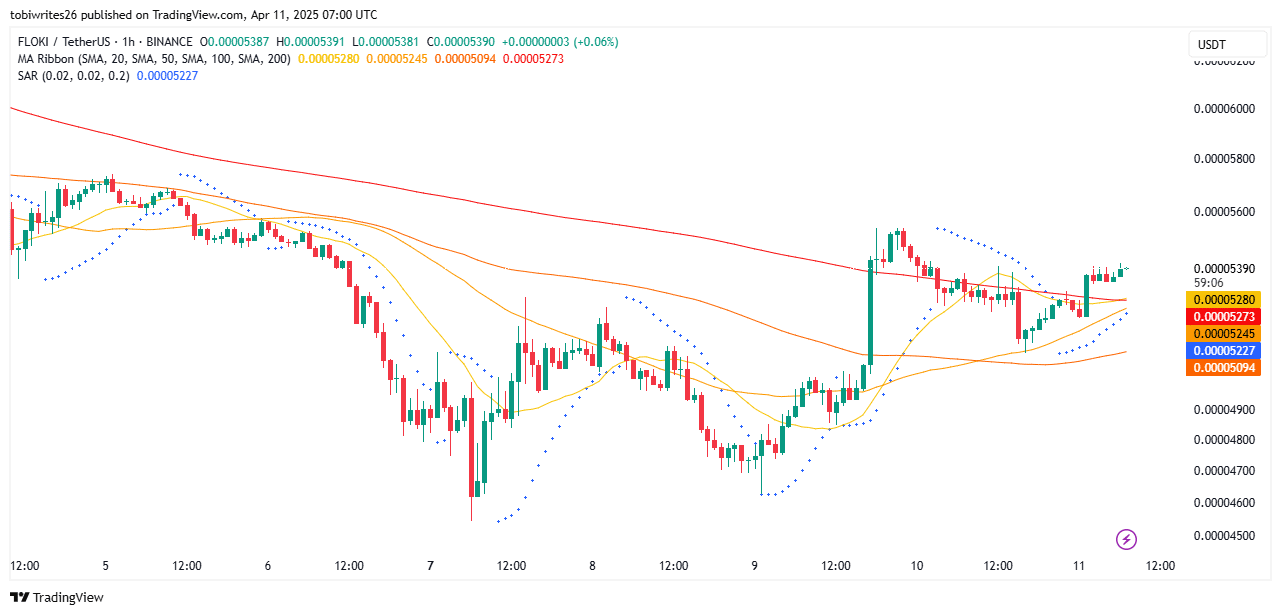

The MA ribbon includes several simple mobile averages (SMA) – 20, 50, 100 and 200. At the time of writing the editorial’s moment, it reflected a degree of bullish feeling.

This perspective was confirmed by a golden cross motif. SMA 20 in the short term also crossed the long -term SMA 200. Such crossing means that short -term merchants have mastered the long -term downward trend.

Source: tradingView

The parabolic SAR also added to this upward wave for Floki. This indicator uses points to determine the trend.

This is the case when these dotted markers appear above the price. This means that sellers are gaining strength on the market. On the contrary, below the price, this means that buyers control.

An overview of the graph pointed out that a series of dotted markers have formed below the action of Floki’s press award. This can be interpreted to refer to market confidence, with another passage to the possible.

Feeling of purchase through the market

Market traders during last week have gradually accumulated the assets, contributing to the training of press prices on the graph.

According to Exchange Netflows, who follow the movement of an asset in and outside the exchanges, traders on the cash market bought $ 502,000 from Floki. If this purchase model continues, these professions could prepare the land for a progressive compression of the offer.

Source: Coringlass

The derivative traders also took advantage of the bullish feeling, placing long bets like overvoltages in volume of purchase.

The purchase sales ratio of takers revealed an increase in the purchase activity, with a reading of 1.024. All reading greater than 1 means that there is more purchase activity on the market and that the asset tends to follow this path.

Overall, if market indicators and feeling continue to stay in the bullish territory, a possible upward price thrust is likely.