- Bullish market structure and buying pressure could allow FLOKI to extend its rally

- Clearance data showed a price decline was likely

The recovery attempt has been relatively strong for Floki Inu (FLOKI). Since the sharp drop on August 5, FLOKI is now up nearly 52%, compared to 31% for Bitcoin (BTC). Additionally, FLOKI has also imposed a bullish market structure on the one-day time frame.

This could pave the way for the memecoin to return to its pre-July price crash levels. At the time of writing, a 20% surge seemed likely.

Daily close encourages further upward movement

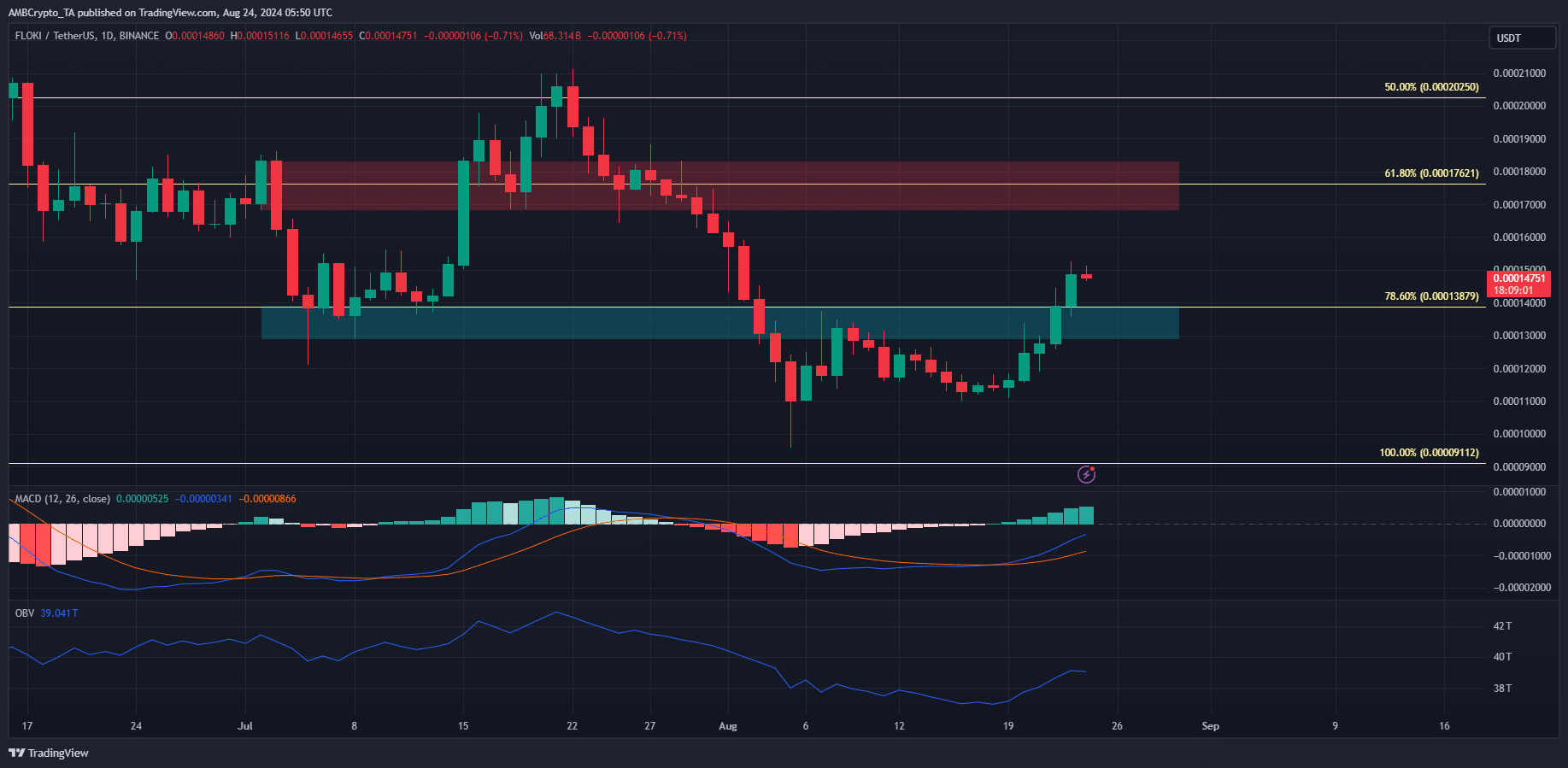

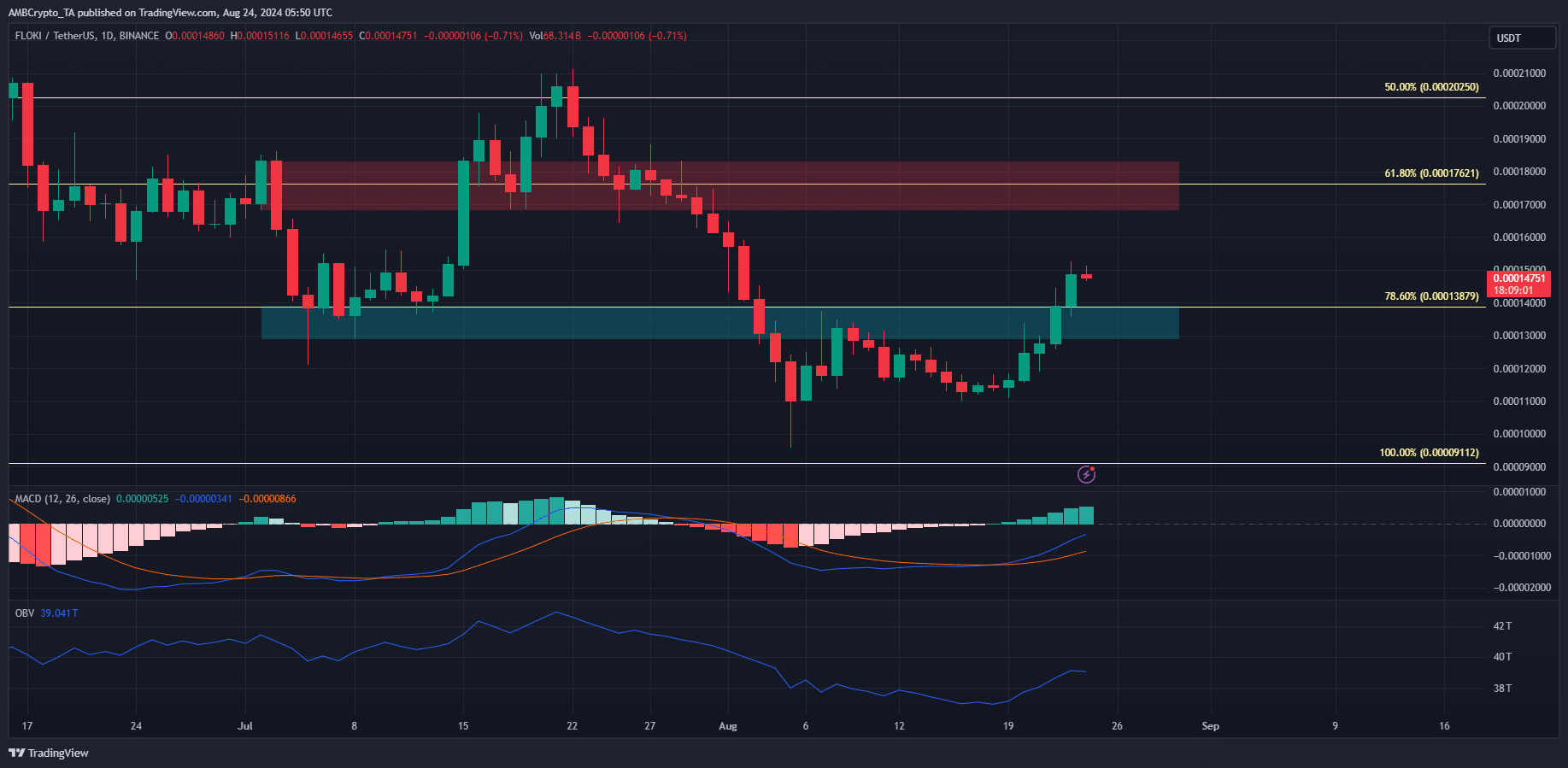

Source: FLOKI/USDT on TradingView

Price action on the daily chart was bullish after the recent move above $0.00014. A retest of the $0.000138 region as support would present a buying opportunity targeting $0.000176, the next significant resistance.

The MACD, although below zero, formed a bullish crossover and signaled that bearish momentum was rapidly losing its grip. The OBV climbed higher over the past week, but was not close to the late July highs.

It is worth noting here that FLOKI appeared to break the downtrend on the daily time frame but was eventually forced to fall. The most recent example occurred on July 21, when a local resistance zone was broken but buyers were unable to defend it.

FLOKI Liquidity Levels Show Strong Uptrend

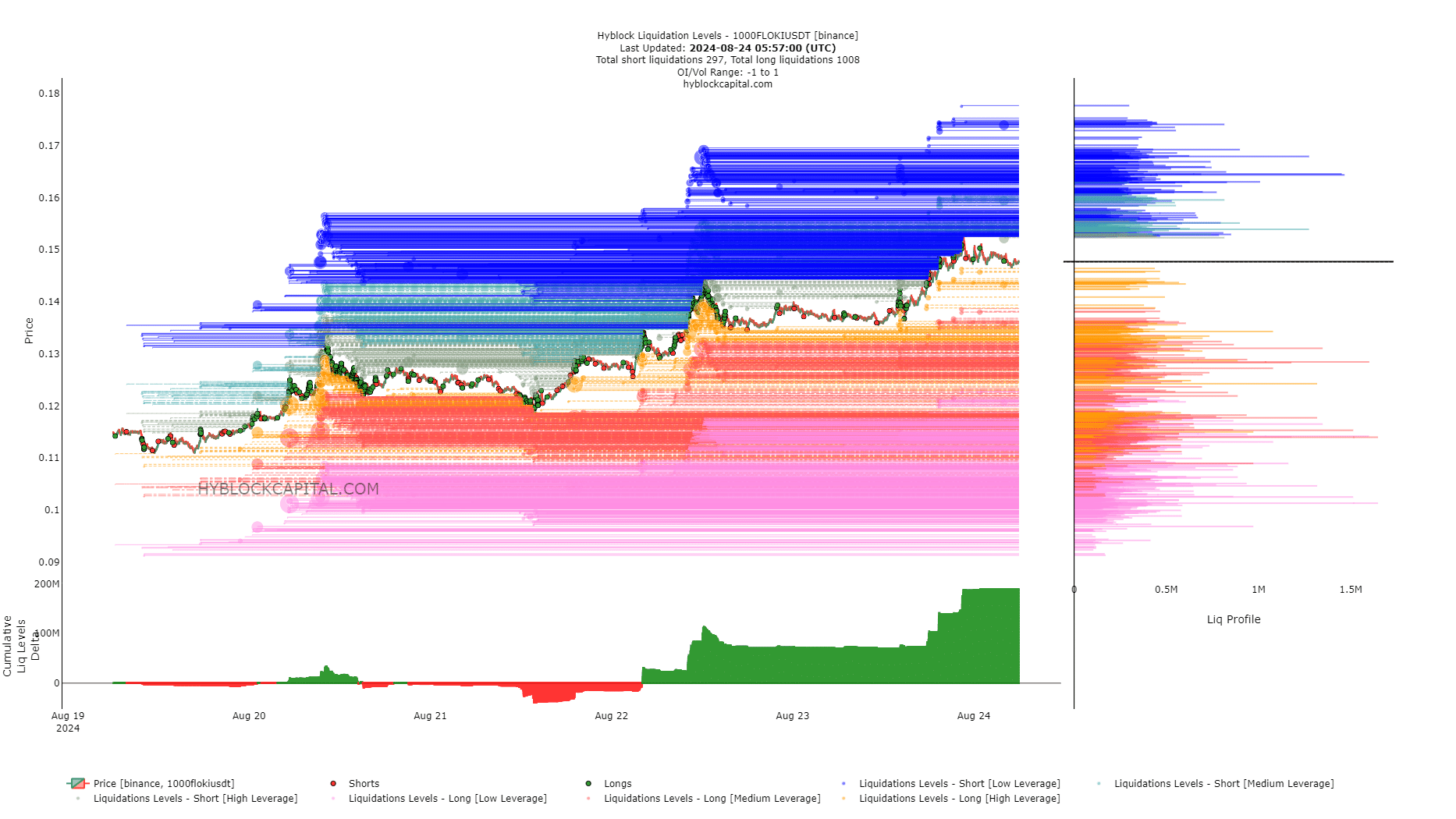

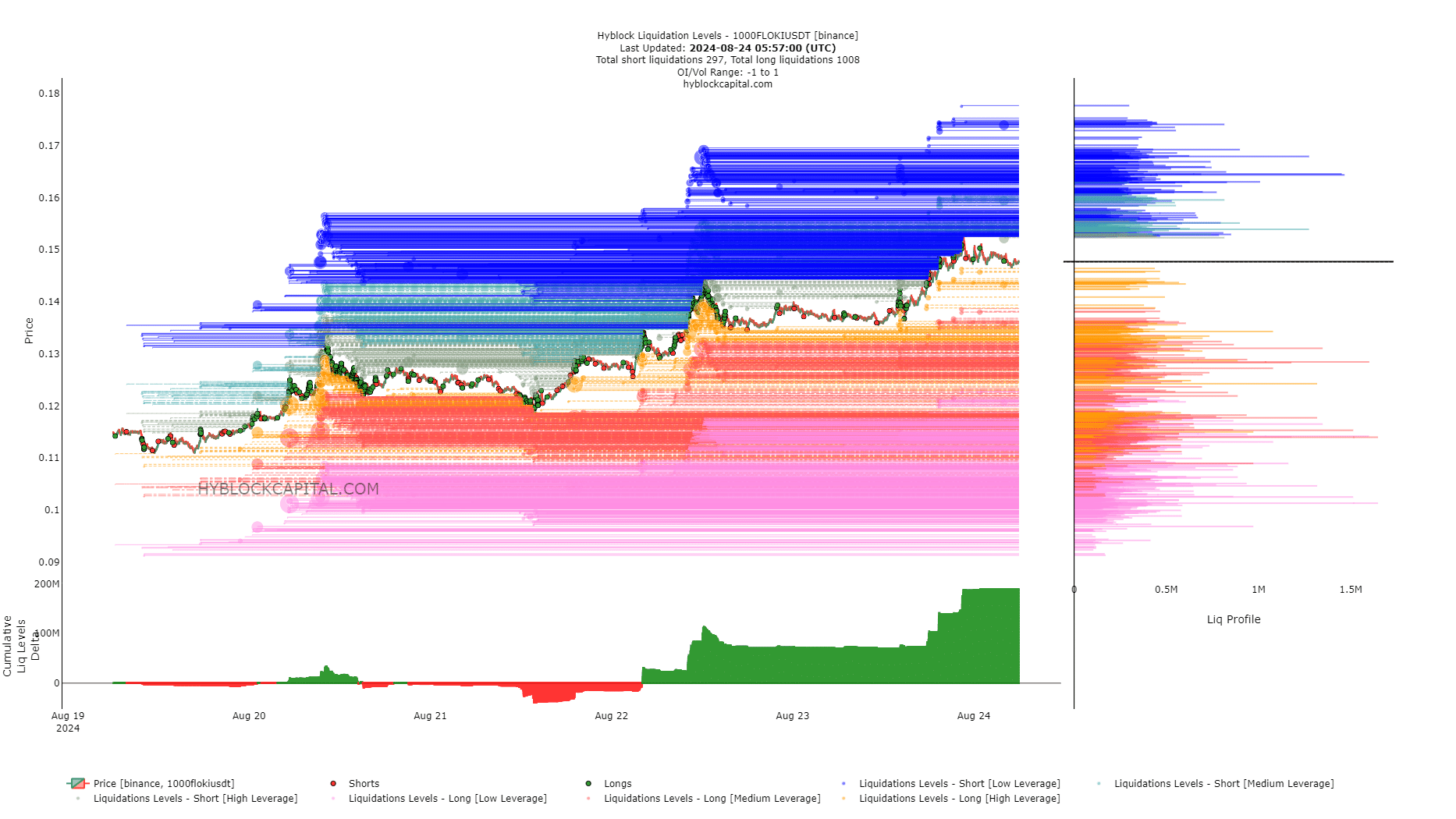

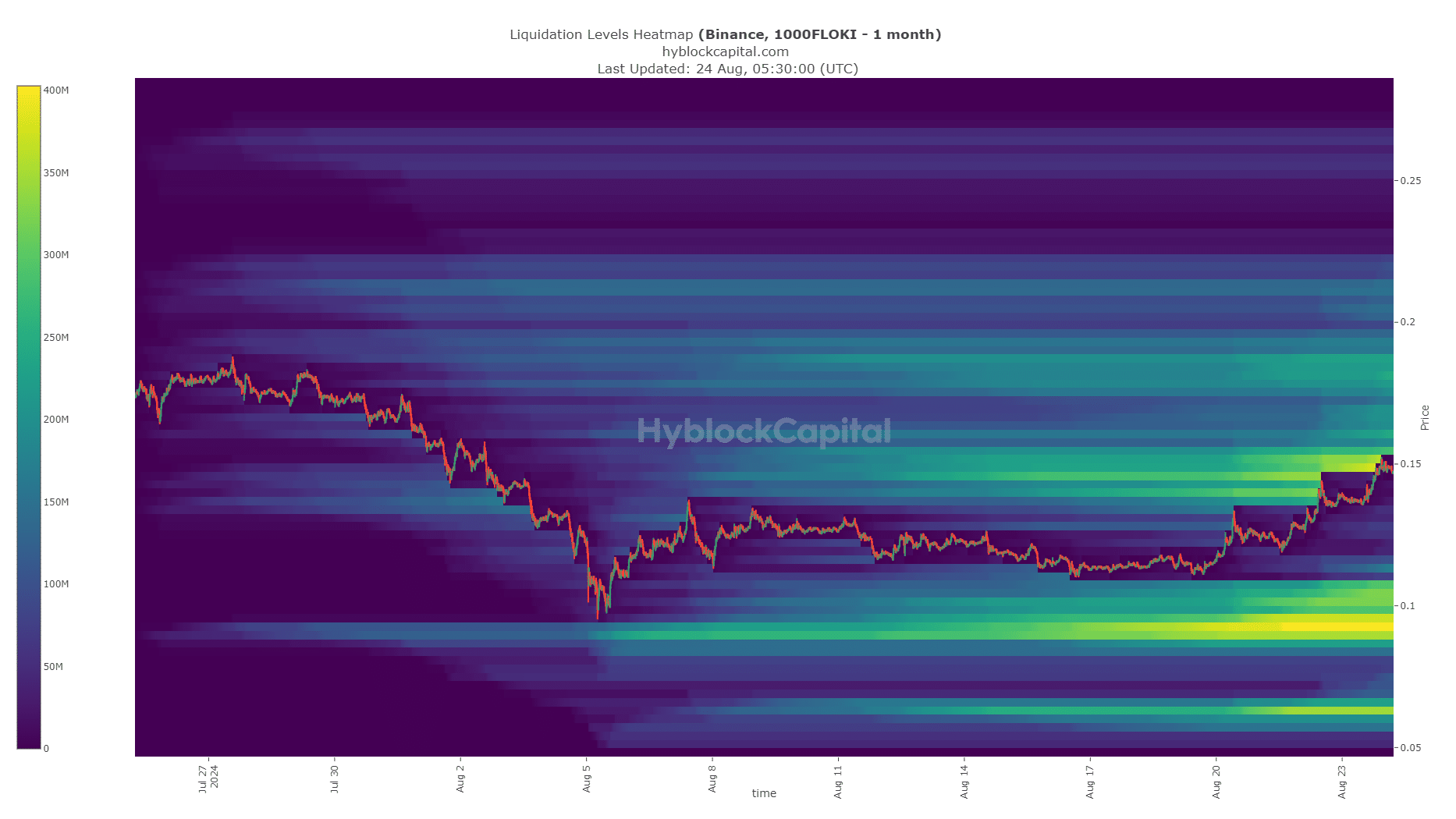

Source: Hyblock

The delta of cumulative liquidity levels was extremely positive, indicating a major difference between long and short liquidation levels in recent days. This bullish anticipation could lead to a squeeze in long positions, although this can by no means be guaranteed.

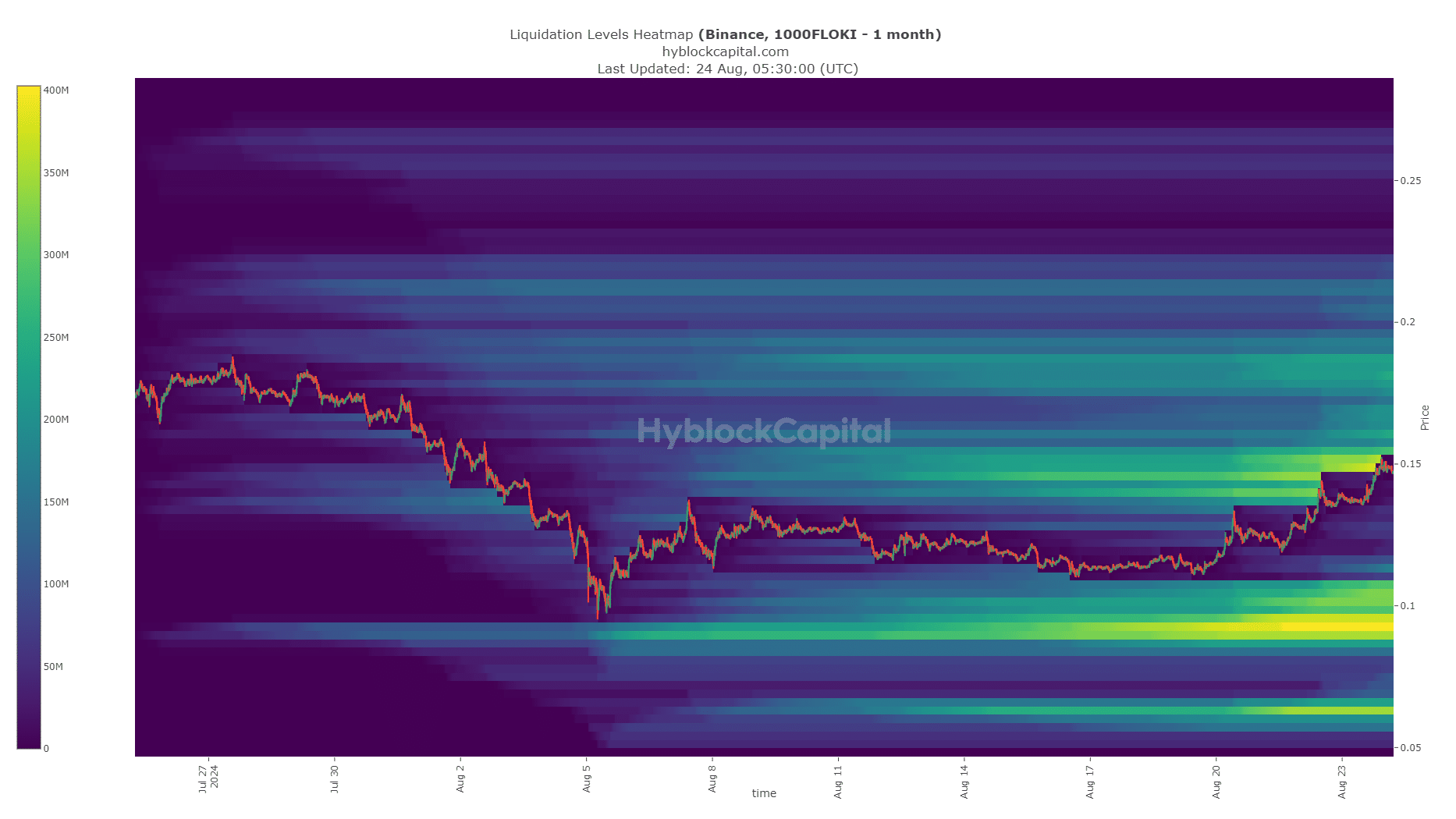

Source: Hyblock

The liquidation heatmap gave another reason for bearish expectations. The $0.00015 pocket was the key liquidity cluster to the north and appeared to have been swept away over the past 24 hours.

Realistic or not, here is FLOKI’s market capitalization in terms of BTC

Liquidity is higher on the upside, but traders may also be wary of a bearish reversal in the short term. A prolonged drop below $0.000128 would signal that $0.0001 is the next target.

Disclaimer: The information presented does not constitute financial, investment, trading or other types of advice and represents the opinion of the author only.