As Bitcoin finally surpassed the $100,000 mark, a wave of optimism swept through the cryptocurrency market.

However, Chris Burniske, former ARK Invest analyst and current partner at Placeholder, urges caution among investors, advising them not to get carried away by the hype surrounding a potential $10 trillion market cap.

The recent rise of Bitcoin has reignited discussions about the future of the cryptocurrency market, with some analysts predicting that Bitcoin could reach astronomical valuations. Burniske cautions, however, that while the idea of a $10 trillion market cap may be “directionally correct” for the long-term future, the market is unlikely to reach such a high valuation during this cycle. .

“People won’t like me to say this, but if $10 trillion is the overall goal, then we probably won’t hit it this cycle,” Burniske posted on X (formerly Twitter), acknowledging the enthusiasm but urging investors to keep their feet on the ground.

Burniske’s caution stems from his experiences in past bull markets, including the 2021 rally. At the time, projections of Bitcoin hitting $100,000 and Ethereum hitting $10,000 were widespread, but the price of Bitcoin has peaked at around $70,000 and Ethereum peaked at almost $5,000. These missed goals remind us how hype can often lead to inflated expectations that ultimately result in disappointment.

Strategic profit taking amid market frenzy

As the price of Bitcoin approached new highs, Burniske emphasized the importance of strategic profit-taking. For those who entered the market when the crypto market cap was below $1 trillion, he suggests it might be wise to start making gains as the market approaches the $3,000 to $3,000 range. 10 trillion dollars. “No one has ever lost money while making a profit,” Burniske remarked, advising investors to balance their long-term goals with the reality of short-term market fluctuations.

Burniske also advocates keeping certain assets in the market for long-term exposure, while taking profits in the market frenzy. “Sure, keep a few coins forever, but also binge profit and live your life. Time is more valuable than even $BTC,” he added, reminding investors that chasing the perfect market movement often leads to missed opportunities.

Volatility issues and liquidity deficits

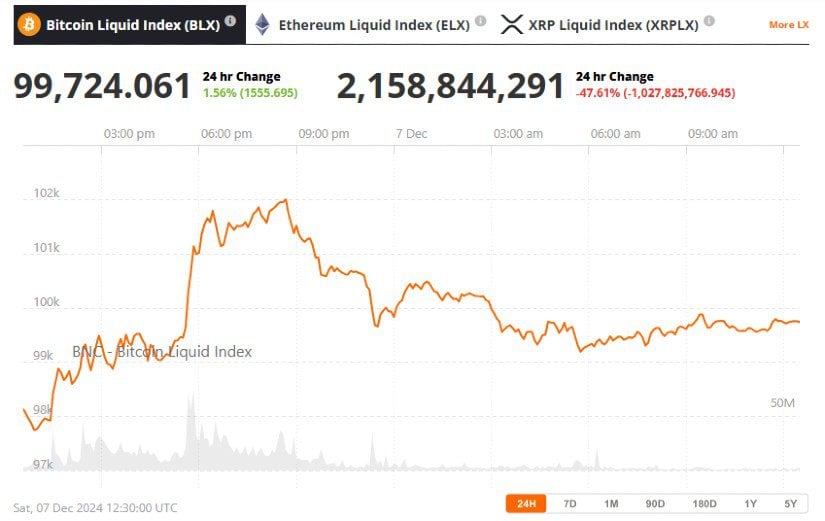

Bitcoin Liquid Index (BLX). Source: Brave new piece

Bitcoin’s rise past the $100,000 mark has sparked concerns about the potential for market corrections and volatility. Analysts are monitoring key levels, such as the $39,000-$40,000 range, which is an important accumulation zone for investors. According to blockchain analytics firm Glassnode, this area represents a crucial support level if the Bitcoin price declines.

Over the past few months, the $62,000 to $64,000 range has also become an area of high demand, which has helped fuel the rise in Bitcoin’s current price. However, as the price of Bitcoin fluctuates, analysts are particularly concerned about liquidity deficits. Glassnode highlights that Bitcoin faces weak support below $96,000, which leaves room for increased volatility if the market drops to $88,000 or lower.

Market sentiment: a mixed picture

While Bitcoin’s record price has sparked celebrations within the crypto community, many investors are also grappling with the tension between optimism and caution. Early adopters, who have weathered years of volatility, are reflecting on their journey, while others are concerned about the increasing institutionalization of the market and its impact on the cryptocurrency’s core values.

Prominent figures, including Anthony Pompliano, have praised Bitcoin holders for their resilience, but skepticism remains over the sustainability of the current rally. Regulatory uncertainty and low liquidity are among the concerns highlighted by critics, with many questioning whether the market will maintain its upward trajectory.

As Bitcoin continues to grow, Burniske’s advice reminds investors that while the cryptocurrency’s future may be very bright, short-term volatility and inflated expectations could derail potential gains. His message encourages a balanced approach to investing, combining long-term holding strategies with prudent profit-taking to weather market ups and downs. While Bitcoin’s recent highs are undeniably significant, Burniske’s caution is a timely reminder of the unpredictable nature of cryptocurrency markets.