Bitmart Research, the search arm of Bitmart exchangepublished a full report on World Liberty Financial (WLFI)Analyzing the Challenge ecosystem evolving the project, the Tokenomic and its unprecedented integration of $ 1.5 billion in the Sigma Alt5 classified at the Nasdaq. With the Stablecoin USD1 at the heart of its expansion strategy, the WLFI quickly deployed loan, trading and reduction of public services through Ethereum, BNB Chain and Solana – while entering high -growth vertical protocols like the samefi, AI and LSD. The partnership with Alt5 Sigma, which reflects the Bitcoin Treasury model of Microstrategy, marks an important step in filling cryptographic assets with traditional financial infrastructures. While the WLFI is gaining ground through the launciations, RWA integrations and ignition ecosystems, this report explores what its architecture and strategic internship actions look like can redefine what the adoption of the institutional crypto in the next cycle looks like.

I. Project updates

In the past year, World Liberty Financial (WLFI) built a complete challenge ecosystem focused on the stablecoin of the USD, extending in the loan, trading, payments, the same, LSD, AI and even its own blockchain. Its strategy can be summarized in three phases:

-

Establish the fundamental demand of the USD1 in deployment of loan and trading scenarios through large blockchains such as BSC, Ethereum and Solana.

-

Integrate the USD1 into the emerging sectors, including memes, stablescoins and AI thanks to investments and partnerships, thus increasing the frequency of use and the grip of users.

-

Ensure long -term growth by strategically investing and incubating projects at an early stage, obtaining token rights and stimulating a new USD adoption.

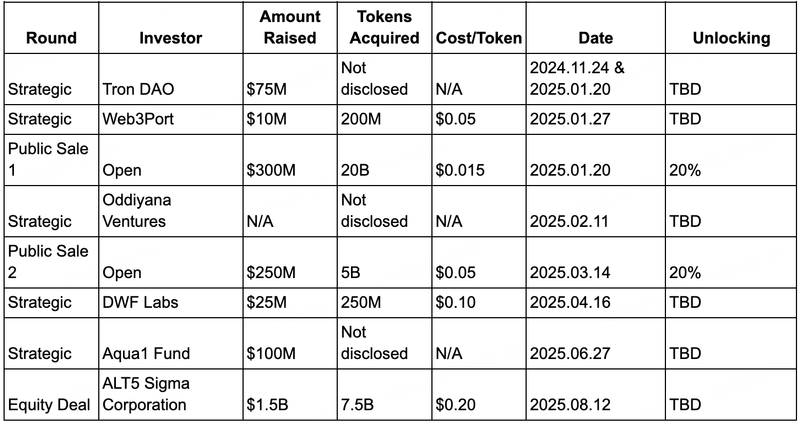

WLFI has carried out four main funds for funding to date, with public sales at a price of $ 0.015 and $ 0.05 per token. Strategic towers have attracted industry leaders such as Justin Sun (Tron DAO), DWF Labs, Aqua1 Fund and Web3port.

The most important milestone was WLFI’s partnership with Alt5 Sigma, listed at Nasdaq. In its latest S1 file, Alt5 SIGMA announced a purchase of $ 1.5 billion in WLFI governance tokens, acquiring about 7.5% of the total offer and receiving $ 750 million tokens in advance. This decision was largely compared to the Bitcoin Treasury Strategy of Microstrategy – recommending digital assets in the balance sheet of a public enterprise, thus increasing the financial and regulatory legitimacy of WLFI. The integration is also underlined by Eric Trump who joins the board of directors of Alt5 Sigma and the CEO of WLFI, Zach Witkoff, becoming president of the company.

Presentation of WLFI investment rounds

II Tokenomics and market performance

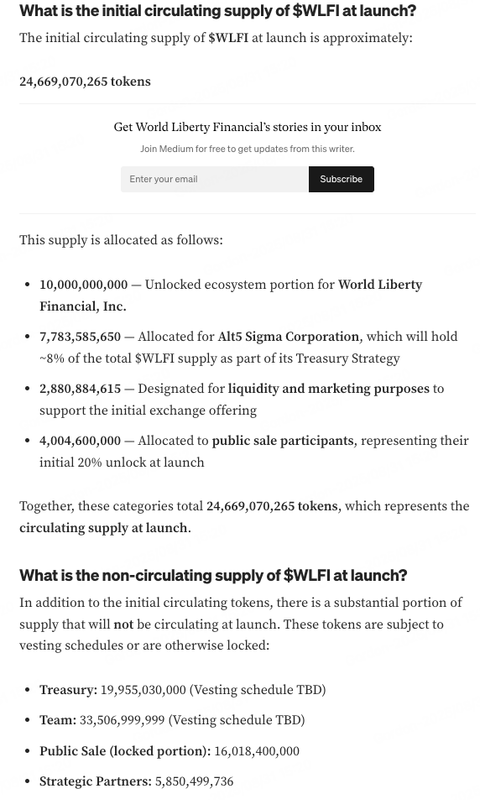

According to the official WLFI blog, 24.67 billion tokens (24.6% of the total offer) were unlocked at TGE, distributed as follows:

In particular, the allocation of Alt5 Sigma is considered to be part of its strategic reserves and should not circulate in TGE. Likewise, ecosystem tokens would be linked to the USD1 award program and are not immediately negotiable. Consequently, the real circulating offer is estimated at 20% of public sales + liquidity / marketing.

Market performance

The WLFI was launched on September 1 with a limited initial dynamic due to the uncertainty of food in circulation. The token culminated at $ 0.32 before correcting $ 0.225 by September 2. This is equivalent to a market capitalization in initial circulation of $ 5.71 billion and an entirely diluted evaluation (FDV) of $ 23.1 billion.

-

Public sale 1 investors ($ 0.015 input) saw paper gains up to 20x.

-

Public sale 2 The participants (entry of $ 0.05) carried out several multiples in TGE.

-

Strategic investors such as Web3port and DWF Labs have also recorded solid returns.

-

Alt5 Sigma, entering $ 0.20, is closest to the current market price and therefore represents a psychological support area. Pre-commercial historical transactions suggest that WLFI finds a strong purchase interest around $ 0.20, but a decisive break below this level could trigger a wider panic of the market.

Currently, the WLFI price dynamics depends on two main factors:

-

Unlock the sales pressure of public sales investors.

-

Potential token entries in the Ecosystem or Strategic Reserves of Alt5 SIGMA.

If the ecosystem tokens remain locked in the USD1 reward plan, short -term sales pressure must remain manageable. However, if the ALT5 SIGMA or the related funds decide to unload the assets, the stability of WLFI prices could face substantial challenges.

III. Ecosystem development

Challenge

-

Dolomite – A decentralized lending and trading protocol on Ethereum. USD1 was integrated, with Dolo / USD1 as the main market pair. Dolomite represents approximately 90% of USD on Ethereum loan liquidity. Its co-founder Corey Caplan Also of WLFI CTO service.

-

Lista Dao – A loan and stablecoin platform based on BSC. USD1 was added as guaranteed, with live pairs live on Pancakeswap.

-

Stake – A transverse LSD liquidity protocol. Combines with WLFI to allow USD -based implementation yields and cross -liquidity.

Flakes

-

Let.bonk – Solana Launchpad official of the USD1, taking advantage of the culture of memes to incubate new projects.

-

Build – A project even on BSC developing an exclusive launchpad at 1 USD.

-

Blocking – Official Launchpad of WLFI, co-founded by Matthew Morganwhich is also CIO of Alt5 Sigma.

-

Aol – even token launched by the WLFI advisor @cryptogle, with plans for America.fun Launchpad.

Rwa and Stablecoins

-

USD1 – WLFI’s Stablecoin USD was launched in March. Market capitalization has exceeded $ 2.4 billion By September 1, with> 88.5% traffic on the BNB channel.

-

ChainLink (link) – WLFI operates the CCIP of the chain chain for cross interoperability USD1.

-

Ethena (ENA) – Pamid in December to integrate into Susde.

-

Finance Ondo (Ondo) – USDY and OSG added to the USD reserves.

-

Endcon finance – WLFI has invested $ 10 million; The USD1 can be used for the decrease in synthetic stablescoins.

-

Panache network – WLFI integrated USD1 as a reserve guarantee for PUSD.

Other projects

-

Vaulta (formerly EOS) – renamed Web3 Banking Infra; WLFI has invested $ 6 million, integrated USD as a settlement.

-

EGL1 – Same Project winning a WLFI trading competition.

-

Freedom – Charity token powered by USD on the BNB channel.

-

U – Project even with the public portfolio of WLFI holding> 45% of the offer.

-

Label – AI decentralized AI data platform using USD1 for business payments and rewards.

IV. Conclusion

The current WLFI traffic offer is subject to two competing interpretations:

-

Optimistic scenario: Only chips of 6.88 billion effectively circulate, because the reserves and allocations of Alt5 ecosystems are strategically locked. At ~ $ 0.23, this is equivalent to a circulating market capitalization of ~ $ 1.58 billion.

-

Risk scenario: ALT5 assets and ecosystem allowances could possibly enter traffic, representing massive overhang and potential sales pressure.

In the meantime, the development of WLFI will continue to revolve around its USD ecosystem. Partnerships and new public services – such as development and loans – should lead to the adoption and evaluation of tokens. Meanwhile, the investment and integration of Alt5 SIGMA governance of $ 1.5 billion in investment of $ 1.5 billion firmly integrated WLFI into the regulated financial narrative. If WLFI will successfully reproduce the Microstrategy Bitcoin Treasury model, it could gain a significant traction in traditional finance and improve its long -term financialization potential.

About Bitmart

Bitmart is a world’s first world trading platform with more than 12 million users worldwide. Cutting classified as the best crypto exchanges on Coingecko, Bitmart offers more than 1,700 trading pairs with competitive costs. Committed to continuous innovation and financial inclusiveness, Bitmart allows users around the world to negotiate themselves transparently. Learn more about Bitmart at WebsiteFollow them X (twitter)Or join their Telegram For updates, news and promotions. Download Bitmart application To exchange at any time, anywhere.

Risk warning:

The information provided is as a reference only and should not be considered as a recommendation to buy, sell or have a financial asset. All information is provided in good faith. However, we do not make any representation or guarantee, express or implicit, as to precision, adequacy, validity, reliability, availability or completeness of this information.

All cryptocurrency investments (including yields) are very speculative in nature and involve a significant risk of loss. Past, hypothetical or simulated performance is not necessarily indicative of future results. The value of digital currencies may increase or decrease, and there may be significant risks in the purchase, sale, detention or negotiation of digital currencies. You must carefully examine whether trading or detention of digital currencies suit you according to your personal investment goals, your financial situation and your risk tolerance. Bitmart does not provide any investment, legal or tax council.