Join our Telegram channel to stay up to date with the latest news

Digital asset investment manager Galaxy Digital is in discussions to provide liquidity to prediction markets Polymarket and Kalshi.

In an interview with BloombergThe company’s CEO, Mike Novogratz, said it was already participating in “small-scale” market-making experiments on prediction markets, adding that it intended to provide “broader liquidity” on these platforms in the future.

By acting as a liquidity provider and market maker, Galaxy Digital would place regular bids and offers to reduce gaps in the platforms’ order books. This will also improve the overall depth of each platform.

Only a few Wall Street firms have publicly ventured into prediction markets. Susquehanna International Group is among a limited number of institutional liquidity providers on Kalshi and Jump Trading also recently began trading on the platform.

Galaxy Digital’s move comes as prediction markets gain momentum

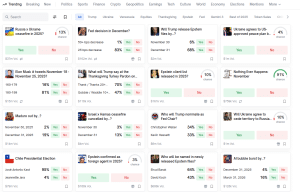

Prediction markets allow traders to bet on real events. These events can range from sports results to political decisions to deadlines and more. Users trade these events via simple yes or no contracts, with contract prices indicating the market-implied probability of each outcome.

Polymarket home screen (Source: Polymarket)

Currently, the market leaders are Polymarket and Kalshi, which collectively recorded a cumulative volume of $42.4 billion.

The platforms gained momentum during the 2024 US presidential election, after Polymarket correctly predicted the election outcome.

Kalshi challenges Polymarket dominance

Polymarket is a decentralization-focused platform that initially dominated the industry, but is now seeing its dominance challenged by Kalshi, which is regulated by the U.S. Commodity Futures Trading Commission (CFTC).

Since September, Kalshi has recorded higher monthly volume than Polymarket.

But that lead could soon be called into question as Polymarket prepares for a U.S. launch. It acquired QCX, a U.S.-licensed derivatives exchange and clearing house, for about $112 million in July, giving it a regulated platform to enter the United States. He received the “green light” from the CFTC to return to the United States.

Polymarket has begun rolling out its platform to a select group of US users in beta mode and is reportedly targeting a late November rollout, initially focused on sports prediction markets.

Polymarket recently signed a multi-year partnership with TKO Group Holdings, owner of the UFC and Zuffa Boxing, to become its “official and exclusive prediction market partner” for live fan engagement.

Meanwhile, Intercontinental Exchange (ICE), owner of the New York Stock Exchange, has made a $2 billion strategic investment in Polymarket and the two have also entered into a deal that will see ICE distribute Polymarket’s data.

We are delighted to announce that Intercontinental Exchange (ICE) — the parent company of @NYSEmakes a strategic investment of $2 billion with a post-money valuation of $9 billion.

Together we are building the next evolution of markets.

A special thank you to everyone who supported us… pic.twitter.com/y7Z3koj3IU

– Polymarket (@Polymarket) October 7, 2025

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news