Join our Telegram channel to stay up to date with the latest news

GameStop has moved its entire Bitcoin holdings to Coinbase Prime, suggesting a potential plan to sell them all, according to CryptoQuant data, as the exchange often serves as a staging ground for large sell-offs.

Although the company has yet to confirm a sale, analysts were quick to describe the timing as consistent with a potential exit from its BTC position.

On January 17, GameStop moved 100 BTC, worth approximately $9.5 million, and an additional 2,296 BTC on January 20, representing 51% of its total BTC cash, with 4,710 BTC acquired between May 14 and 23, 2025, spending approximately $504 million at an average price of $107,900 per coin.

GameStop throwing in the towel?

Their on-chain wallets just moved all BTC holdings to Coinbase Prime for sale.

Between May 14 and 23, 2025, they purchased 4,710 BTC at an average price. price of $107.9k, investing ~$504 million.

Sold now for around $90.8k, potentially realizing around… pic.twitter.com/Bp7MwRVQ43

– CryptoQuant.com (@cryptoquant_com) January 23, 2026

The BTC treasury remained untouched for months before the abrupt January 2026 exit, suggesting the move was planned rather than routine.

With the company selling BTC at nearly $90,800, it would record around $76 million in losses based on the difference between the average purchase price and current market prices.

GameStop sell-off speculation amid market caution

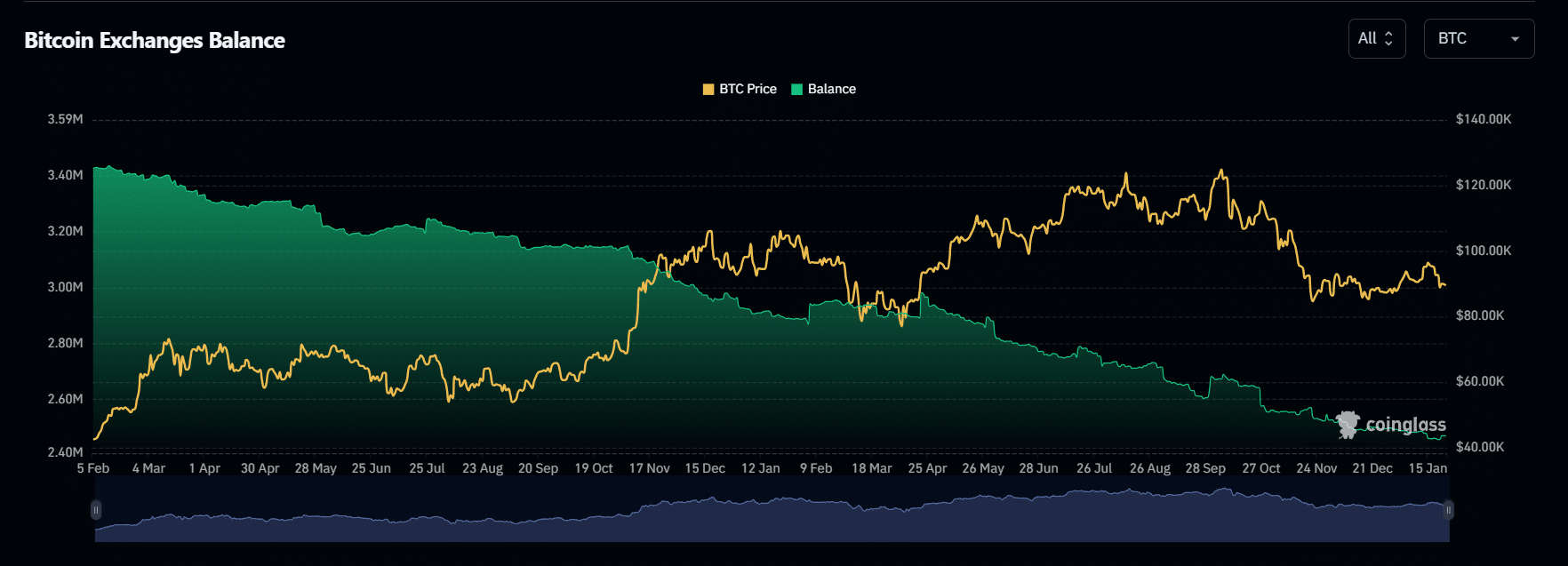

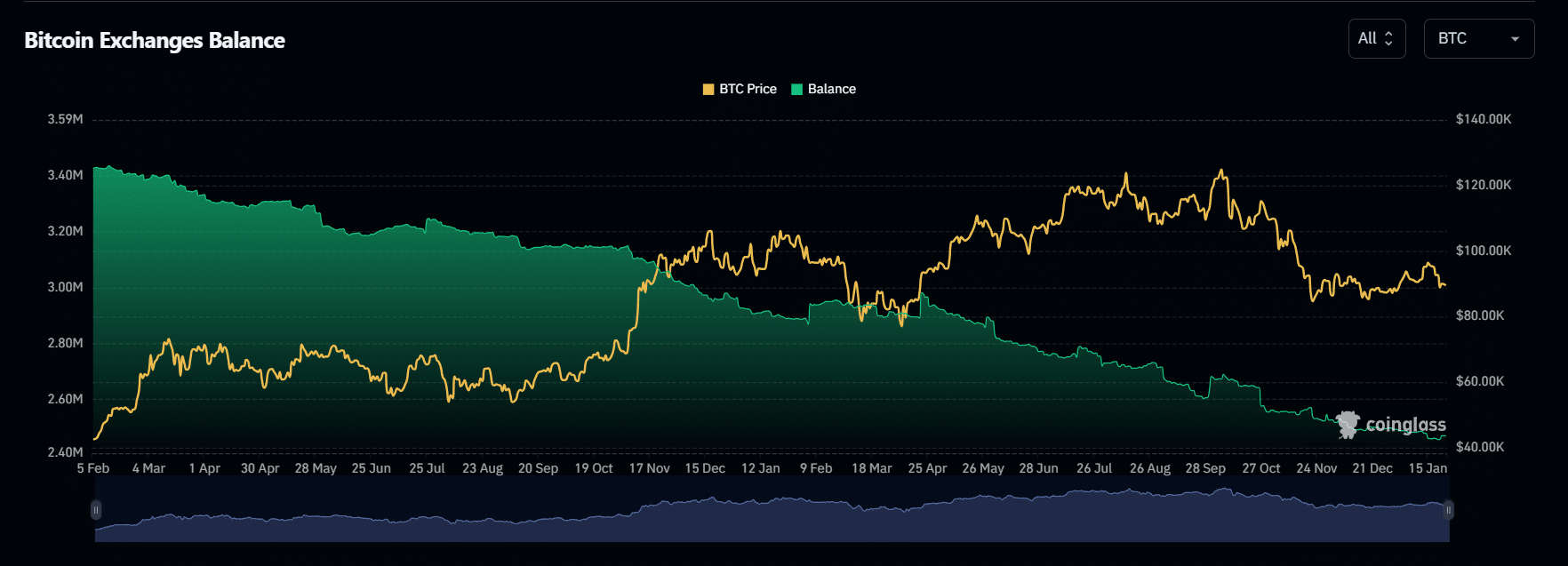

Speculation of an inbound sell-off by GameStop comes as Bitcoin struggles to regain bullish momentum, trading at $89,534 as of 1:39 a.m. EST, amid indicators pointing to increasing activity on the sell side.

Data from coin mechanism shows that centralized exchanges continue to face a sustained outflow of BTC, with 208.95 BTC leaving exchanges in the last 24 hours.

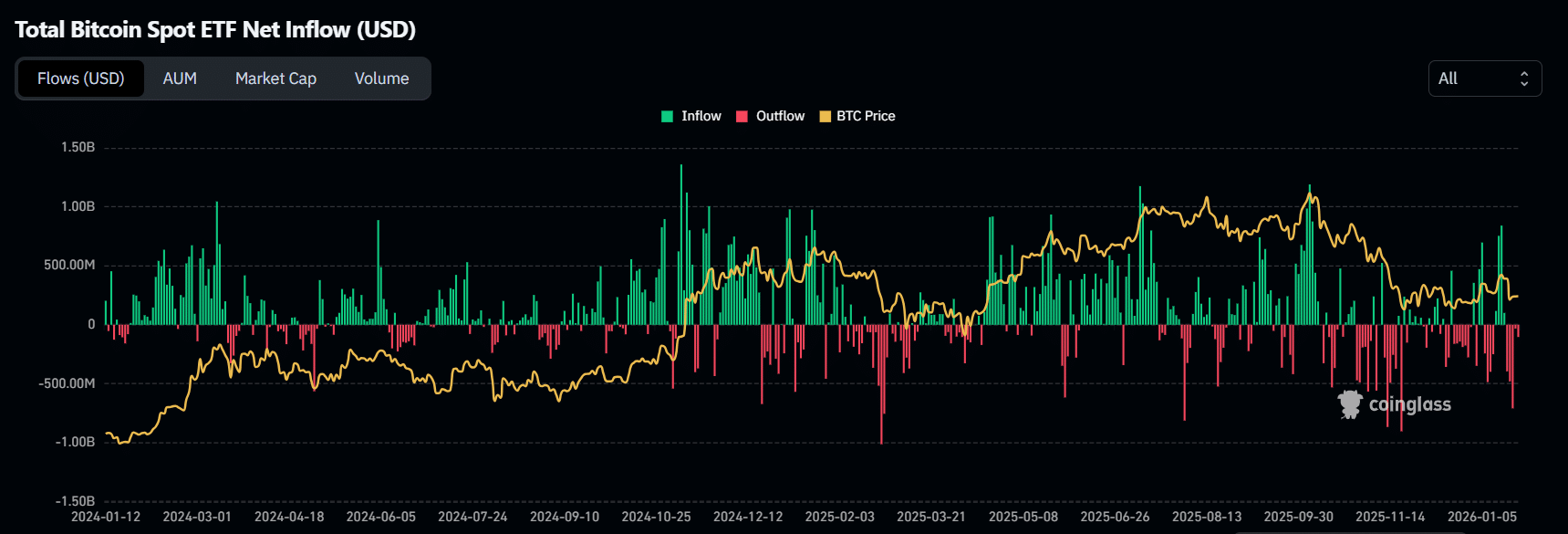

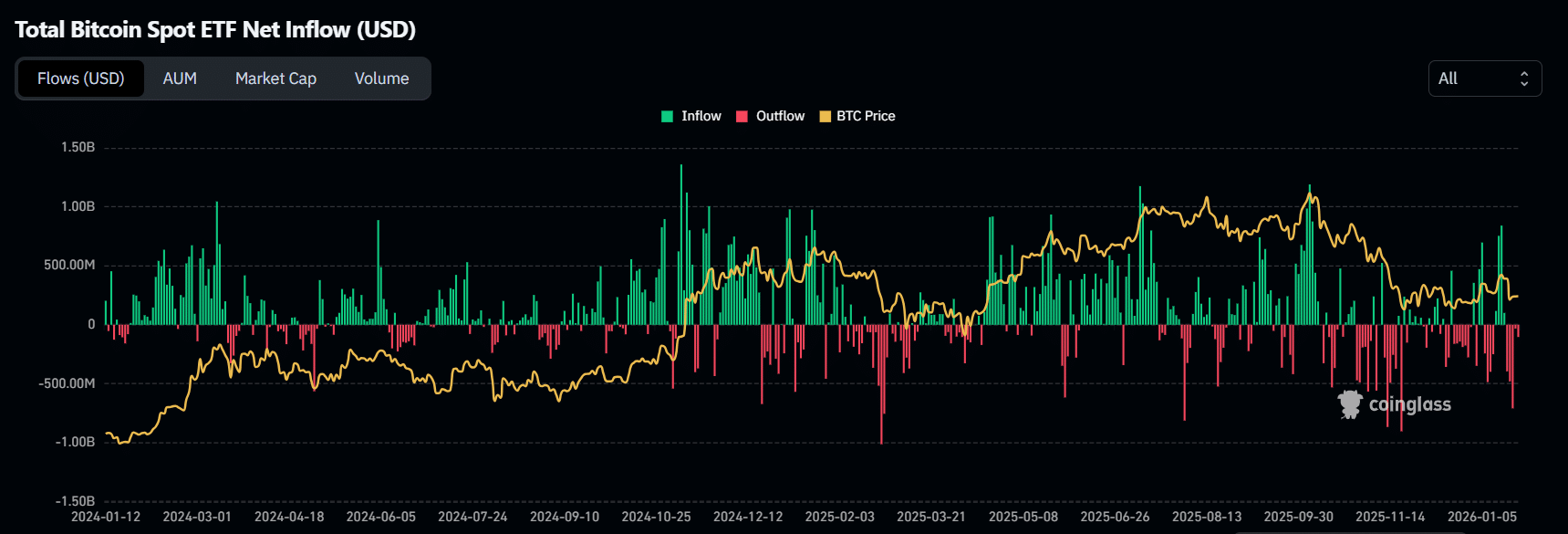

Meanwhile, US Spot BTC exchange-traded funds (ETFs) saw net outflows of $103.5 million over the past 24 hours, marking the fifth consecutive day of outflows this week.

The weakening demand comes amid a week of macroeconomic uncertainty linked to new tariff threats from President Donald Trump, as investors turned to safe haven assets like gold and silver, both of which have reached new all-time highs.

Meanwhile, GameStop shares moved in a different direction with the sale, the company’s shares negotiate to around $23.28 after a 1.26% jump in the last 24 hours.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news