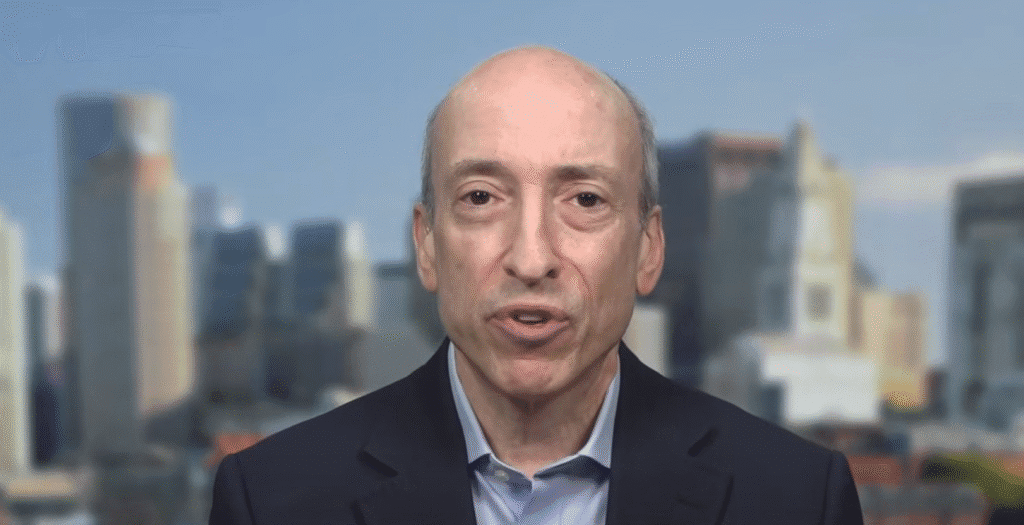

Gary Gensler broke two months of public silence with a fuel appearance in the Squawk box in CNBC, granting his first interview since his resignation from the President of Securities and Exchange Commission (SEC) of the United States on January 20. In a 17 -minute exchange with Andrew Ross Sorkin, the former regulator applauded Bitcoin’s stay while comparing most non -bitcoin tokens to “memes led by feeling”.

The remarks came while the SEC, under the acting president Mark T. Uyeda, moves away from the actions in application of the titles which defined the era peopleler. Gensler refrained from talking about individual cases, which emphasizes rather that cryptographic industry has no fundamentals.

Gensler kisses the maximalism of Bitcoin

“I will take a step back in all individual cases and repeat this to your public public. It is a very small part of the financial markets. But if you are interested in it, think of each type of financial asset of tradic on a little fundamentals and feeling.

“And although something like Bitcoin can persist for a long time because there are seven billion people in the world, a real lively interest, there are ten or fifteen thousand others of these tokens … And if it is just feeling, then generally these do not end well and most, then, added,” he added.

Pressed by the co-hospital Joe Kernen on the fact that Bitcoin is treated differently, peopleler conceded a precious analogy to which he had long resisted during his functions: “I think that the distinction is similar to metals, there are only two or three precious metals. We, humans, the feelings are negotiated over the years. »»

The interview lands in the midst of an unprecedented retirement by the Litigation Commission that Gensler himself had authorized. On February 27, the SEC filed a joint stipulation rejecting its civil action against Coinbase, constantly implementing the 20 -month struggle against the non -registered broker activities of the Stock Exchange. Barely five weeks later, lawyers told Kraken that the agency would abandon its complaint in 2023 in terms of exchange of securities “with prejudice”, sparing penalties and operational concessions.

The most consecutive reversal involves Ripple laboratories. On March 19, CEO Brad Garlinghouse declared the victory after learning that the SEC would withdraw its planned appeal from last year’s mixed decision on XRP sales. A joint request filed on April 11 asks the second circuit to hold all “outstanding” calls, effectively closing a four -year battle which once threatened to define the status of security of cryptographic assets in American law.

During its mandate, the Office of Application of Pensler opened or extended more than 150 cases of crypto, arguing that almost all tokens, except Bitcoin, considered as not registered security. His post-emission rhetoric affinizes this line rather than softening it. By praising Bitcoin resilience while rejecting other tokens as a speculative “feeling”, he echoed the Bitcoin maximalist thesis according to which only the original cryptocurrency can work as non-sovereign money.

At the time of the press, BTC exchanged $ 84,178.

Youtube star image, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.