In an interview with David Gura on Bloomberg Markets on Wednesday, outgoing Securities and Exchange Commission (SEC) Chairman Gary Gensler reviewed his mandate and the role of crypto within the US capital markets. Gensler, who has less than two weeks left in his term, remained firm on his stance on the digital asset space, calling it “riddled with bad actors” and emphasizing that “many of them will not survive.”

Crypto is still the “Wild West”

Gensler began by responding to the criticism he faced during his tenure. “It’s a great privilege to serve in a role like this,” he said, noting that he is the 33rd chairman of the SEC and that he thanks President Joe Biden for the appointment. “You come into this central square and you debate these things that are important to 330 million Americans,” he added.

When asked if the level of scrutiny he has experienced is different from his time as head of the Commodity Futures Trading Commission (CFTC) during the global financial crisis, Gensler acknowledged: “ This is changing.” However, he maintained that the commission’s main goal remains “taking care of ordinary Americans, trying to reduce the costs of the markets… It doesn’t surprise me that there are some in the middle of the market who (…) might have ideas. on this and object.

When it comes to crypto, Gensler echoed a theme he has repeatedly emphasized since taking office: The digital assets sector represents less than 1% of U.S. capital markets — he rated the entire of the capital market at around “120 trillion dollars” – and yet it demanded considerable demands. Watch out for the SEC.

He stuck to his previous portrayal of the “Wild West” of crypto, emphasizing: “It’s a field that was built around non-compliance. » He also invoked the coercive measures taken under his mandate and that of his predecessor, Jay Clayton. “Jay has initiated 80 enforcement actions in this area. We recruited about 100 over our four years,” Gensler said. “That’s maybe about 5 percent of what we do in law enforcement,” he noted, explaining that the other 95 percent targets traditional scammers and fraudsters.

Highlighting how sentiment-based and volatile the space is, Gensler divided the world of digital assets into two parts: “This area is full of bad actors. Let me split the pack in two just for a minute. The public knows a lot about Bitcoin, which, depending on its market value on a given day, represents between two-thirds and 80% of the crypto’s market value. And then there’s everything else. Or some people say Bitcoin and Ethereum and everything else.

He was blunt in his assessment that the “other 10,000 or 15,000” are projects without fundamentals that only benefit from changes in sentiment. “I’ve never seen a field so focused on sentiment and less on fundamentals. And these 10,000 to 15,000 projects, many will not survive. It’s like venture capital investments. They will not survive. »

Gensler also pointed out that there are a large number of “small pump and dump systems.” Referring specifically to high-profile enforcement actions, Gensler said, “We’ve had a few years where, you know, they’ve become famous, but they’re in prison. The Sam Bankman-Frieds, the CZs and the Do Kwons, where tens of billions of dollars were lost by investors.”

Gensler was also asked about the transition from his time at MIT, where he studied digital assets, to his enforcement-focused approach at the SEC. He addressed the public perception of him being a “champion” of crypto by highlighting the difference between academic investigation and regulatory responsibilities. “When you are in academia (…) you can study something and observe it (…) But then when you do this job (…) building on my predecessor (…) It is a field full of challenges and non-compliance with legal standards. »

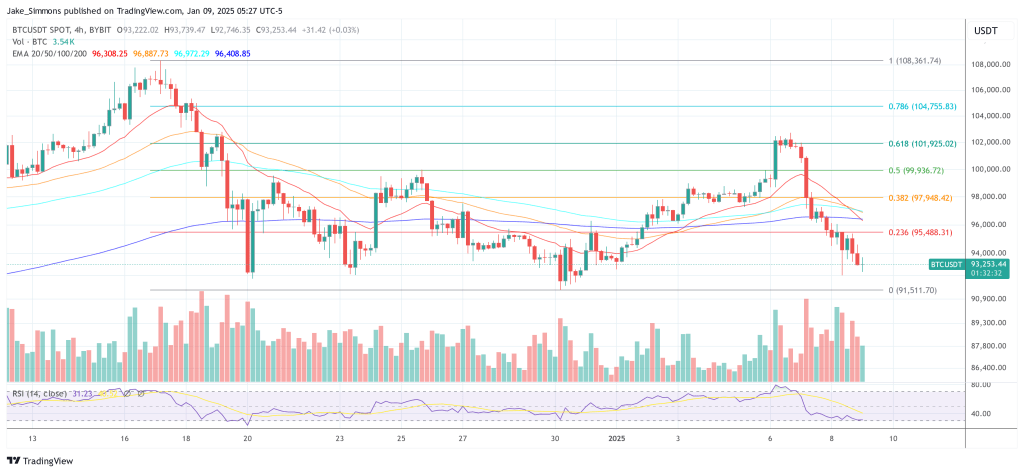

At press time, Bitcoin was trading at $93,253.

Featured image from YouTube, chart from TradingView.com