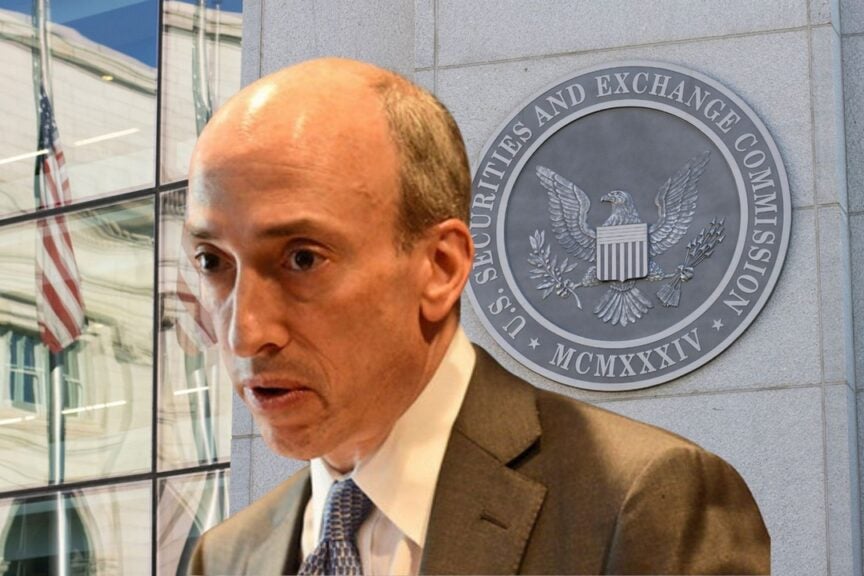

President of the SEC Gary Gensler On Wednesday, he stressed the importance of investor protection and capital markets transparency when discussing the SEC’s approach to regulating cryptocurrencies.

What happened: Addressing concerns about the SEC’s method of enforcing regulations in the crypto space in an interview with Bloomberg, Gensler emphasized that the agency’s role aligns with a broader legislative framework designed to protect public interests and promote capital formation.

“We have enjoyed nine decades of robust legislation from Congress,” Gensler said, referring to the SEC’s power to regulate financial markets to ensure transparency and stability.

Gensler noted that the relatively young crypto market has exposed many investors to significant losses, highlighting the need for clear regulatory oversight.

“Too many people have been hurt, too many people have lost money and ended up in bankruptcy court,” he noted, emphasizing the importance of protections to prevent fraud and maintain trust. investors.

Also Read: Bitcoin Price Stays Below $68,000, But: “Bull Market Will Last Longer,” Says Industry Expert

He also stressed that effective public disclosures and protections against conflicts of interest are fundamental to maintaining trust and avoiding the types of market failures seen in the 1920s.

While Gensler acknowledges that monitoring emerging financial sectors can be difficult, he suggested that new rules in areas such as private credit and non-bank lending would continue to prioritize transparency, risk management and to competition.

The private credit market, Gensler observed, “has not been challenged in an inevitable downturn,” but he noted that its growth could be beneficial to borrowers and investors if properly regulated.

The future of cryptocurrency regulation will be a key topic at Benzinga’s Future of Digital Assets event on November 19.

Read next:

Image: Shutterstock

News and market data powered by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.