Reports from the Ripple Swell 2025 conference show growing interest in XRP. Traders and fund managers are watching November closely.

Related reading

According to speakers at the event, several planned measures could inject more money into the token in the short term.

Canary Capital ETF Calendar

Canary Capital’s spot ETF is expected to go live following an updated S-1 filing, with a possible automatic launch 20 days later on November 13.

Reports on the scene cite Steven McClurg, CEO of Canary Capital, as confirming the update. This filing removed an amendment clause that would have given the SEC greater control over the effective date of the product.

According to reports, the timeline could still change if the SEC answers questions or government operations change, but for now, November 13 appears to be a key date.

Retail and Cool Whale Activities

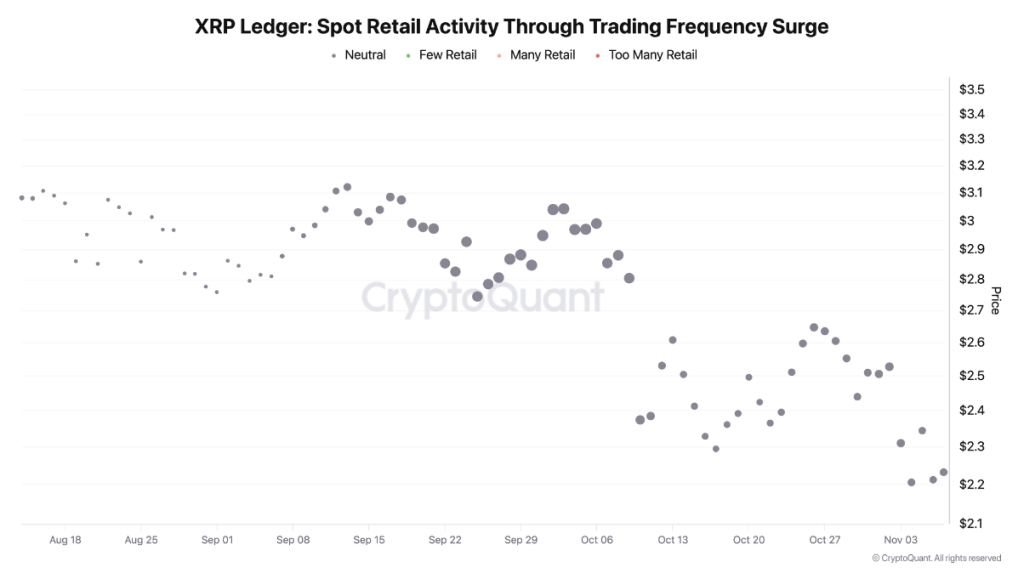

CryptoQuant charts show that retail trading activity has slowed since the big sale on October 10, when around $19 billion was wiped out in a single day.

Small investors have retreated to a neutral zone, which some analysts interpret as cautious waiting rather than an exit. At the same time, large on-chain movements to exchanges have declined sharply – from around 49,000 on October 25 and 44,000 on October 11 to around 800 on a recent Friday.

This decline in whale-to-exchange transactions suggests that fewer large sellers are currently moving funds to exchanges.

“The last half of November is going to be important for $XRP And @Ripple,” said @TeucriumETFs CEO @GilbertieSal during a recap of #RippleSwell Day 1. Go swivel ladies and gentlemen… Believe! ✨ pic.twitter.com/mw9VLuRUCB

– Rayfuentes (@RayFuentesIO) November 5, 2025

Institutional signals

Speakers at Swell highlighted growing institutional interest. Teucrium CEO Sal Gilbertie told the audience that the last half of November could be very important for XRP, tying this view to broader trends in tokenization and institutional flows.

Citibank projections cited at the event indicate that tokenized assets could reach billions within five years, and other panelists mentioned measures planned by traditional financial players.

Circle also reportedly plans to begin trading publicly traded shares in early December, in what some see as another push toward broader participation.

Advice from market players

Gilbertie urged holders to focus on the long term. “Believe in it. Don’t worry about volatility. It will even out as adoption happens and more institutional money comes in,” he said.

This view has been shared by other commentators who have pointed out that ETF listings and institutional integration have historically changed the way markets price assets.

Related reading

What to watch next

Market participants will follow the SEC process, any additional filings, and determine whether the government schedule affects the ETF start date.

On-chain signals – like whale transfers and exchange flows – will also be closely monitored. For now, reports suggest a mix of distrust among retail traders and growing interest at the institutional level, with November 13 marked as a date many are watching.

Featured image from Unsplash, chart from TradingView