The growing attraction of Ethereum among the institutional actors made another leap forward as a global fundamental Inc. (FGF), a company listed at the Nasdaq specializing in reinsurance, in market banks and asset management, revealed an ambitious cryptocurrency strategy in a recent deposit with dry. The plan marks a major pivot towards Ethereum investments, reporting increased confidence in the long -term potential of the assets.

The announcement immediately had an impact on the feeling of the market. While FGF shares closed the regular session on August 7 at $ 36.17, down 1.44% for the day, they jumped 3.76% after opening hours to $ 37.53 after the news. Investors reacted to the aggressive treasure allocation plan, which positions the company alongside other prospective companies adopting Ethereum as part of their business reserves.

FGF’s decision reflects the trend of the Ethereum treasury strategy recently adopted by Sharplink Gaming, highlighting a growing business transition to the integration of ETH into long -term capital strategies. This wave of institutional adoption reinforces not only the position of Ethereum on the cryptography market, but also strengthens its story as a reserve of value and strategic assets in the evolution of the financial landscape.

The bet of $ 5 billion from the FGF on Ethereum marks the quarter of a fatty institution

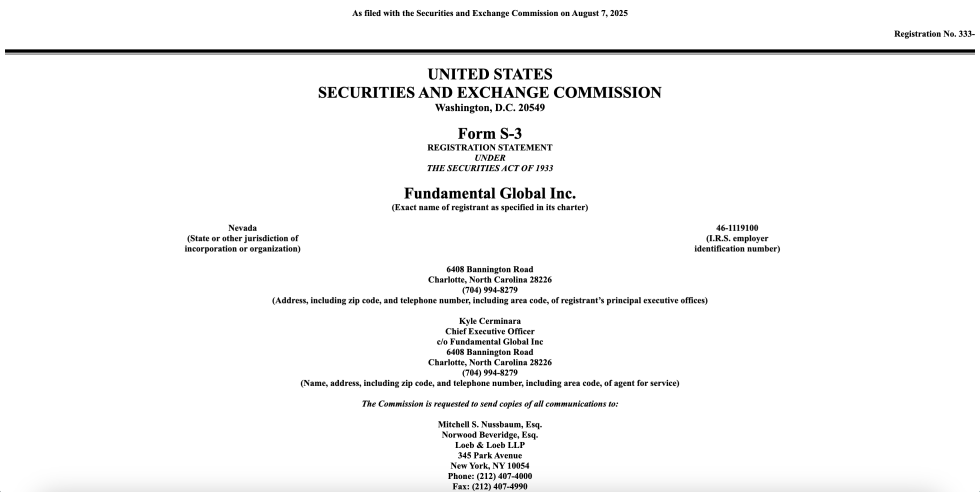

Global Fundamental made a historic passage in the cryptocurrency sector, submitting a S-3 form with the United States Securities and Exchange Commission (SEC) to offer up to $ 5 billion in securities. According to the file, the majority of products will aim to acquire Ethereum, while the rest will cover the needs of companies and operational. This represents a major strategic change for a company listed on the stock market historically outside the cryptographic space.

In the file, FGF described its new approach: “We have recently launched an Ethereum (ETH) cash. ETH is the native token of the Ethereum network. Ethereum is the basis of digital finance and the colony layer for the majority of stablecoins, decentralized finance (DEFI) and token assets. ”

The FGF also underlined its intention to accumulate ETH as a long -term treasure intake, with the aim of increasing its overall position and increasing the ETH by ordinary part through the professional management of the Treasury. The strategy will take advantage of capital recovery activities alongside advanced blockchain -based tools such as puncture, replenishment, liquid puncture and other DEFI protocols to maximize yields and growth in assets.

By positioning ETH as its main cash reserve asset, FGF joins a growing list of businesses – like Sharplink Gaming – which incorporate Ethereum in their business reports. This approach not only diversifies the reserves, but also aligns the company with one of the fastest sectors in digital finance.

The FGF’s commitment reflects a broader institutional recognition of the role of Ethereum as a Blockchain infrastructure base. While more and more companies are adopting similar cash strategies, ETH demand could see sustained increase pressure, strengthening its position as a strategic actor, yield generator and accrediting the value in the landscape of the corporate treasury.

Price action details: key levels to monitor

Ethereum (ETH) shows a renewed bullish momentum, as seen in the 4 -hour table, after recovering the critical resistance level of $ 3,860. The escape came with a high purchase volume, pushing prices to the $ 3,900 area. This decision follows a strong resumption compared to the lowest local of $ 3,350 earlier in the week, ETH now negotiating above its 50 -day mobile averages (blue), 100 days (green) and 200 days (red) – a structurally bullish configuration.

However, the fork of $ 3,900 to $ 3,920 is becoming a short -term resistance, where the sellers began to make profits. A decisive closure above this level could open the door to a retaining of the psychological bar of $ 4,000, seen for the last time in mid-July. Unpipening, immediate support is $ 3,860 – the previous resistance has now returned to a potential demand zone. If this level fails, ETH could review the region of $ 3,700, aligning with the MA of 100 days for an additional technical confluence.

The volume models indicate that buyers remain in control, but the market may require consolidation before another step. As long as ETH holds more than $ 3,860, the broader trend promotes upward continuation, in particular with institutional interests – such as the Treasury Plan Ethereum of $ 5 billion in global fundamental – strengthening the bullish narrative. A break of less than $ 3,860 would weaken these short -term perspectives.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.