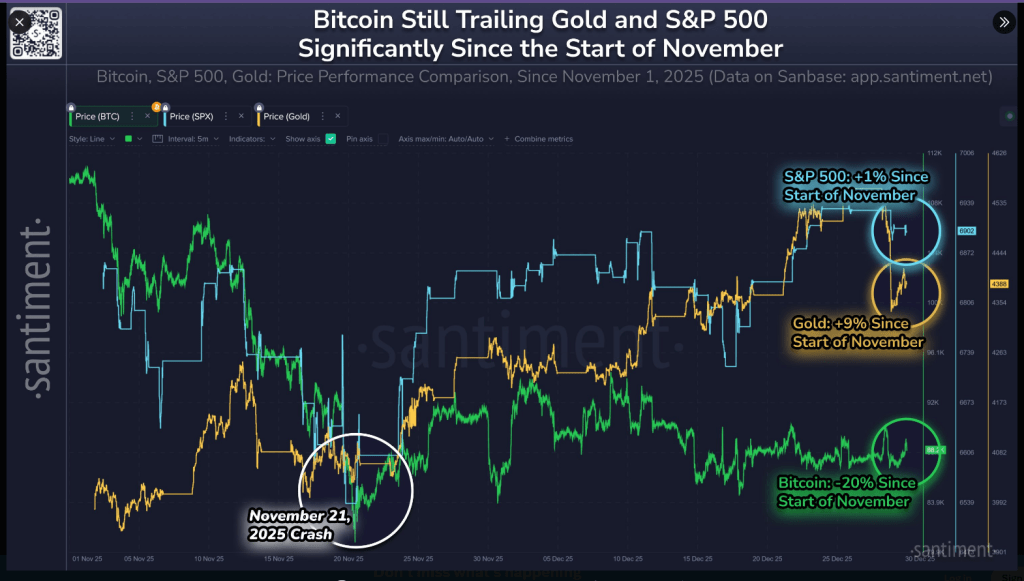

Bitcoin is lagging gold and the S&P 500 after a sharp pullback in November, according to market intelligence firm Santiment. Gold is up 9% since early November, the S&P 500 is up 1% and Bitcoin is down about 20%, trading near $88,000 on Wednesday. According to reports, this gap has made crypto quieter, while other markets post modest rebounds.

Related reading

Whale accumulation signals

Santiment data reveals a divergence in behavior among holders. Small portfolios were busy buying in the second half of 2025, while large portfolios remained largely flat and sold after hitting October’s all-time high.

Large farmers are often treated as market players, so their cautious attitude has kept pressure on prices. Historically, a shift in which large holders begin buying as retail trading slows has marked true trend shifts, but this condition is not yet entirely evident.

📊 The correlation between Bitcoin & crypto compared to other major sectors is still lagging behind. Since the beginning of November, price performance is as follows:

🥇 Gold: +9%

🏦 S&P 500: +1%

🪙Bitcoin: -20%🤞 By 2026, there will remain an opportunity for crypto to catch up. pic.twitter.com/FW8JaQboTV

–Santiment (@santimentfeed) December 30, 2025

Mixed on-chain data

Reports note some signs of stabilization. Long-term Bitcoin holders reduced their holdings from 14.8 million coins in mid-July to 14.3 million in December, then halted sales. Active Bitcoin addresses increased by 5.51% in the last 24 hours, but transactions fell by almost 30% in the same window.

This mismatch suggests that more people are monitoring the market, while fewer people are committing funds. The raw numbers show interest, but not a clear return to wider commercial activity.

The voices of the market weigh

Garrett Jin, who once ran the BitForex exchange, said traders were already reallocating capital, arguing that money moves from one market to another when opportunities present themselves. The capital is the same and as always, it is wise to sell high and buy low, Jin wrote, according to social media posts.

Another analyst, CyrilXBT, described the current setup as late-cycle positioning ahead of a possible rotation: when liquidity turns, gold could cool, Bitcoin could take the lead, and other tokens could follow.

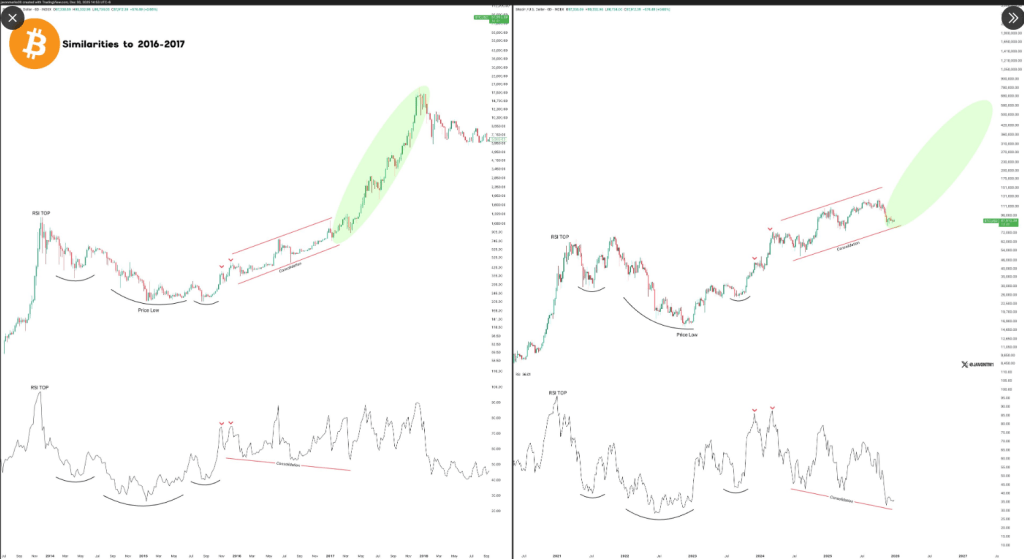

Bitcoin currently continues to resemble the 2016-2017 period, just before a parabolic move.

These two setups keep coming to mind due to their extreme similarities and the bullish signals are holding and even flashing here as well.$BTClooks absolutely ready to go 🚀… pic.twitter.com/H1hInYwix8

– JAVON⚡️BRANDS (@JavonTM1) December 30, 2025

Price calls and technical notices

Tech commentators remain divided. Javon Marks pointed out parabolic patterns in Bitcoin’s chart that echo the 2016-2017 rally and continues to forecast a rally towards $125,000.

Based on CoinCodex data, a more modest development is expected initially: the platform predicts that BTC could reach $91,500 by January 30, 2026, an increase of 3.68% from current levels.

Related reading

CoinCodex ranks the sentiment as bearish and the Fear & Greed Index at 23 (extreme fear). The site also notes that Bitcoin has had 15/30 green days and a volatility of 2.11% over the last 30 days, with the last update being on December 31, 2025.

Short-term traders should focus on whether large wallets start buying in volume again and whether trading picks up alongside the increase in active addresses. If whales start accumulating again as long-term holders stop reducing their positions, this combination would give a stronger signal than either measure alone.

Meanwhile, reports point to stabilization rather than a confirmed reversal, leaving room for a catch-up in 2026 if liquidity and confidence improve.

Featured image from Unsplash, chart from TradingView