Join our Telegram channel to stay up to date with the latest news

Ethereum and the broader cryptocurrency market declined over the past 24 hours as escalating geopolitical tensions between the United States and the European Union fueled risk aversion among investors.

At the same time, traditional safe-haven assets rallied sharply, with gold hitting new records and silver also hitting new highs amid a flight to quality triggered by President Trump’s renewed tariff threats against several European countries over the Greenland conflict.

Spot gold rose 1.1% to around $4,725 an ounce in early trading on Jan. 20, closing in on its all-time high of nearly $4,795 set late last year, according to market data.

The metal has extended its relentless uptrend into 2026, supported by safe-haven demand as investors prepare for possible disruptions in transatlantic trade.

The price of silver also rose almost 1% to reach a new record high of $95.3/ounce.

ETH price was trading at $3,095 as of 4:29 a.m. EST after a 3.6% decline in the last day, with the crypto market also falling more than 2% to a market cap of $3.15 trillion, according to Coingecko data.

Crypto Market Reeling as Trump Tariffs Reduce Risk

Over the weekend, Trump threat that it would impose import duties of up to 25% on several major European countries, including Denmark, France and the United States, until they reach an agreement to cede Greenland to Washington.

The US president’s demands have been largely rejected by European leaders, with France preparing economic retaliatory measures against the United States.

Trade between the two regions has caused heavy losses in global risk-oriented markets amid fears of a possible dissolution of NATO as Trump plans to take direct action to seize Greenland.

Adding to tensions, Trump said he would impose 200% tariffs on French wines and champagnes because he wants French President Emmanuel Macron to join his Peace Initiative Council aimed at resolving global conflicts.

“I will put a 200% tariff on his wine and champagne, and he will join, but he doesn’t have to join,” Trump said.

JUST IN – Journalist: Can you respond to Macron saying he will not join the peace council?

Trump: Nobody wants him… I will put a 200% tariff on his wines and he will join pic.twitter.com/S5pTcTbTvn

– Insider Paper (@TheInsiderPaper) January 20, 2026

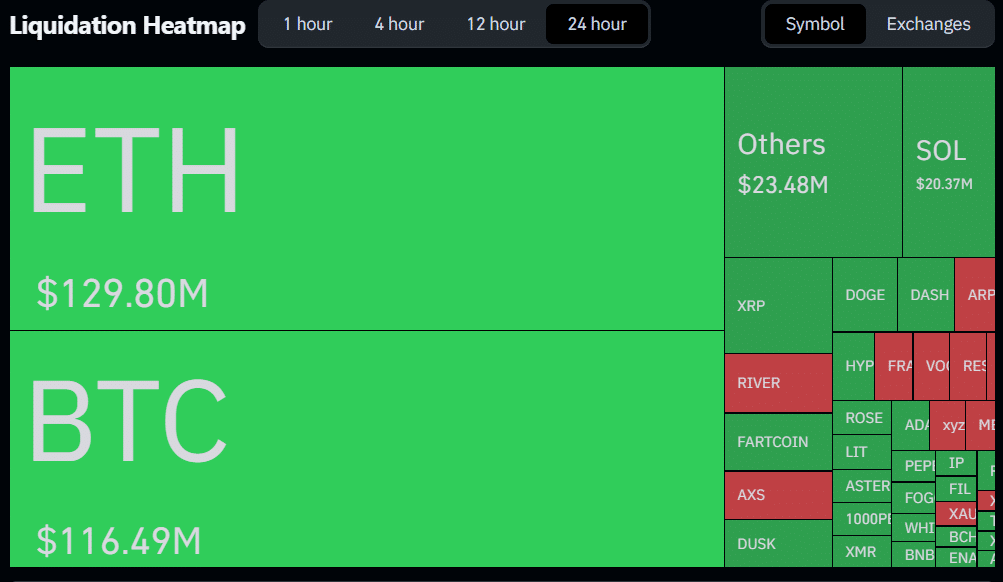

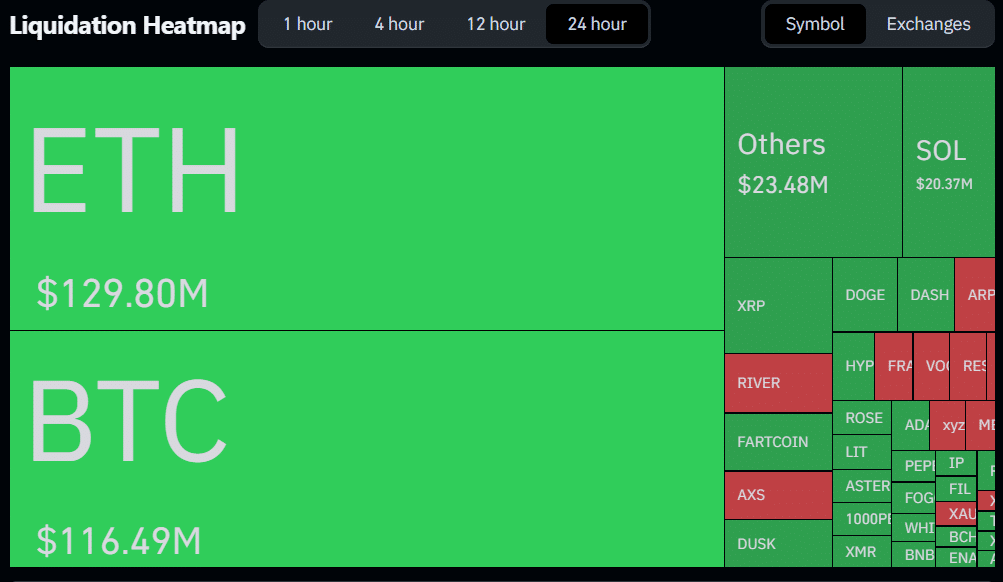

This has caused jitters in the crypto space, with total liquidations amounting to $361 million, with $124 million coming from Ethereum long positions alone.

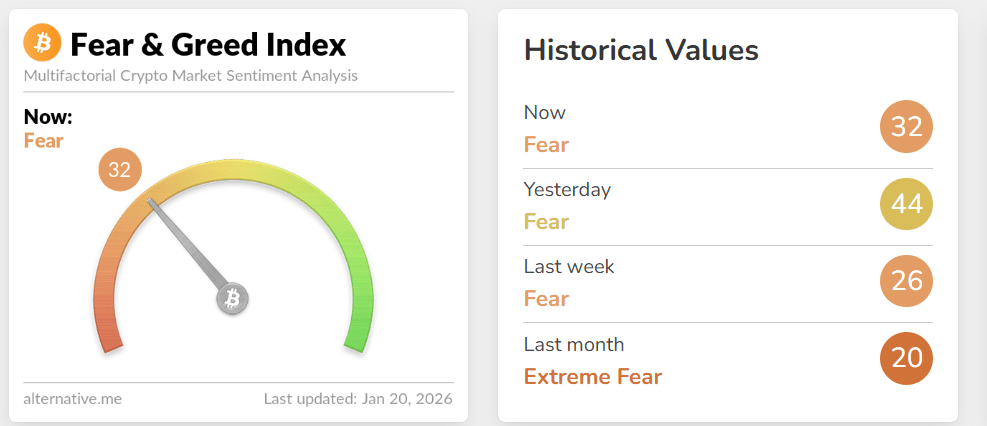

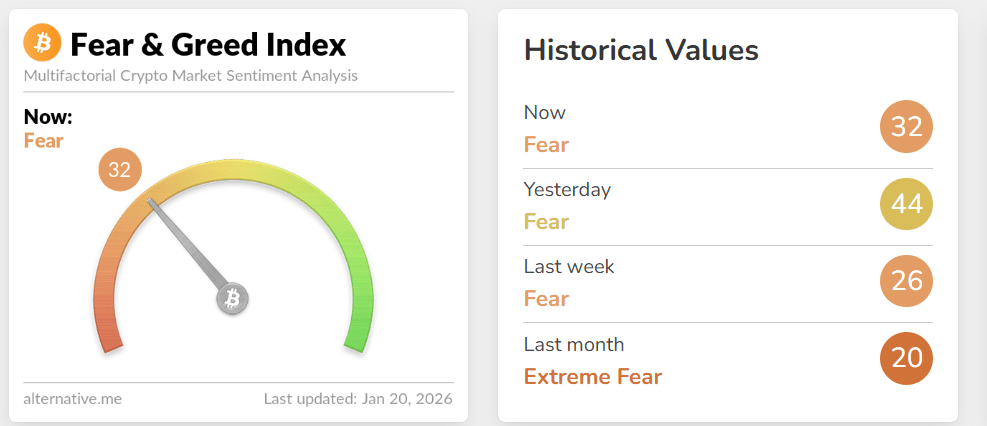

Furthermore, the Crypto Fear and Greed Index remains in the fear zone after several weeks of extreme fear, showing that investor sentiment has softened but remains cautious and the market may be undervalued.

Ethereum Price Analysis: Drop Is a Warning Sign

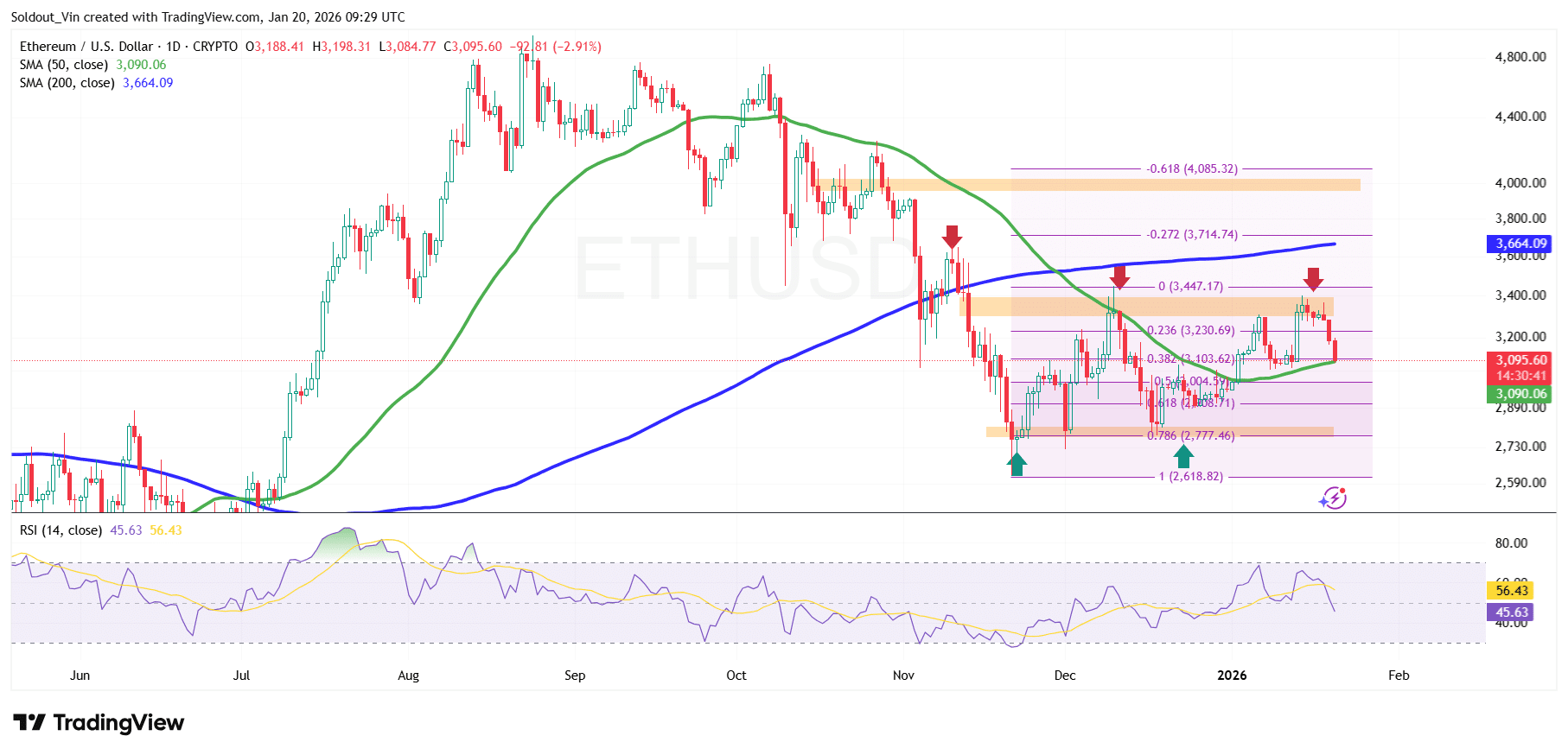

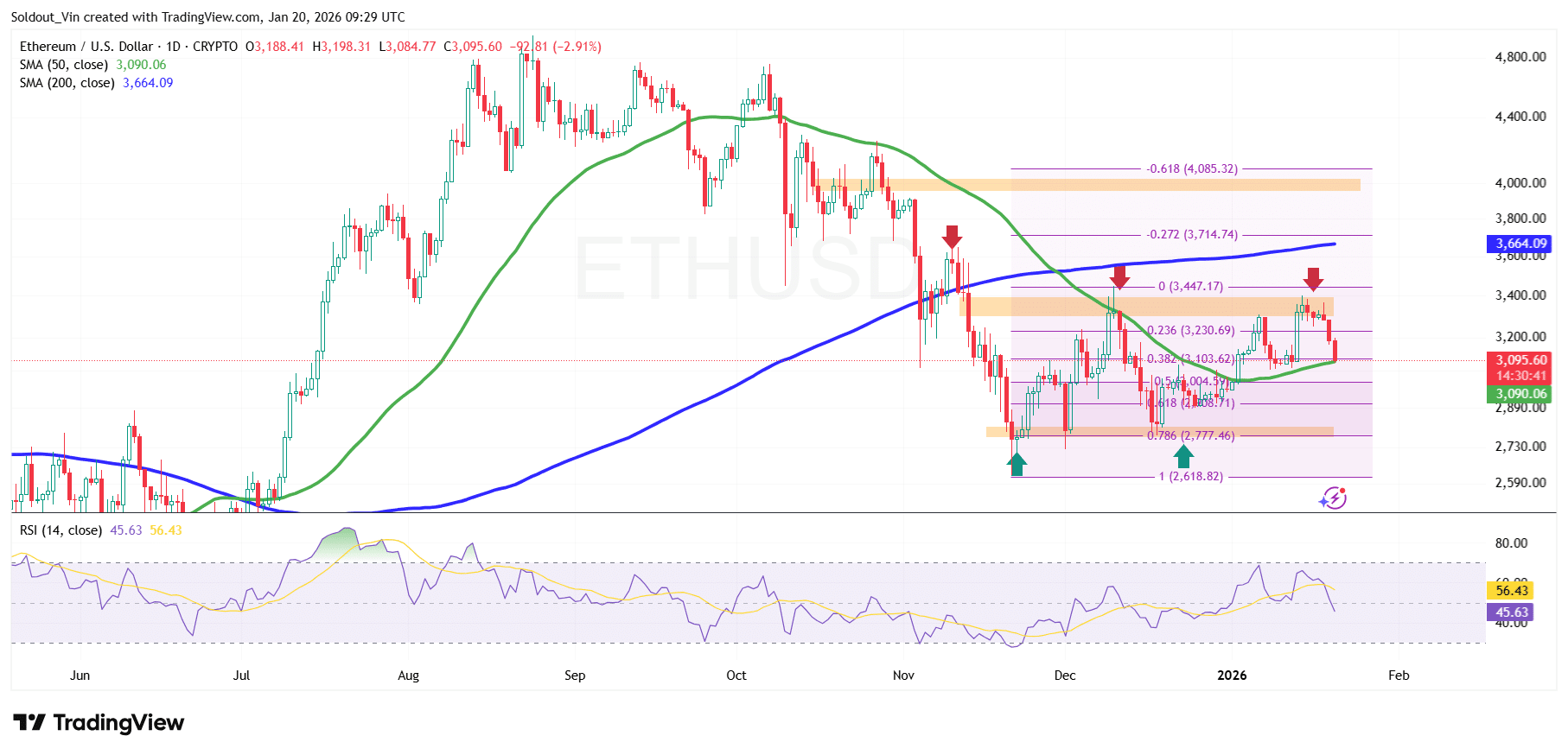

Ethereum price is currently trading around $3,050 to $3,150, trying to stabilize after a sharp decline. While buyers defend the psychological support at $3,000, the overall price action suggests more caution than strength.

The recent decline follows a strong rejection from the $3,600-$3,700 region, where Ethereum failed to hold above the 50-day simple moving average (SMA).

This barrier triggered sustained pressure from the bears, pushing price down towards the $2,750-$2,800 demand zone, a historically important support zone aligned with the 0.786 Fibonacci retracement.

Ethereum is currently trading near the 50-day SMA ($3,090), which serves as near-term support. However, the price remains significantly below the 200-day SMA near $3,660, which continues to act as major overhead resistance.

Momentum indicators also reflect this caution. The Relative Strength Index (RSI) is hovering around 45, below the neutral level of 50. This suggests that the bearish momentum has eased, but the bullish momentum has not yet returned.

ETH Price Prediction: $2,600 Level in Sight

Not holding $3,000 would increase the risk of a further pullback towards $2,800 – $2,750, near the 0.786 Fibonacci level. A break below this demand zone would expose the cycle low of $2,620, which is still a critical level for bulls to defend.

Conversely, it could attempt another push towards the $3,350 resistance zone, an area that has repeatedly capped and prohibited any upward movement.

A break above this range could open the door to a retest of $3,660 at the 200-day SMA level.

For Ethereum to realistically re-enter a bullish structure and target the $4,000 region, it would need a sustained trend reversal, starting with a decisive close above the 200-day SMA.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news