Join our Telegram Channel to stay up to date on the coverage of information on the breakup

Google Cloud launches its own layer-1 blockchain for financial institutions, taking the undulation, the circle and the payment band.

Google Cloud’s web3 strategy manager Rich Widmann shared new details on the blockchain, called Google Cloud Universal Ledger (GCU), in an article on August 26 on Liendin.

“GCUC brings together years of R&D at Google to provide financial institutions with a new layer 1 which is efficient, credibly neutral and allows intelligent contracts based on Python,” wrote Widmann.

“In addition to bringing Google’s distribution, GCUL is a layer of neutral infrastructure,” added Widmann. “Tether will not use Circle’s blockchain – and Adyen will probably not use Stripe’s blockchain. But any financial institution can build with Gucul.”

By moving into the blockchain payment infrastructure, Google Cloud is positioned to compete on financial rails that could shape the future of payments. The stake can be which ultimately controls the backbone of digital finance: giants of established technology or cryptographic pioneers.

Google Cloud also wrote in an official blog The fact that GUCU “simplifies the management of commercial bank funds and facilitates transfers via a large distributed book, empowering financial institutions and intermediaries to respond to the demands of their most demanding customers and effectively compete”.

An increasing number of companies launching their own blockchains in the middle of growing regulatory clarity

Google Cloud is the last company to announce that it is working on its own LAYER-1 blockchain network. The USD Coin (USDC) Circle, and the stripe payments giant, are among others that have announced similar developments in recent months.

It was then that the web3 industry gains more regulatory clarity in the United States under the Trump administration.

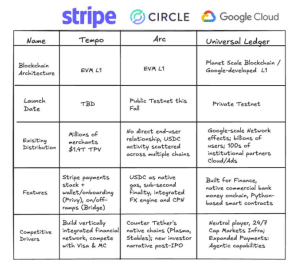

Widmann has also shared a table comparing Google Cloud’s GUCU with Circle Arc and Stripe’s Tempo Blockchains.

Table comparing Gucul with the arc and the tempo (Source: Linkedin)

According to the table, the Google Cloud blockchain network will operate the existing user basis for the “billions of users” technology and “100s of institutional partners”.

Its main competitive objective is to become a 24/7 infrastructure provider for world capital markets. The team will also seek to extend payments and allow agent capabilities with its channel.

Google Cloud described its blockchain as a private and authorized “authorized system” in its blog article. However, he said that this could make the network “more open as regulations are evolving”.

This closed nature has aroused criticism from crypto and web3 purists who argue that the principles of the network go against decentralized values and without authorization on which the community is built.

“It is an authorized channel, led by an American company with close links with the government”, an X user said. “I do not think these people understand what” credibly neutral “means in the context of blockchains, because it is literally the exact opposite of” credibly neutral “.”

Starknet CEO Eli Ben-Sasson also commented on the project. Responding to a post X on the blockchain, he said that he thought that societies creating their own layer 1 channels would not do it.

I think the companies that make L1s are NGMI. Including the base. I know it is a controversial opinion. But reminding you, I said the same thing about Diem (for those who remember it).

– Eli Ben-Sasson | Starknet.io (@elibensassassa) August 27, 2025

Google Cloud will allow intelligent contracts based on Python

Ethereum has benefited from an advantage before the market since its creation in July 2015, being the first big book distributed to allow programmers to create decentralized applications (DAPP) on a blockchain network.

Several financial institutions have used this ability to explore how they can be used to create new financial products.

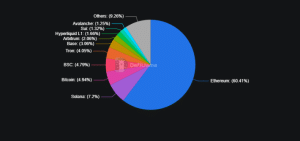

According to Defillama, Ethereum still explains the majority of the value locked in the blockchain space. With approximately 94.261 billion dollars of total locked value (TVL), Ethereum currently has a share of 60.41% of the market.

TVL depression by blockchain (source: Defillama))

The next largest market share goes to Solana, with its $ 11.231 billion TVL representing 7.2% of the value currently locked on blockchains.

However, Ethereum’s intelligent contracts operate on a new programming language called solidity. Many software developers have learned to write intelligent contracts using solidity, but the need to learn that a new software has an obstacle to adoption.

Google Cloud will tackle this problem by allowing developers to write smart contracts using Python, which is one of the most popular and most used programming languages on a global scale.

According to a Statistical surveyPython was the third most popular programming language in July 2024, with 51% of the 60,171 survey respondents showing a preference for Python, while 1.1% preferred solidity.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup