The launch of Ethereum spot ETFs has yet to live up to the market’s initial optimism, as evidenced by their performance over the past few weeks.

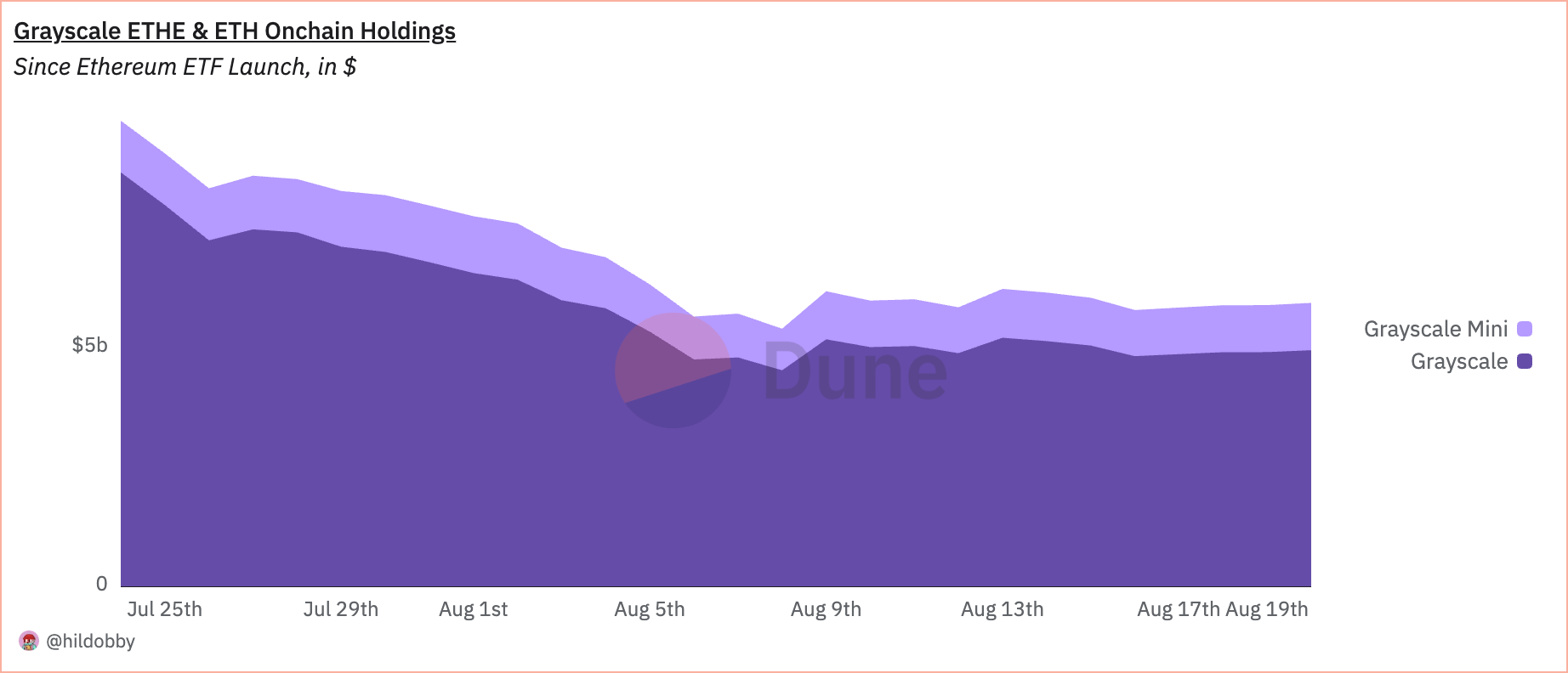

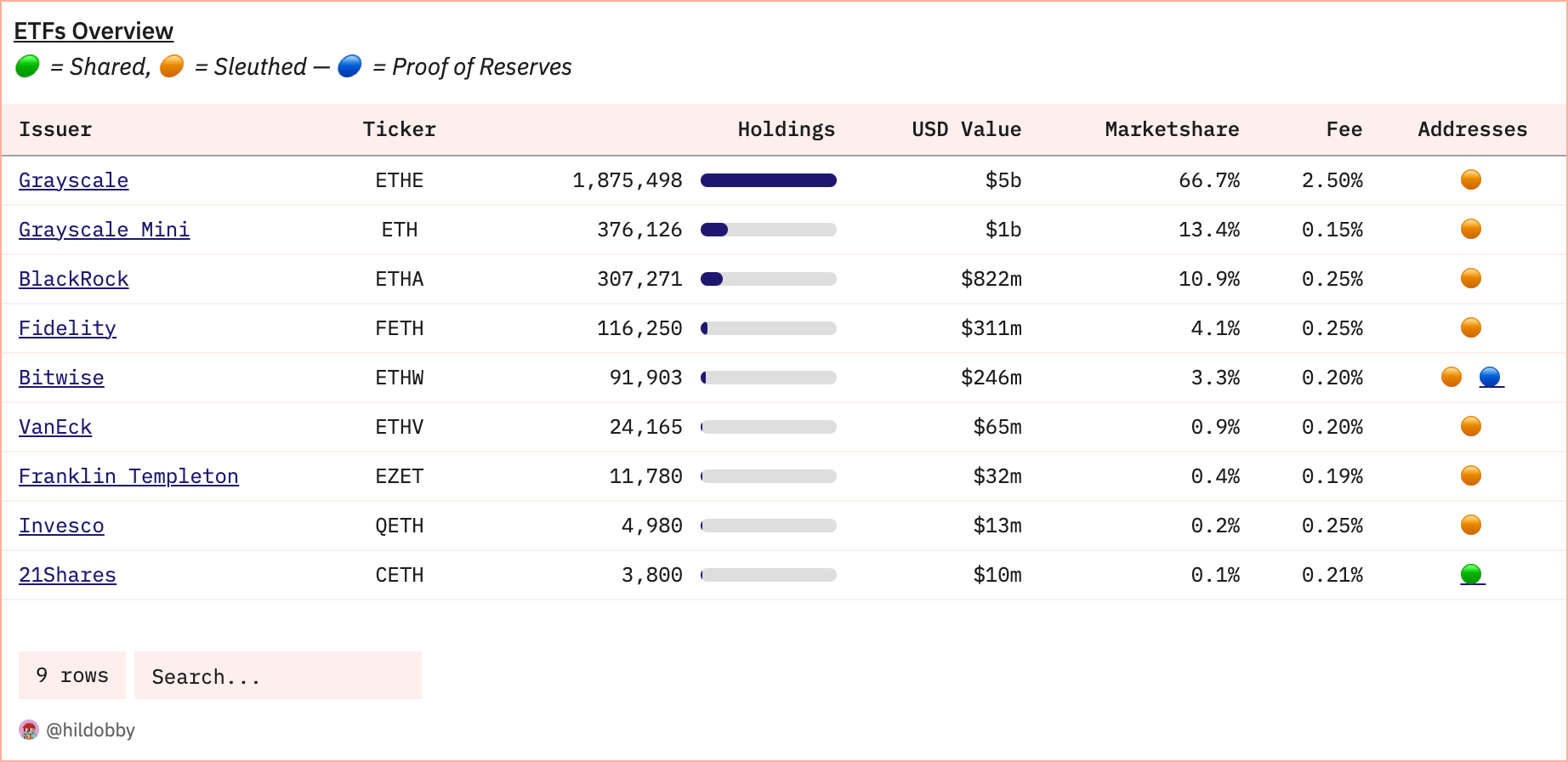

The total on-chain holdings of Ethereum ETFs currently stand at approximately 2.81 million ETH, valued at approximately $7.33 billion, representing approximately 2.3% of Ethereum’s total supply.

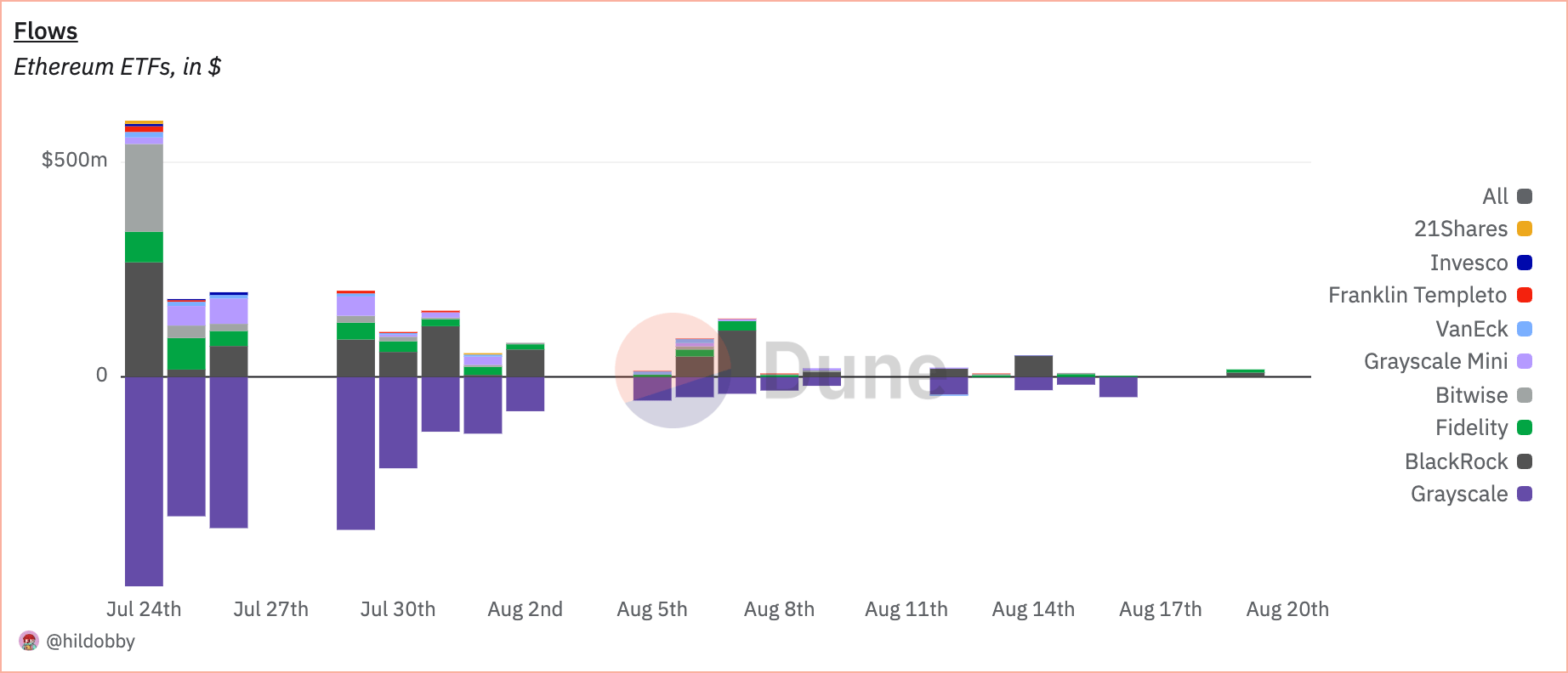

Despite these large holdings, net flows since launch have been negative, with a total outflow of 136,700 ETH.

The outflows were driven primarily by Grayscale’s ETHE, which saw a withdrawal of $487.88 million in the first day of trading alone. Other Ethereum ETFs saw steady inflows, but these were not enough to offset the slowdown in ETHE.

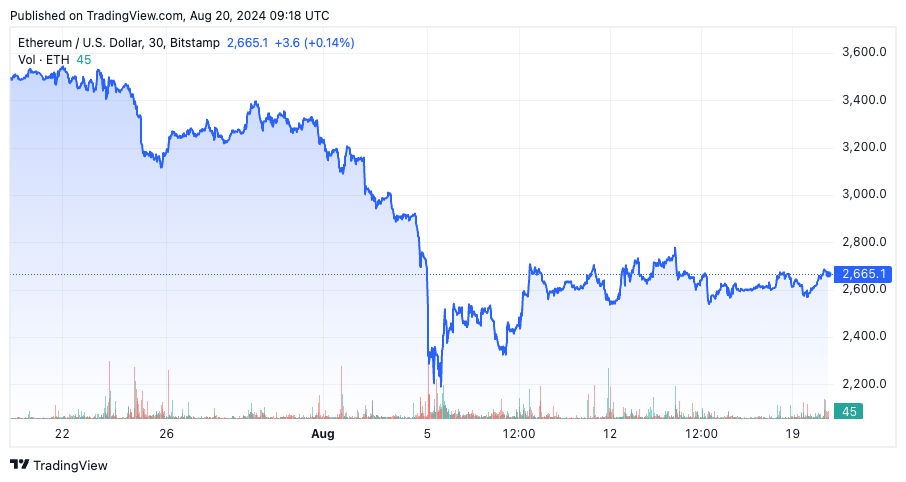

The market’s reaction to these outflows was reflected in the price of Ethereum, which struggled to maintain its momentum after its launch. After an initial surge in anticipation of the ETF launch, the price of Ethereum fell significantly, hitting a low of $2,338 on August 7.

While some recovery has been seen since then, with prices hovering around $2,600, the overall sentiment remains cautious. The overall market downturn has compounded this uncertainty, leading to a lack of clear bullish momentum for Ethereum.

Adding to the complexity, the Ethereum futures market has shown a marked increase in leverage ratios, signaling increased risk-taking among traders. This increase in leverage suggests that while some investors are betting on short-term price movements, overall sentiment remains volatile. The market’s reaction to these leveraged positions could further exacerbate price swings, especially if negative sentiment continues to dominate.

Despite these challenges, Ethereum-based financial products continue to attract significant institutional interest. BlackRock’s iShares Ethereum Trust (ETHA) has consistently attracted some of the largest flows among Ethereum ETFs, indicating that not all players are pessimistic about Ethereum’s long-term prospects.

Additionally, the overall Ethereum ETF market has shown some positive momentum, with occasional days of net inflows, particularly as ETHE outflows have started to slow. This has led some analysts to speculate that the worst of the outflows may be over, potentially paving the way for a recovery in both ETF flows and Ethereum price.

The current state of Ethereum ETFs shows that the market is still finding its footing amid broader volatility and specific challenges related to Grayscale’s ETHE.

Although initial performance has been disappointing compared to spot Bitcoin ETFs, slowing ETHE outflows and continued institutional interest suggest there may be room for optimism in the medium to long term.

However, for now, Ethereum and its ETFs remain in a precarious position, with their future performance likely closely tied to broader market trends and the actions of major institutional players.

Grayscale outflows eclipse Ethereum ETF inflows appeared first on CryptoSlate.