Crypto asset management giant Grayscale expects a 1,000-fold increase in a crypto subsector amid “structural changes in digital asset investing.”

In a new research report, Grayscale targets tokenized assets, or the practice of placing real-world assets like stocks, real estate or commodities on the blockchain for more accessible and efficient trading.

The company says the asset class has the potential to grow 1,000x and coins expected to benefit from the “huge” potential growth include top-tier chains Ethereum (ETH), BNB Chain (BNB), Solana (SOL), and decentralized oracle service Chainlink (LINK).

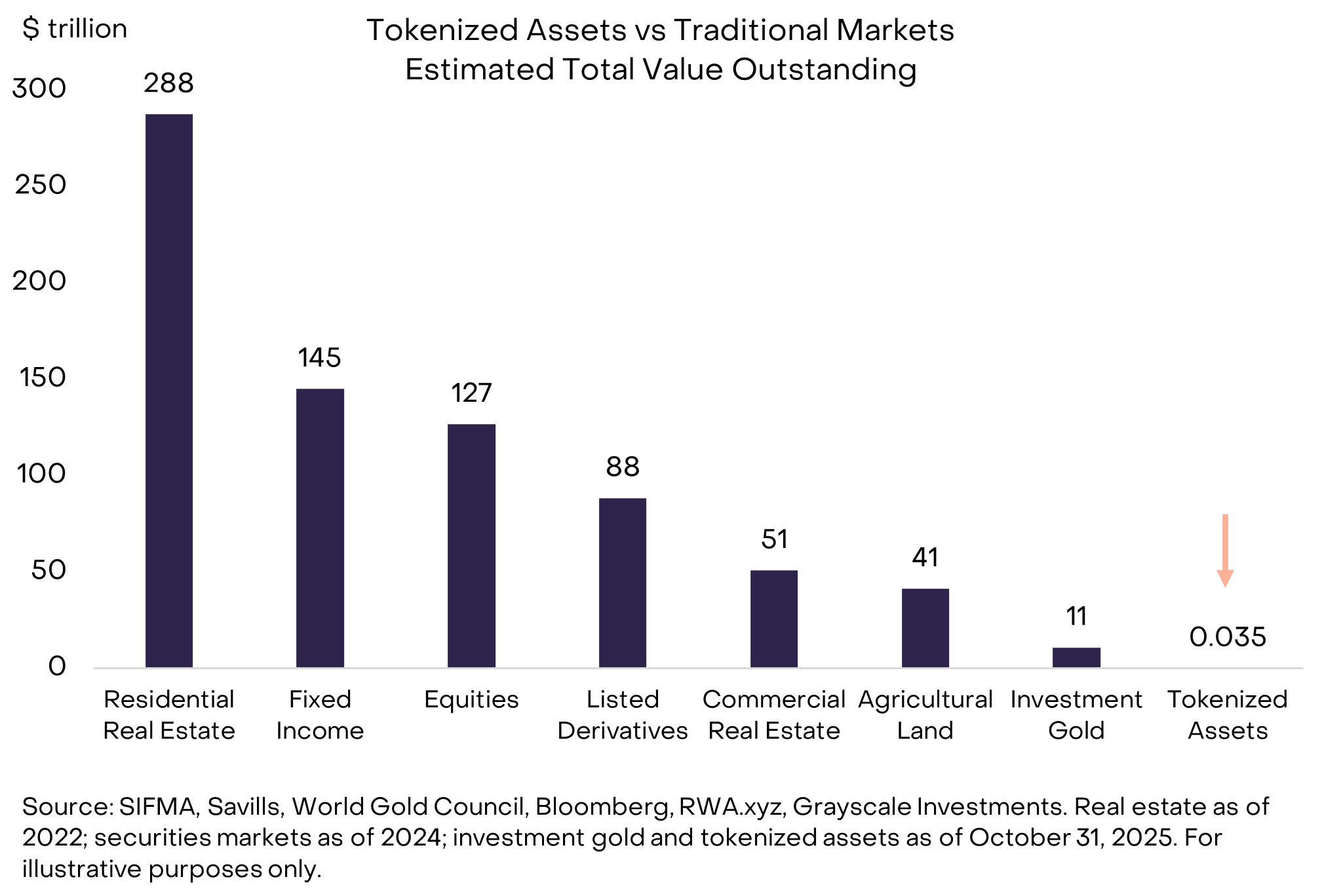

“Tokenized assets are tiny today: just 0.01% of the global market capitalization of stocks and bonds (Figure 11). Grayscale expects rapid growth in asset tokenization over the coming years, facilitated by more mature blockchain technology and improved regulatory clarity. By 2030, it would not be surprising to see tokenized assets grow by approximately 1,000 times, in our opinion.

This growth will likely create value for blockchains that process transactions in tokenized assets, as well as a variety of supporting applications. The top blockchains for tokenized assets today(6) are Ethereum (ETH), BNB Chain (BNB), and Solana (SOL), although this list will likely evolve over time. In terms of supporting applications, Chainlink (LINK) seems particularly well-positioned, given its unique suite of software technologies.

Read the full report here.

Follow us on X, Facebook and Telegram

Don’t miss a thing – Subscribe to receive email alerts straight to your inbox

Check Price Action

Surf the daily Hodl mix

& nbsp

Disclaimer: Opinions expressed on The Daily Hodl do not constitute investment advice. Investors should conduct due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and transactions are at your own risk and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: halfway