Grayscale Investments has decided to capitalize on one of the most explosive crypto rallies of the year, filing to convert its long-standing Zcash Trust into a US-listed exchange-traded fund.

Wednesday’s submission to the Securities and Exchange Commission marks the company’s latest attempt to expand its ETF lineup into the fast-moving private coin sector, at a time when Zcash has surged nearly 1,000% in the past year.

If approved, the product would become the first U.S. ETF to offer regulated exposure to Zcash, a cryptocurrency built around zero-knowledge proofs that allow users to conceal transaction details.

Grayscale Says Zcash ETF Could Open Regulated Path to Private Coin Market

According to the filing, although Zcash inherits the supply model and deflationary design of Bitcoin, its defining difference lies in the selective privacy provided through shielded transactions.

According to Grayscale, investors are increasingly seeking this capability as concerns about the traceability of Bitcoin and other transparent blockchains grow.

A Zcash ETF would reduce the management premium associated with the current trust structure and provide easier access to buying and selling through traditional brokerage accounts.

It would also provide institutional managers with a regulated path into the private coin market, an industry that has historically struggled to attract traditional capital due to compliance concerns.

Zcash’s rapid rise began in September, driven by concerns that government agencies had become more effective in tracking Bitcoin activity.

By the end of November, ZEC had risen from around $40 to over $700 in a matter of weeks, an unprecedented development for an asset created in 2016.

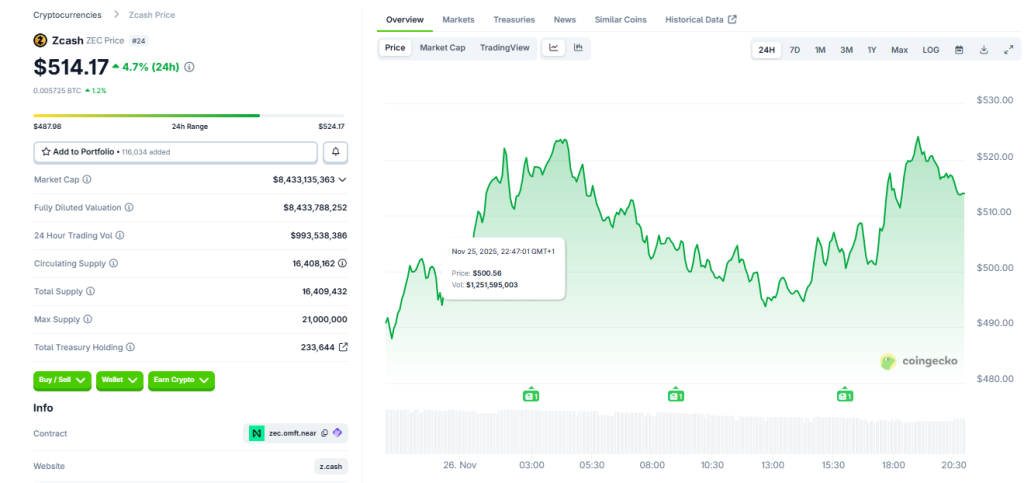

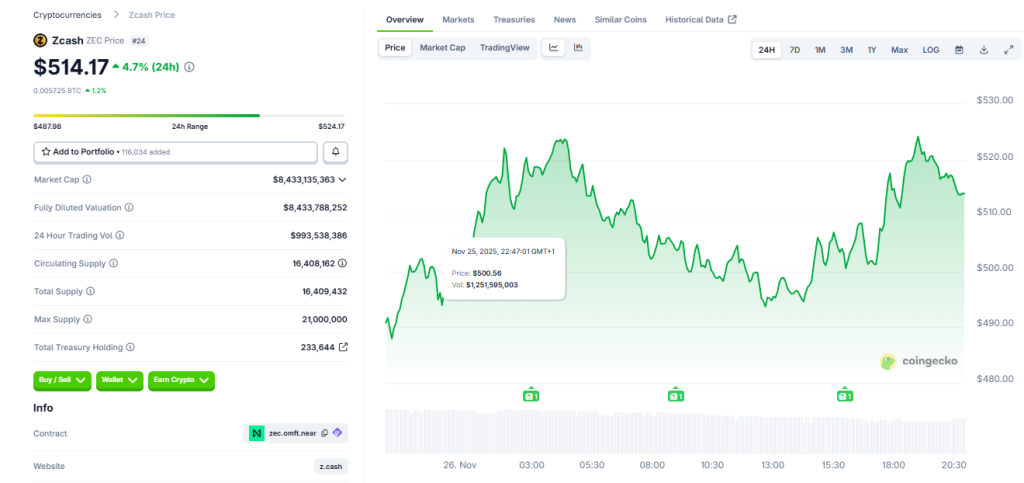

The rally has not been without volatility. Zcash hit $723 on Saturday before sinking to $504 the next day, then briefly recovered to $677 before another sharp decline.

On Wednesday, the coin was trading around $450, still up for the week despite a roller coaster ride.

According to CoinGecko data, the asset then showed hovering around $514.37, a 30-day gain of over 47%, but still well below its all-time high of $3,192.

The market whiplash intensified after BitMEX co-founder Arthur Hayes issued a warning to holders, urging users to remove ZEC from centralized exchanges.

Hayes argued that storing the asset on platforms that only support transparent addresses strips Zcash of its privacy guarantees, effectively converting it into a traceable token.

His comments reignited long-standing concerns about self-custody, regulatory oversight, and the privacy contradictions that coins face when interacting with traditional trading platforms.

Promotional Concerns, Fake Headlines Spark Debate Over Zcash’s Parabolic Run

Analysts also became cautious as Zcash’s chart began to show signs of exhaustion.

Trading data shows the coin forming a symmetrical triangle after its 1,500% rise, a pattern that can break in either direction but often resolves to the downside during periods of macro uncertainty.

A breakdown could push ZEC towards $282, aligning with the main weekly trendlines. Comparisons to BNB’s parabolic rise and collapse in 2021 have fueled additional fears, with some technical analysts warning of a potential 60% correction if momentum continues to fade.

At the same time, questions about market manipulation have surfaced. Venture capitalist Mark Moss shared screenshots suggesting agencies were seeking paid promotions for ZEC, while analyst Rajat Soni accused promoters of circulating fabricated headlines.

These allegations contributed to a broader debate over whether Zcash’s recent rise represented genuine demand or a contrived attempt to attract outflow liquidity.

Grayscale’s filing comes amid a broader wave of ETF activity in the United States. On November 22, the New York Stock Exchange approved the listing of Grayscale’s XRP and Dogecoin ETFs, converting both from private trusts to fully tradable funds.

The company also successfully converted its Bitcoin and Ethereum trusts into spot ETFs, products that have attracted significant capital inflows since regulatory approval.

With Solana, Dogecoin and XRP ETFs already trading, Zcash is the latest addition to Grayscale’s efforts to transform traditional trusts into more liquid investment vehicles.

Article Grayscale Targets First US Zcash ETF As Privacy Coin Soars 1000% – What’s Next? appeared first on Cryptonews.