As the US presidential election approaches, betting platform Polymarket sees odds rising for Kamala Harris, with her odds rising from 33% to almost 39%.

Additionally, the October jobs report shows that the economy is starting to grow under Biden and Kamala. As they put it, “Vote for Kamala Harris to keep this momentum going!” »

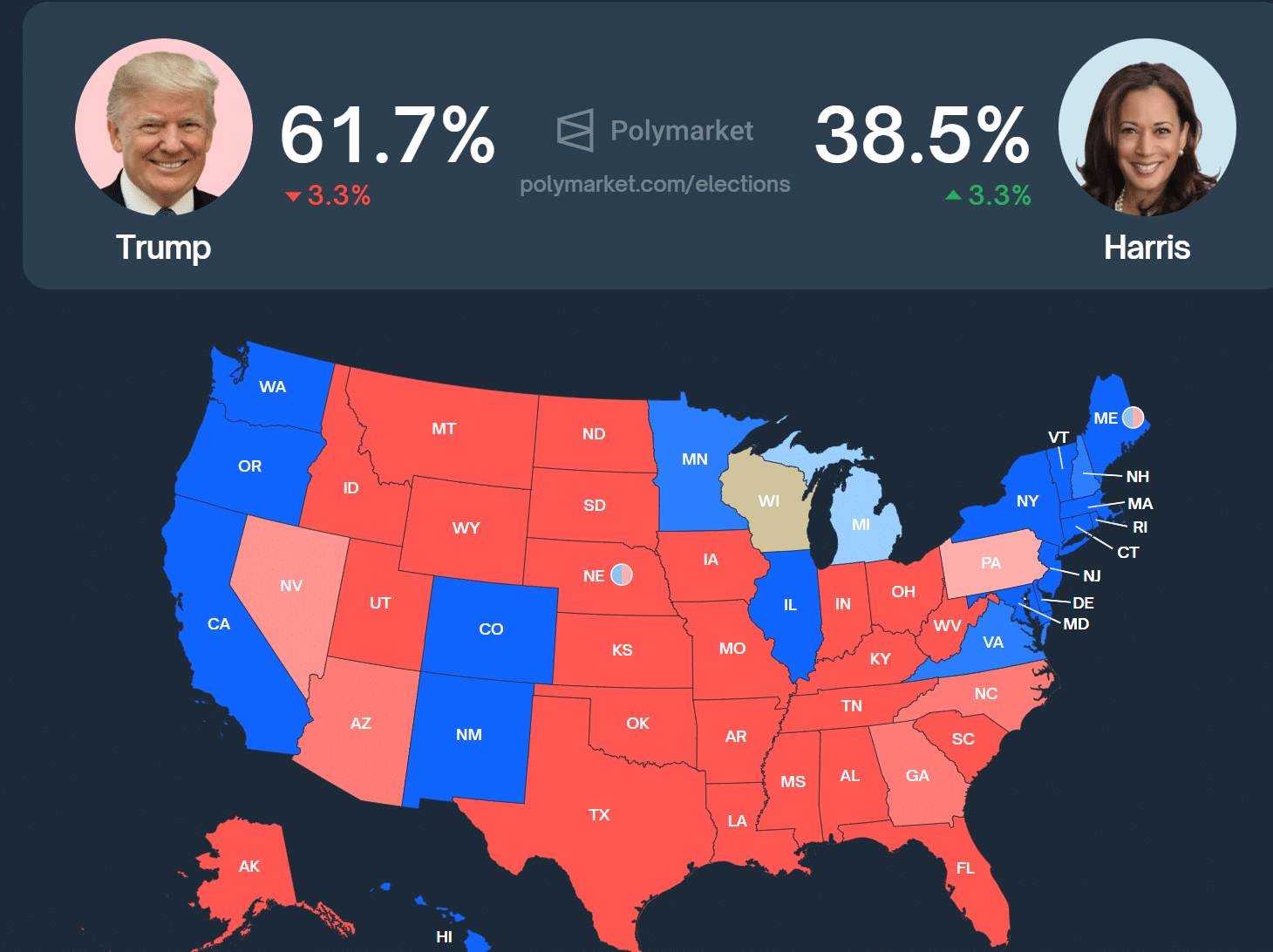

Here’s who Polymarket oddsmakers think will win the election in light of new information.

Kamala Harris: the mechanisms of market movement

Polymarket is a prediction market where users can bet on various outcomes, including political races. Traders buy “stocks” with the potential to earn $1 each if their predictions prove correct.

Right now, a rise in Harris’ stock price indicates heightened expectations that she will win, even though Donald Trump maintains a 62% probability, making him the current favorite.

Trump’s odds are down 5.6% today.

Trump • 60.9% chance

Harris • 39.1% chance

There are 4 days left. pic.twitter.com/FFzTdYgkTq

– Polymarket (@Polymarket) October 31, 2024

It is speculated that the rise in Harris’s odds is due to traders hedging their bets. Large transactions exceeding $10,000 suggest significant investments in Harris, perhaps as a hedge against a potential Trump loss.

This hedging strategy allows traders to mitigate risks associated with election unpredictability.

After all, Trump is already calling for election fraud in Pennsylvania and is also suing CBS for fraud.

DISCOVER: Best New Cryptocurrencies to Invest in in 2024 – Best New Crypto Coins

Impact of voting and polling irregularities

Reports of voting irregularities (ballot burning) also influenced market behavior, forcing traders to reevaluate their positions. These allegations, coupled with traditional polls showing Harris ahead in key states like Michigan, Pennsylvania and Wisconsin, could influence sentiment.

Newsweek highlighted the importance of these states, emphasizing the need for Trump to secure at least one to win.

The dynamic nature of Polymarket means that every trade impacts the odds, leading to potential volatility. Low liquidity can cause dramatic price swings, as seen when a large purchase temporarily raised Trump’s rating to 99%.

Crypto betting markets and election odds at Polymarket

Crypto is on the ballot this election cycle, with both candidates outlining their approach to digital currencies. That said, fluctuating election odds have reverberated through crypto markets, with some attributing recent downturns to Trump’s declining prospects on Polymarket.

The CoinDesk 20 Index, for example, fell 4.4% in 24 hours, reflecting the intertwined nature of political events and crypto market reactions.

Notably, a user named Clumpyclumsy invested over $250,000 in Harris “yes” stocks, highlighting the high stakes involved.

As the election approaches, Kamala Harris’ growing chances on Polymarket highlight that this election will be closer than anyone would like. Why can’t we get a landslide victory for once?! For traders and spectators alike, deciphering the code of these interactions is essential to surviving the rat race of prediction markets. As for crypto, we’ll see if either candidate delivers on their promises.

RELATED: Crypto Mayor Unveils Satoshi Nakamoto Statue in Switzerland. And why did the CEO of Tether move to Lugano?

Join the 99Bitcoins News Discord here for the latest market updates

The post Harris Odds Rise on Polymarkets: what will happen with US electoral crypto? appeared first on .

Trump • 60.9% chance

Trump • 60.9% chance Harris • 39.1% chance

Harris • 39.1% chance