Warning: The following is a paid partner content. DL News and DL Research did not carry out an independent analysis on the content of this article.

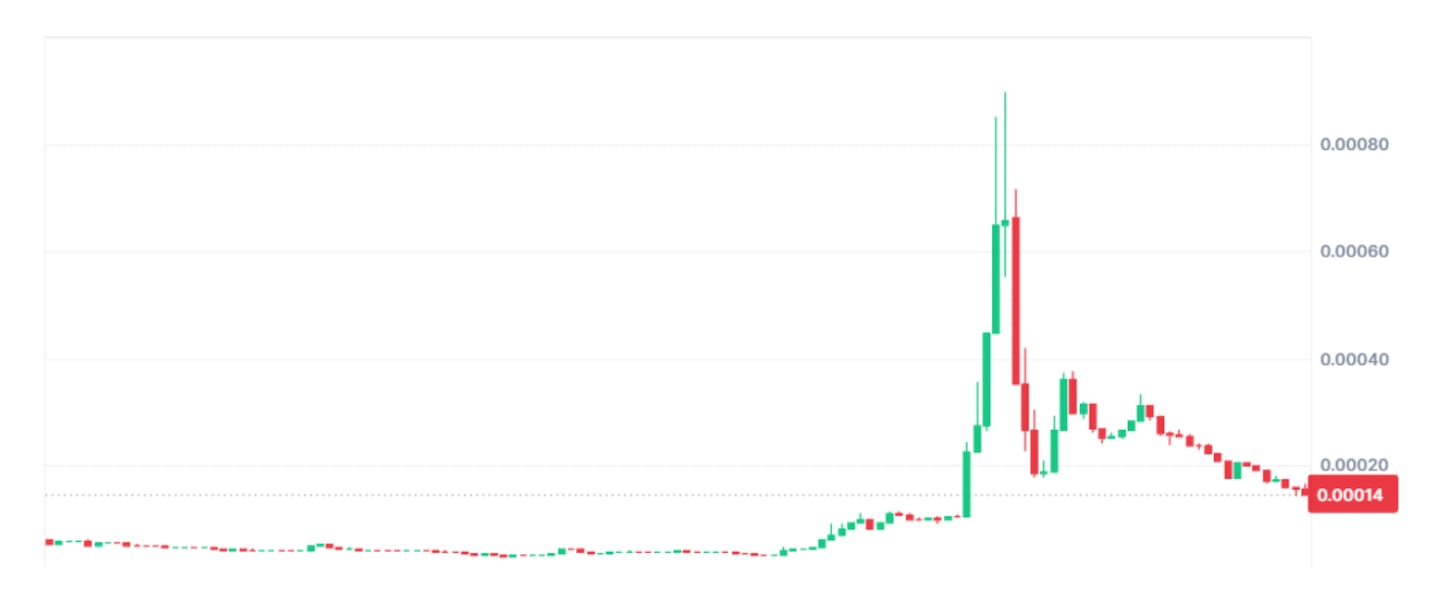

Girl Hawk Tuah Memecoin ($ Hawk) took the world of crypto, fueled by the viral renown of Hailey Welch and the growing tendency of speculation on the memes piece. In the hours following its launch, the price of the token rose, attracting thousands of merchants wishing to catch the next Pepe style escape.

But just as quickly as he went up, $ Hawk collapsed by more than 90%, destroying millions of values and letting investors rush to get answers. The crash has rekindled the concerns about the volatility of meme parts, the risks of investment focused on the overhaul and the growing number of pump and crisp schemes.

Is this the beginning of the end of the coins, or just another chapter of the speculative nature of the crypto? More importantly, what lessons can investors learn from this accident to avoid falling into the same trap?

Let us fall down what happened to Hawk Tuah Coin, what it reveals on the current state of the cryptography market, and how traders can identify the best crypto to buy for a safer investment in 2025

The climb and fall of Hawk Tuah Coin – a familiar model?

The coins often follow a predictable cycle:

1️⃣ A viral moment creates an instant media threw.

2️⃣ The token is launched and prices are increasing as Fomo retail investors.

3️⃣ The first holders and initiated throw their assets, crushing the price.

4️⃣ late buyers end up with worthless tokens.

$ Hawk was no exception. By driving on the frenzy of social media around Hailey Welch, the play soaring in the hours following its launch, reaching a market capitalization of nearly $ 500 million. But the data on the chain quickly revealed large sales of initiates, draining liquidity and sending prices in a free fall.

The rapid accident resulted in shooting charges, many traders stressing that the first portfolios poured millions of tokens at the top price. Welch herself moved away from the project later, saying that she had no involvement, but the damage has already been caused.

What does this mean for the cryptography market – is the era of the medal dying?

The collapse of Hawk Tuah Coin raises important questions about coins and their place in the landscape of evolving cryptography.

In the wake of the escape of Pepe, a flood of similar tokens hit the market, but very few managed to maintain a long -term value. Although the first adopters may have seen rapid gains, most of these projects collapsed as quickly as they emerged, leaving many investors trapped in short-term threshing cycles.

At the same time, a change is underway. More and more traders are looking beyond pure speculation, turning to projects with real utility, committed communities and lasting ecosystems. The cryptography market ripens and investors are beginning to recognize that real value comes from long -term adoption, not only viral trends.

The pieces even are not entirely dead, but their undisputed era of domination is discolored. The new wave of investment favors the basic principles of pumps based on social media, while industry is evolving towards a more focused on public services.

The transition to utility – what stimulates the next wave of cryptography adoption?

Although the pieces even have proven that they can attract short -term speculations, the long -term winners of the crypto are those who build real ecosystems and offer real use. Investors are starting to recognize the difference between ephemeral and sustainable adoption.

A clear sign of this change is the growing interest in projects that provide real commitment beyond speculation. Platforms that offer interactive ecosystems, governance mechanisms and real use cases are starting to stand out, not because of viral moments but because of the value they bring to users.

An excellent example of this change is The last dwarfs ($ TLD)An ecosystem based on blockchain which has discreetly reached more than 300,000 users committed before even registering on trade. Unlike the typical hype -focused launch, excitement around $ TLD is not fueled by social media gadgets or celebrity mentions, but by an increasing community that actively participates in its economy.

Why projects like the last dwarfs ($ TLD) are gaining ground

Unlike speculative coins, the last dwarfs are not only a token – it is an entire ecosystem designed to merge games, mark them out and parade them in an innovative way.

At the heart of its ecosystem is the gamified Launchpad, a first platform of its kind where players can engage in a gameplay while unlocking access to blockchain projects at an early stage. This model transforms games into an investment opportunity, allowing users to win, play and actively participate in the growth of the ecosystem.

Beyond its main platform, the last dwarfs are only placed on a scale thanks to its deep integration with Telegram and the Blockchain tone. Telegram has more than 900 million active users, and by taking advantage of this vast network, TLD can transparently embark on a massive user base without the friction of traditional web3 adoption obstacles. This positions it as one of the most accessible and evolving blockchain projects in space.

A booming industry and a growing ecosystem

The web 3 -year -old industry should exceed $ 60 billion by 2028, with major players such as Epic Games and Ubisoft already making significant investments in blockchain games. The last dwarf is part of this rapid expansion market, having already obtained more than 50 partnerships within the tonne ecosystem, positioning itself as a key player in the sector.

Unlike speculative tokens, $ TLD is the backbone of the whole ecosystem, acting as the main currency for staggered, governance, transactions at stake, etc. $ TLD holders do not passively invest, they also have voting power in governance, influencing key decisions in the development of the ecosystem.

To lead to a new extension, the latest dwarfs have launched a subsidy program to encourage third-party developers to build new games and platforms within the TLD ecosystem. This guarantees continuous growth, new content and an autonomous environment.

In a market that moves away from the beaten media -focused on the same, projects like $ TLD are distinguished because they offer a real commitment, sustainability and a real use case – not just the illusion of fast earnings.

Final reflections – What are the best cryptos to buy now?

The Hawk Tuah currency crash is a major warning sign that the parts even cannot support value without real fundamental. While some traders are still pursuing media -dressed gains, the future of the crypto belongs to projects with real adoption, committed communities and long -term sustainable growth.

The next 100x crypto It will not only be another token – it will be a project built for real growth.

While coins are fading, investors focus on more promising opportunities. The market evolves – Will you be ahead of the curve?