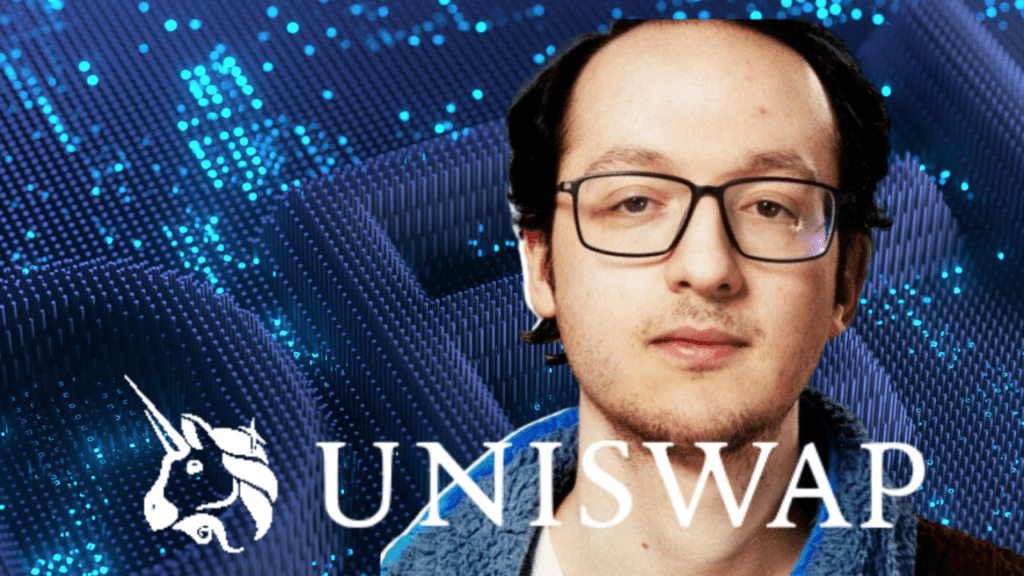

Uniswap CEO Hayden Adams denied on September 12, 2024 that the company charges decentralized finance (DeFi) protocols for protocol deployments.

Uniswap CEO Hayden Adams denied on September 12, 2024 that the company charges decentralized finance (DeFi) protocols for protocol deployments.

The allegations surfaced following a tweet from X user Alexander, who claimed that Uniswap was looking for developers for $20 million after deeming a recent rollout unnecessary.

The controversy began when Millicent Labs co-founder Kene Ezeji-Okoye claimed that Uniswap charged $10 million for the deployment and another $10 million for user incentives related to the carbon credit exchange. These allegations led Alexander to claim that Uniswap was exploiting developers for substantial sums.

In response, Adams clarified on X that neither Uniswap Labs nor the Uniswap Foundation charge fees for deploying the protocol. He emphasized that all deployments are done through governance votes, reflecting the decentralized nature of the system.

Adams further explained that the process of deploying the Uniswap interface on new blockchain networks depends on the level of activity and effort required, but there are no financial requirements involved.

Adams’ public denial was an effort to correct misleading claims and reassure the community that Uniswap’s deployment processes remain transparent and decentralized.

Uniswap recently faced legal challenges from the U.S. Commodity Futures Trading Commission (CFTC), which charged the company on September 4, 2024, with providing illegal leveraged cryptocurrency trading services to U.S. retail investors. The company settled the charges by agreeing to pay a $175,000 civil penalty and to cease and desist from violating the Commodity Exchange Act.

In April 2024, the SEC accused Uniswap of operating an unregistered securities exchange. Uniswap responded by claiming it was a software company, not an exchange or broker-dealer, and criticized the SEC for protecting outdated systems at the expense of consumers. CEO Hayden Adams expressed frustration with X, citing the need to defend both the company and the DeFi industry from what he sees as regulatory overreach.

Despite these challenges, Uniswap remains one of the leading decentralized finance (DeFi) platforms, facilitating token swaps across multiple blockchain networks. As of September 12, 2024, it held approximately $4.35 billion in total value locked (TVL), according to DefiLlama.