Join our Telegram channel to stay up to date with the latest news

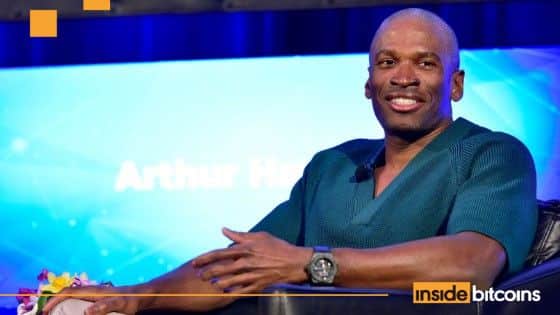

Maelstrom, run by the family office of BitMEX co-founder Arthur Hayes, plans to raise $250 million for a private equity fund that will buy mid-sized crypto infrastructure and analytics companies.

THE Maelstrom I Equity Fund plans to spend between $40 million and $75 million per transaction on up to six crypto companies, co-founder and managing partner Akshat Vaidya told Bloomberg.

Financing for the planned acquisitions is expected to be finalized by September 2026.

Maelstrom will focus on trading infrastructure and analytics platforms

Vaidya said on

The fund will be the first private equity (PE) fund fully focused on acquiring profitable off-chain crypto infrastructure companies, Vaidya said.

Maelstrom Equity Fund I, LP* is out of the bag

Let’s dive in –

* @CryptoHayes‘ first external fund, the first PE fund with controlled buyout to specialize solely in the crypto industry. Targets = profitable, off-chain “pickaxes and shovels”.

Why we are building this:

– Problem 1:… pic.twitter.com/K5E2wWbUqF– Akshat_Maelström (@akshat_hk) October 17, 2025

The Maelstrom co-founder identified three fundamental issues that make crypto acquisitions difficult.

In addition to the fact that founders of cash flow companies have limited liquidity options, he noted that it is difficult for traditional financial investors to gain exposure to quality companies. Institutional investors also have few fund options and can only invest in the crypto space through venture capital (VC) funds which offer low risk-adjusted returns, Vaidya added.

Maelstrom will also use its team’s combined experience and network to professionalize and scale the businesses into ready-to-acquire assets. This will then give large investors a way to enter crypto through profitable, profitable businesses rather than volatile tokens.

According to Vaidya, this will enable large-scale exposure to the crypto space with lower risk levels.

Hayes becomes more active in crypto space after Trump pardon

Hayes, who will help lead the new fund, resigned as CEO of BitMEX in 2020 after U.S. authorities accused him and associates Benjamin Delo, Gregory Dwyer and Samual Reed of violations of the U.S. Bank Secrecy Act.

Hayes surrendered to U.S. authorities in 2021, pleaded guilty in 2022 and was sentenced to two years of probation including six months of home confinement.

His presence in the crypto space has become more prominent since he received a pardon from US President Donald Trump in March.

Following the sharp correction in the price of Bitcoin over the past week, Hayes said on X yesterday, it is “on sale”.

BTC Price (Source: CoinMarketCap)

“If the regional banking turmoil in the United States turns into a crisis, be prepared for a 2023-like bailout,” he said. “And then go shopping assuming you have available capital.”

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news