- The HBAR crypto gained more than 34% in 24 hours to reach its highest level in five months.

- Rising Open Interest and DeFi TVL suggest the rally could continue.

Hedera (HBAR) gained more than 30% in 24 hours, outperforming the 30 largest cryptocurrencies by market capitalization.

At press time, the altcoin was trading at a five-month high of $0.118, with a market cap of $4.22 billion.

Will HBAR crypto continue to rise?

HBAR’s recent gains follow an uptick in buying activity, as shown by the green bars on the volume histogram over the past five consecutive days.

At the same time, the relative strength index increased and reached a value of 88 at press time, which shows that HBAR is overbought.

Typically, whenever the RSI reaches overbought levels, it portends an upcoming short-term correction.

However, traders might choose to hold and not sell as other technical indicators suggest the bullish momentum is strengthening.

The Directional Movement Index (DMI) showed that the upward trend is strong. Positive DI (blue) was higher than negative DI (orange), as the gap between them widened, showing bullish momentum.

Additionally, the average directional index (ADX) was trending toward the north, indicating that the press time trend was positive. The ADX value at 42 also suggests that the uptrend is strengthening.

Source: TradingView

If the bullish momentum continues, HBAR will rally to resistance at the 1.618 Fibonacci level ($0.13). The last time HBAR broke this resistance, it surged to $0.18.

Therefore, if buyers continue to accumulate, a similar rally could occur.

On the other hand, traders should pay attention to the support at $0.0546, as failing to hold this support level could trigger a trend reversal.

Speculative activity on the rise

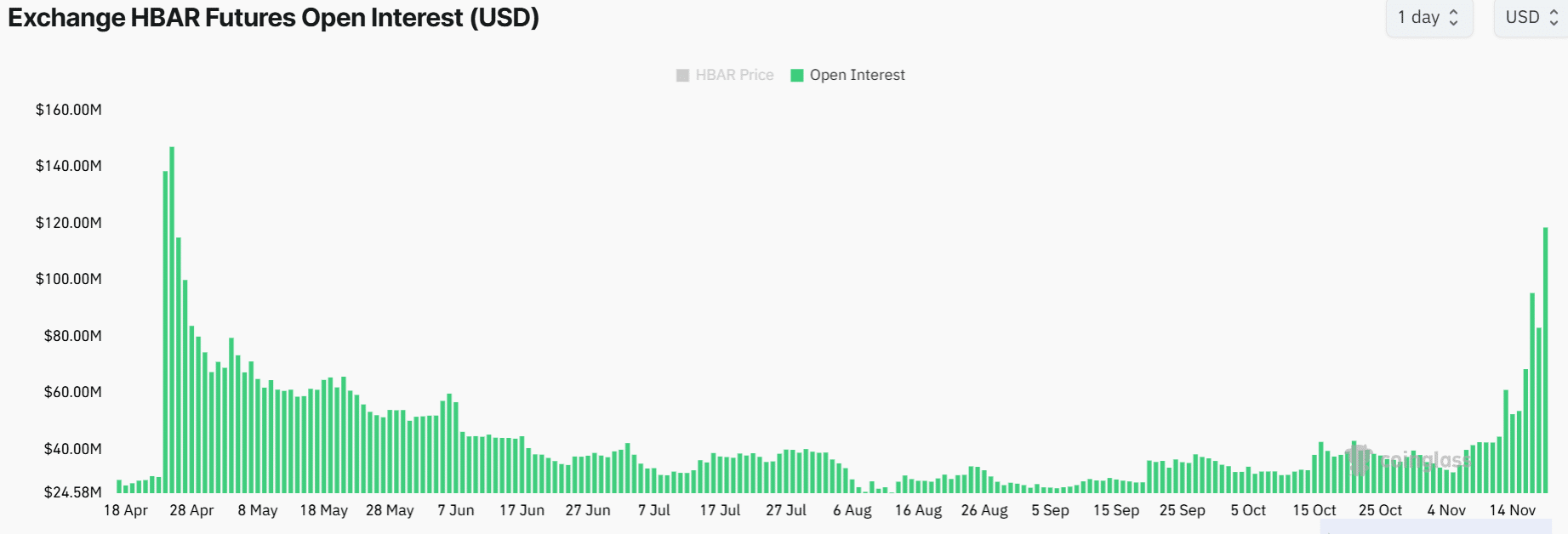

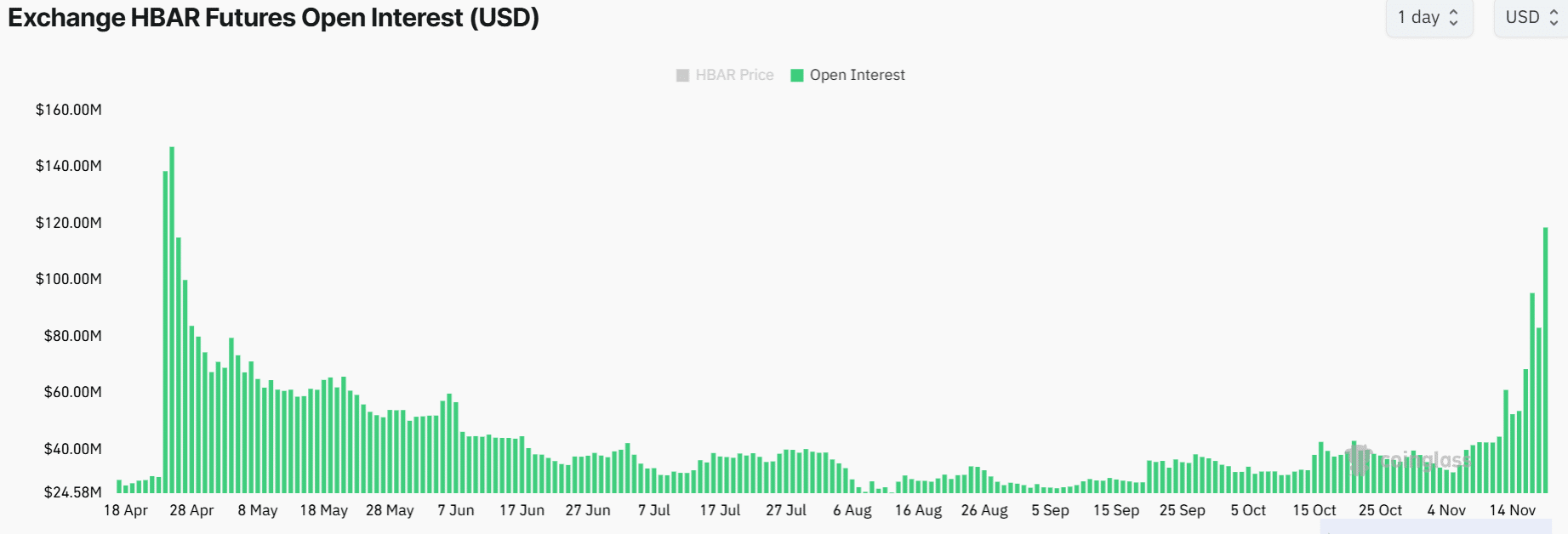

The derivatives market has shown increasing speculative activity around HBAR. At press time, trading volumes for the altcoin on this market stood at $1.37 billion, an increase of over 104% in 24 hours.

Open interest also jumped to $118 million, its highest level since late April, indicating traders are opening new positions.

Source: Coinglass

When Open Interest increases alongside price, it shows bullish momentum and conviction in the uptrend. Additionally, funding rates have remained positive, showing that there is higher demand for long positions.

If the market maintains this bullish outlook, HBAR could extend its gains. However, a rise in open interest also shows an increase in leverage, which in turn could cause volatile price movements.

Increased DeFi activity could fuel the rally

The Hedera blockchain has also seen an increase in decentralized finance (DeFi) activity, which could fuel HBAR’s rally.

Data from DeFiLlama showed that in just one week, Hedera’s DeFi TVL increased by 82% to $93 million at press time.

Read Hedera (HBAR) Price Prediction 2024-2025

A similar increase was also seen in DeFi volumes, which increased significantly over the past week.

Increasing DeFi activity is typically a catalyst for price growth. Therefore, if this TVL continues to rise, it could support the bullish momentum and generate more gains for HBAR.