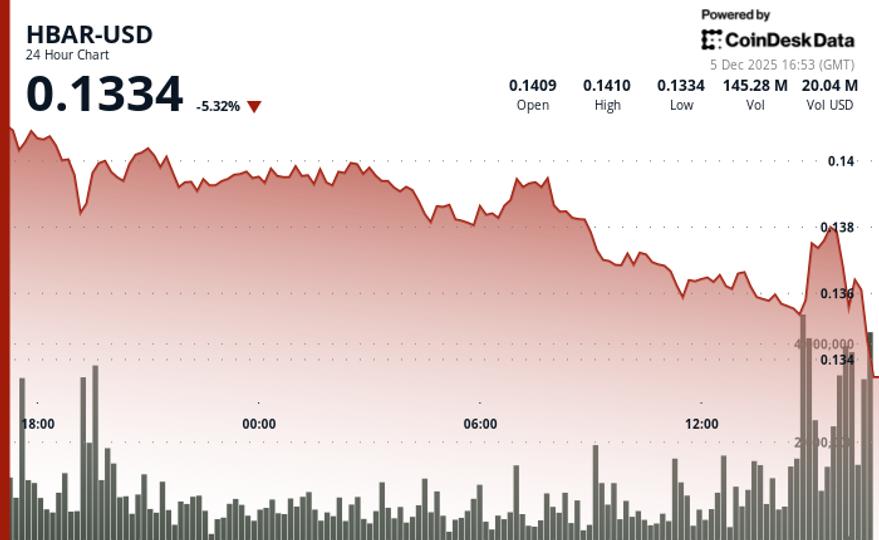

HBAR fell 2.2% during Thursday’s session as technical selling overwhelmed speculation in emerging ETFs. The token decisively moved below the $0.1380 support on volume that peaked 47% above the daily average of 35.5 million tokens.

The outage accelerated around 09:00 GMT when 52.21 million tokens changed hands. The bears pushed prices towards session lows near $0.1367 before the momentum stalled.

Recent price action shows HBAR testing critical support levels of $0.1354. The token briefly broke this bottom on volume of 2.37 million before returning to current levels around $0.1361. Technical indicators indicate oversold conditions, but bearish momentum persists as traders wait for clearer directional signals.

Bearish technical data contrasts with fundamental developments in light of growing interest around Canary Capital Group’s HBAR ETF. Institutional product launches typically drive structural demand over longer periods. Short-term price action remains dominated by technical factors, with traders weighing oversold conditions against established downtrend momentum.

Key technical levels signal caution for HBAR

Support/resistance analysis:

- Main support holds at $0.1354 after a successful defense during the session lows.

- A resistance cluster is forming between $0.1380 and $0.1391 from the broken support levels.

- Immediate consolidation floor established at the $0.1357 support zone.

Volume analysis:

- The volume of outages at 52.21 million confirms a technical outage with a peak of 47% above the average.

- The decline in volume late in the session suggests that exhaustion selling is near current levels.

- Recent hourly periods have data gaps, indicating potential reporting issues.

Chart templates:

- The established downtrend shows successive lower highs throughout the session.

- Limit trading emerges between $0.1354 and $0.1380.

- The potential for an oversold bounce develops from the testing low of $0.1354.

Risk/reward assessment:

- The resistance target lies at $0.1380 for any technical recovery attempts.

- A failure of support below $0.1354 opens deeper retracement scenarios.

- Current positioning above $0.1357 provides a defensive entry for contrarian plays.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.