Hedera Hashgraph has just taken a decisive step that could redefine its positioning of the market and the performance of Hbar prices’ action: the network has officially joined the ERC3643 standard, a framework designed to unify identity on the chain, compliance and the issue of tokenized assets.

This surprise decision is linked to Hedera in the T-Rex protocol ecosystem, which already underlies billions of dollars in safety tokens in accordance in the compatible chains Ethereum and EVM-an important step for the sustained institutional adoption of Hbar.

For the context, ERC3643 is not just another token standard. Unlike ERC20 or ERC721, it was explicitly built for the regulated securities markets with integrated compliance, KYC / AML checks and transfer restrictions directly to intelligent token contracts.

By adopting it, Hedera has actually opened its infrastructure to the institutional quality tokenization market, a segment that was to become dollars’ billions by the end of this decade.

How will ERC3642 increase the Hbar price?

(Source)

Strategic significance is twofold for Hbar holders. First, he grants improved institutional legitimacy to Hedera. Now Hedera has long marketed as a business quality blockchain alternative.

However, the integration of the ERC3643 gives this substance, with the introduction of compliance rails that institutional investors and asset managers require, from investment capital to real estate and token funds.

However, beyond that, it also introduces a new era of in-depth interoperability and liquidity.

As the ERC3643 is already taking place on Ethereum ecosystems, Hedera can now draw from transversal liquidity pools and settle as a viable host for security tokens.

This reduces Hedera’s previous isolation and positions Hbar as a potential payment asset in a wider financial battery.

If the adoption is accelerating, the implications for the assessment of Hbar are obvious: an increased demand for native tokens Hedera will stimulate public services and the public service will stimulate Hbar prices growth.

In simple terms, ERC3643 integration reduces the barrier to traditional financial institutions to rely on Hedera, a catalyst that could ignite a strong increase for Hbar in the coming months.

Discover: 9+ best high -risk crypto and reward to buy in August 2025

Hbar price analysis: Is hedera priming for a new test of all time?

While Hedera innovates with the integration ERC3642, the Hbar price is in substantial consolidation, following a triple support test of less than $ 0.22.

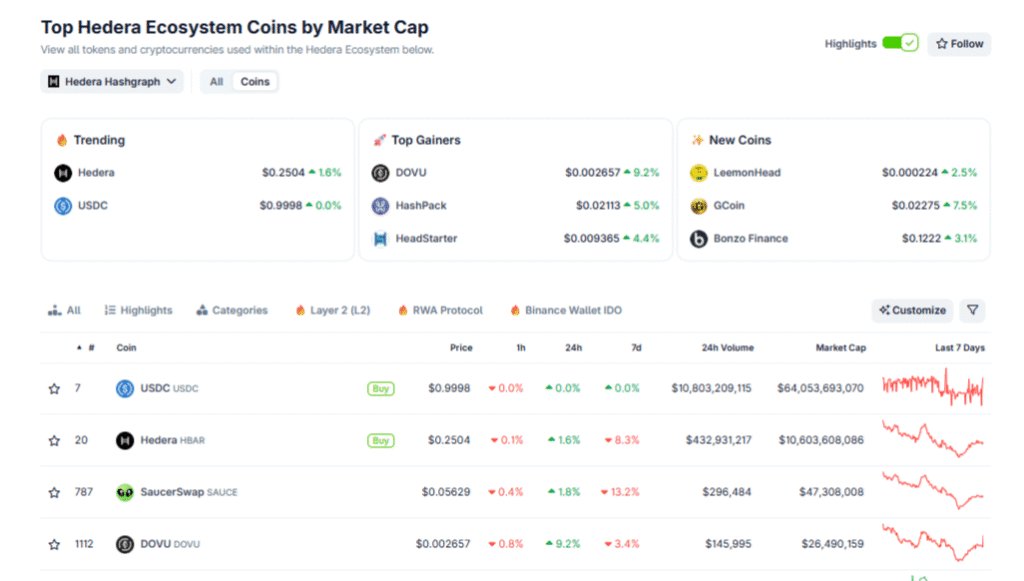

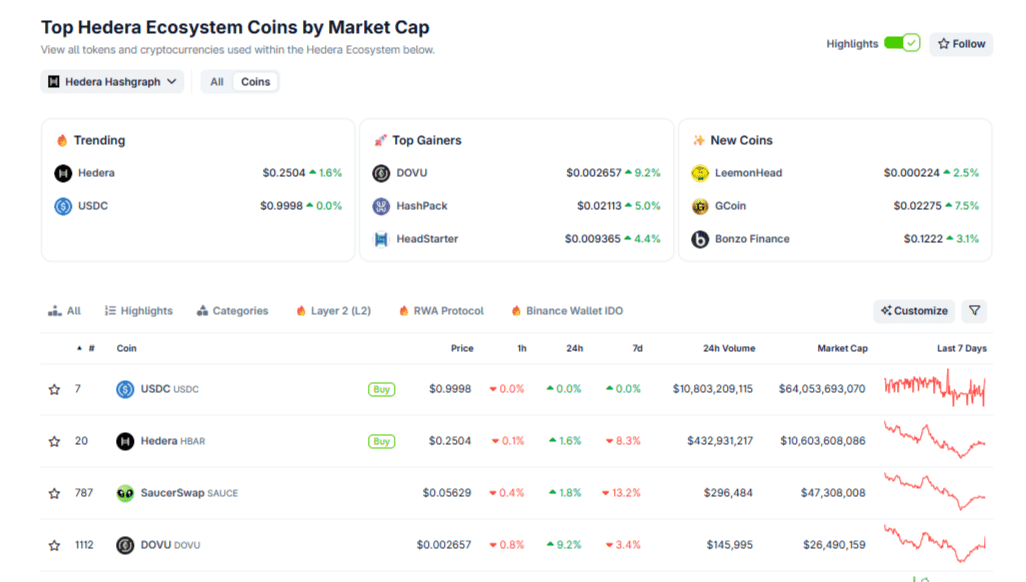

Now, negotiating at a current market price of $ 0.251 (representing a variation of 24 hours of + 0.94%), the Hbar price is above both a key psychological recovery ($ 0.25) and firm support from 200-DMA ($ 0.20).

(Hbarucedt)

Although the Hbar price has been able to get out of the disastrous “McDonalds” model after these refusals, prudence remains among traders after the double rejection to resistance around $ 0.30, which indicates the level of local key to monitoring.

Any break above this level would almost certainly give way to a remedy of the ATH at around $ 0.40, but, such an important decision, although reinforced by ERC3642 integration, should be accompanied by a significant movement in Bitcoin, followed by a drop in BTC.D.

For the moment, the RSI indicator illuminates a probable route to a retest of $ 0.30 after increasing fundamentals, with current reading at 53 years suggesting that a reasonable degree of increase is on cards this week.

DISCOVER: 20+ Next Crypto to explode in 2025

Main to remember

-

The Hashgraph Hedera association has made a youth of the ERC3642 association.

-

By joining the token standard, Hedera opens the door to a real institutional interest for token titles.

-

Experts provide that this could cause precipitation for public services on Hedera, which could therefore strengthen the price of Hbar.

-

For the moment

The post Hbar price set to go to be beards: ERC3643, T-Rex protocol, new era for Hedera? appeared first on 99Bitcoins.