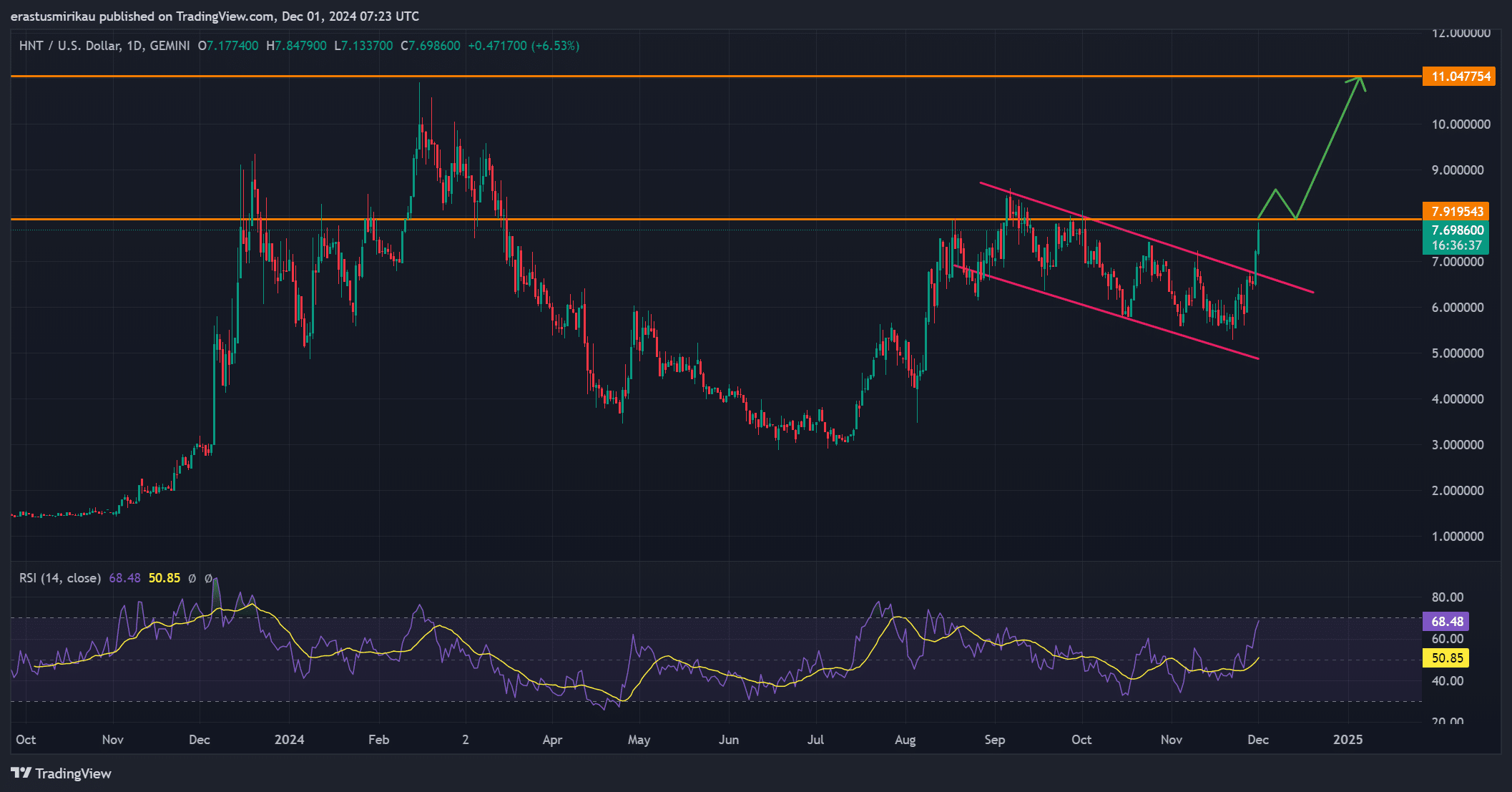

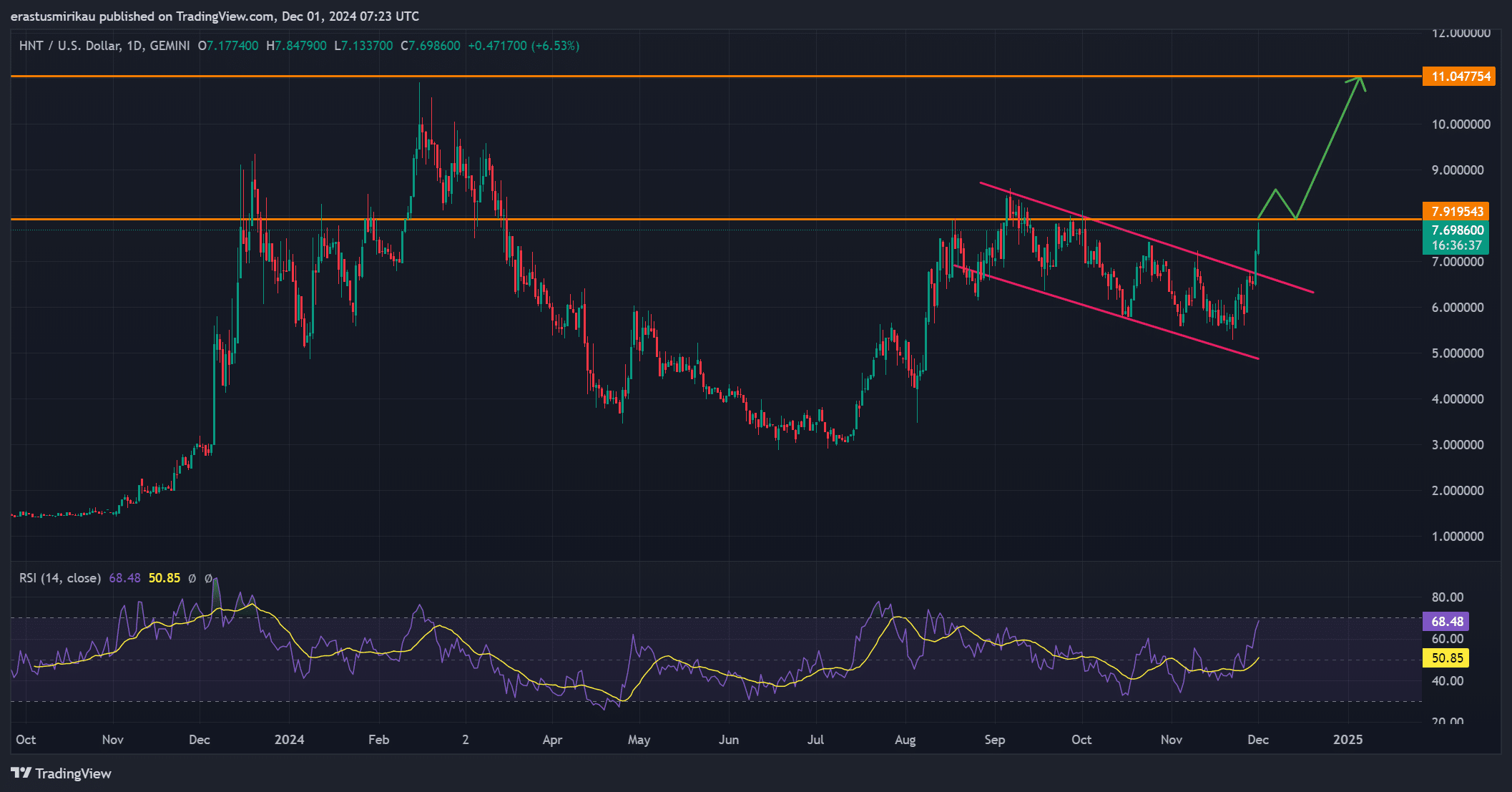

- HNT broke out of a bull flag pattern, eyeing key resistance at $7.90.

- Increased social dominance and rising open interest suggest continued bullish momentum.

Helium (HNT) showed strong upward momentum after breaking a bull flag pattern on the daily chart, with the price at $7.87 at press time, up 19.38% over the past 24 hours.

This increase is accompanied by a significant volume increase of 176.42%, bringing the total trading volume to 51.86 million.

As HNT approaches the critical resistance level at $7.90, it is poised for further potential gains.

With favorable technical indicators and growing market interest, the coin could be poised for a significant rally, possibly towards $11 in the near future.

What does the bull flag breakout mean for HNT?

Helium’s exit from a bull flag pattern signals increasing bullish momentum. A flag pattern typically follows a sharp upward move, followed by a period of consolidation, before breaking out again.

This suggests that it could continue its uptrend.

However, the token faces crucial resistance at $7.90. A successful break above this level could push it towards $11, making it a key point for traders to watch.

HNT’s RSI was 68.48 at press time, approaching overbought territory. Although this may indicate a short-term pullback, an RSI between 70 and 80 often accompanies strong uptrends.

Therefore, unless Helium undergoes a strong correction, the coin could continue to rise.

Source: TradingView

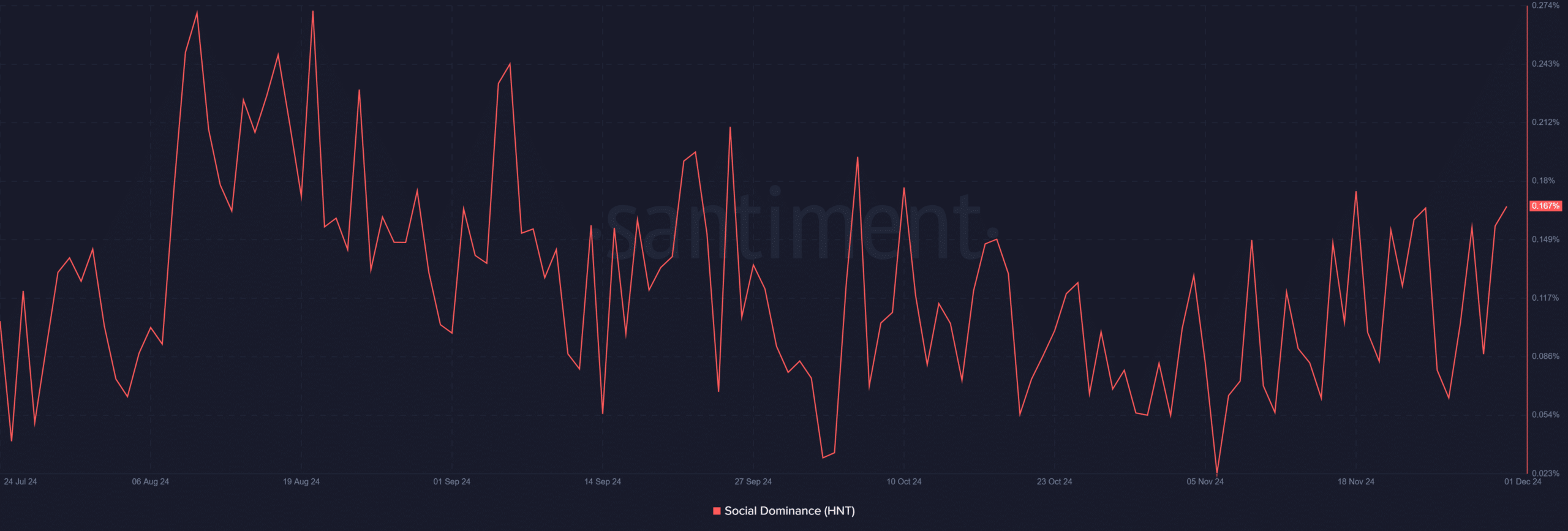

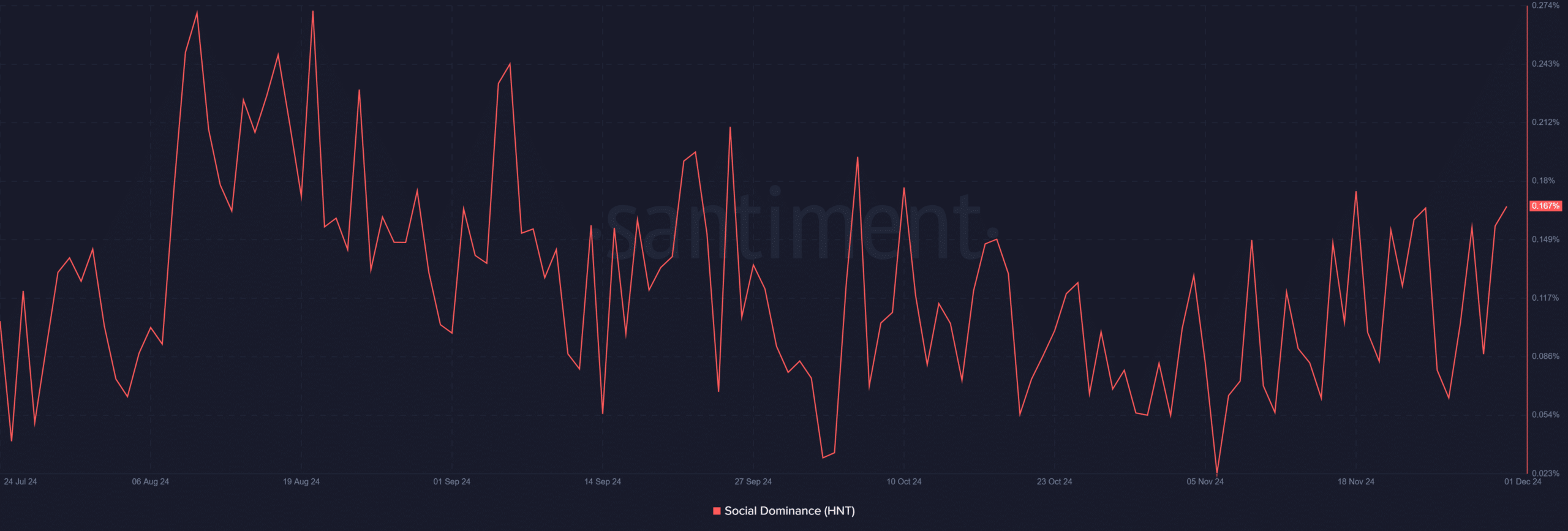

How does HNT’s social dominance impact its price?

Social dominance increased from 0.156% to 0.167% in the last 24 hours. This increase suggests growing awareness and discussion around the coin, which could spark more market interest.

Therefore, increased social dominance often determines price movements as traders notice the growing presence of the token.

This increase in social attention could help fuel HNT’s momentum and support its progression towards higher price levels.

Source: Santiment

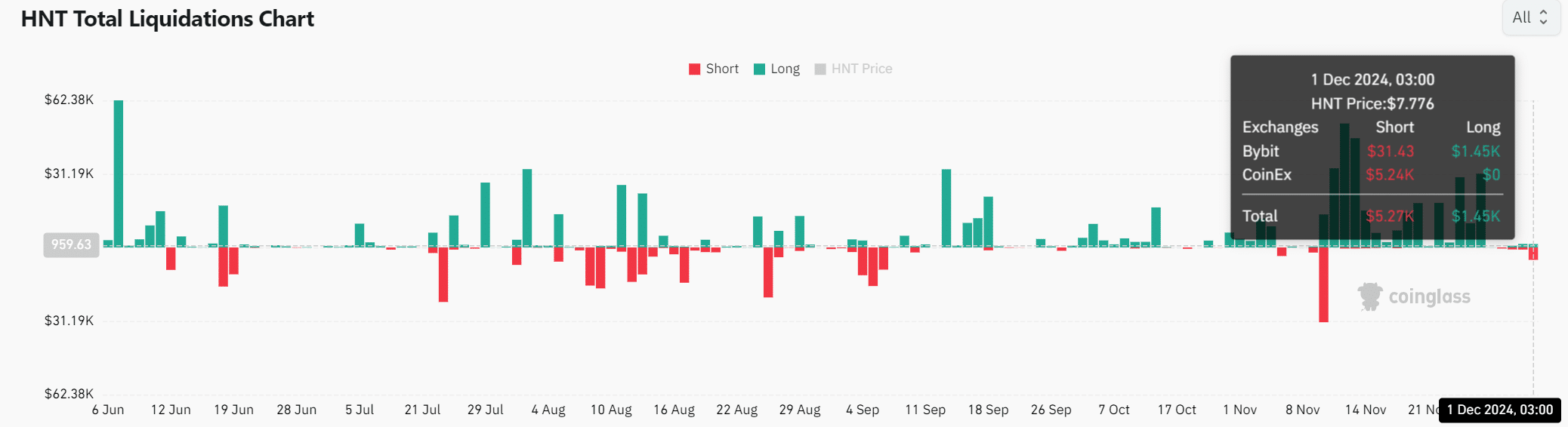

What does the liquidation data indicate about market sentiment?

HNT liquidation data shows bullish market sentiment. Shorts were liquidated at $5.27,000, while longs were liquidated at a lower value of $1.45,000.

This suggests that more traders are positioning for an upward price movement, reinforcing the current uptrend. As shorts are forced to cover, buying pressure could push the price even higher.

Source: Coinglass

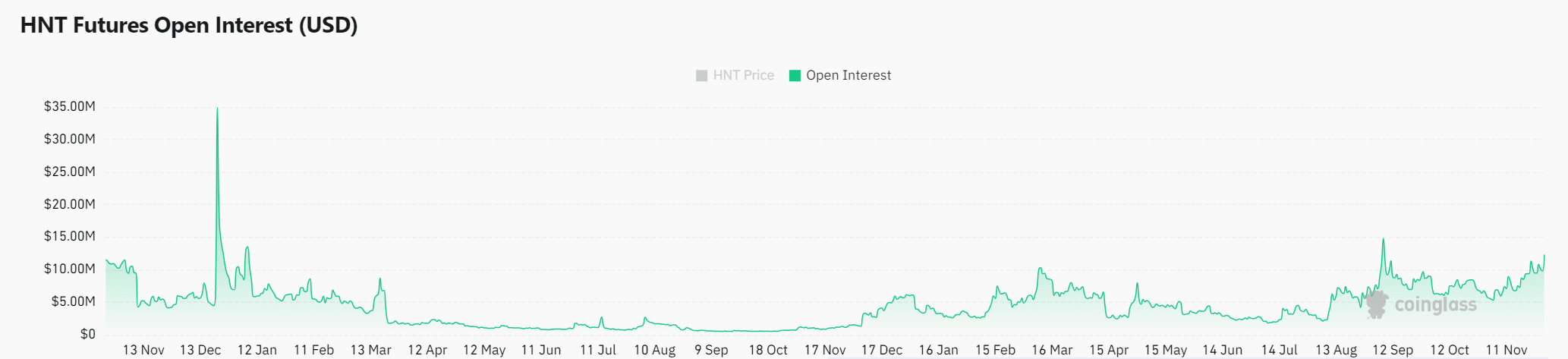

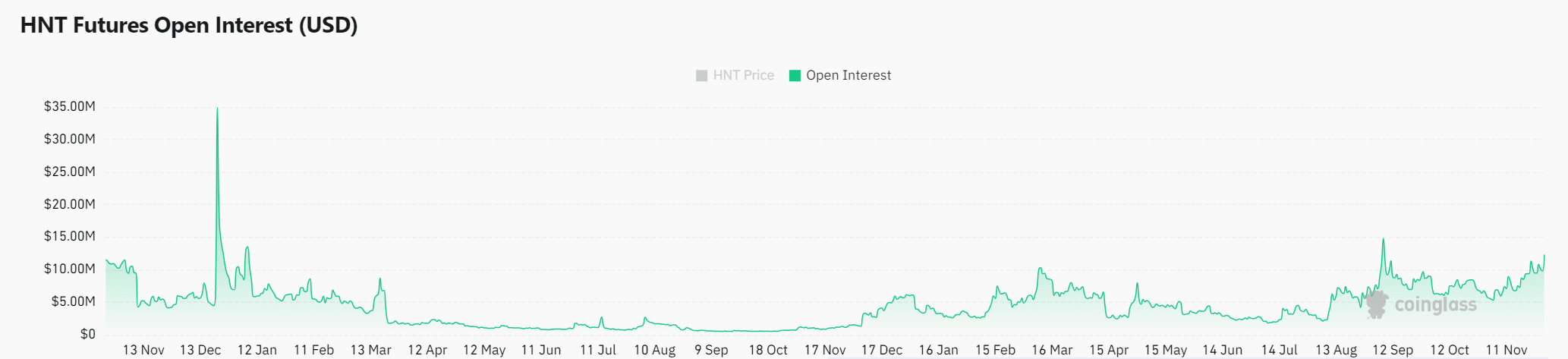

Rise of open interest

Open interest for HNT jumped 18.29%, reaching $12.27 million. This spike reflects increased trader participation and growing confidence in HNT’s potential for further gains.

As more positions are opened, the rise of open interest strengthens the case for continued bullish momentum.

Source: Coinglass

Is your wallet green? Check out the Helium Profit Calculator

Conclusion: Can HNT reach $11?

HNT’s exit from the bull flag pattern, growing social dominance, and increasing open interest suggest strong upside potential. If HNT manages to break the resistance at $7.90, it could move towards $11.

However, the RSI indicates the possibility of a short-term pullback. If the bullish momentum persists, HNT will likely continue its ascent.