Bitcoin recently produced a movement linked to the beach, prices oscillating between $ 83,000 and 86,000. Interestingly, popular analyst of Crypto Burak Kesmeci has identified important price levels for any short -term action.

Support at 82,800, resistance to 92,000 – but where is Bitcoin?

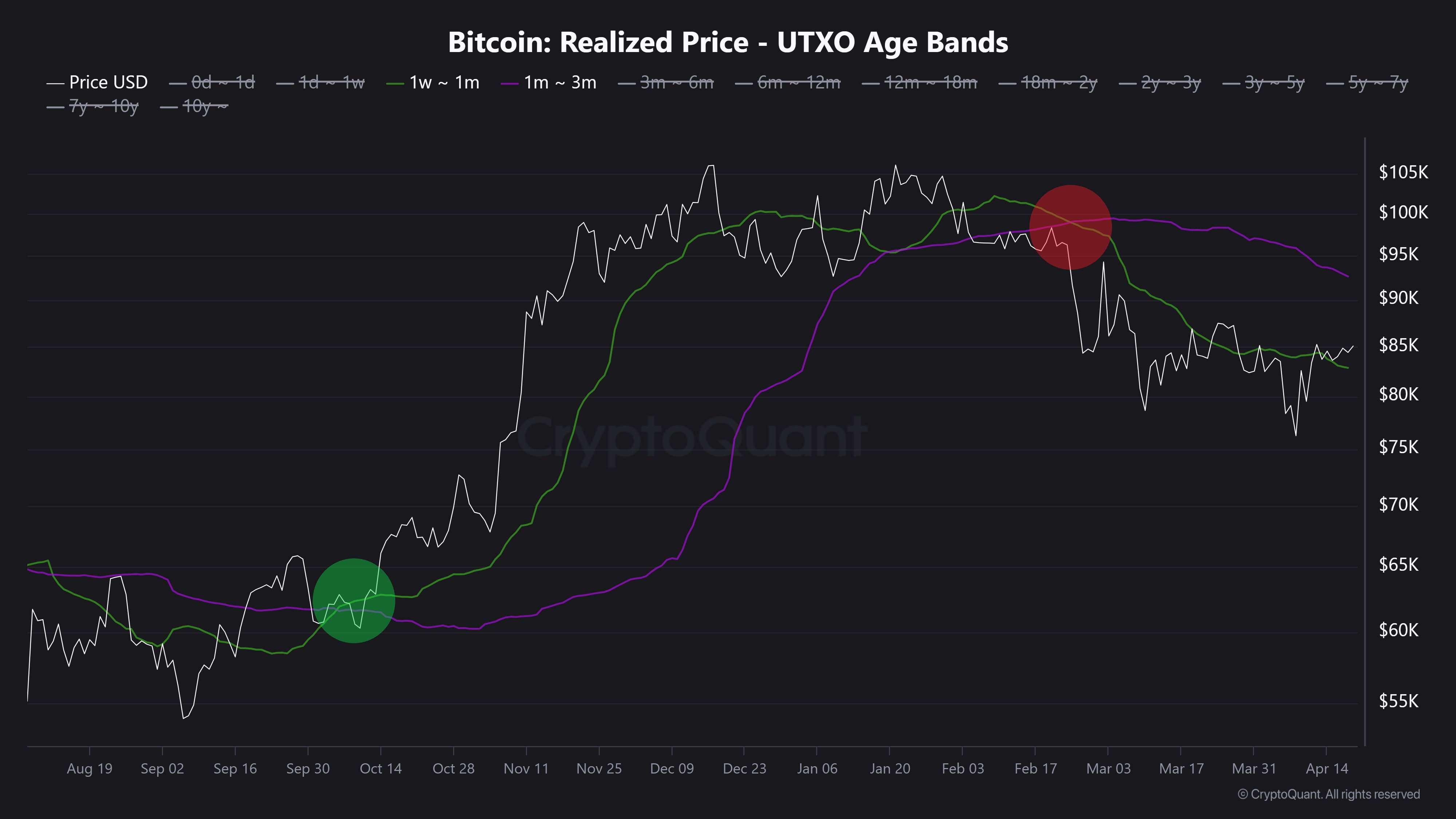

In a new post on X, Kesmeci shared an analysis on the interesting channel of the Bitcoin market. Using the basis of short -term investor costs, the analyst has identified two key price levels that could prove to be essential to the next major Bitcoin movement.

First, Burak Kesmeci focuses on the average costs of new traders in the last 1 to 4 weeks, which is probably the most reactive to price changes. The price made for these traders are currently $ 82,800, forming short -term support which indicates that many recent buyers are still in profit and can defend this level as a psychological floor.

Meanwhile, Kesmeci also highlights the price level of $ 92,000, which marks the basis of the average cost of BTC holders for 1 to 3 months. This price has become an important resistance zone, as investors are likely to leave the market once they break. In addition, the price level of $ 92,000 is also marked by a confluence with various technical indicators.

The interaction between these two levels is significant. Historically, short -term btc upward trends tend to start when the cost base of more recent investors, 1 to 4 weeks, crosses that of 1 to 3 BTC holders. This change indicates confidence and the desire to buy at higher levels, which often feeds broader rallies.

However, this dynamic remains to be played on the current market. Bitcoin is currently negotiating around 85,000, positioning it above his support for the average of 1 to 4 weeks of $ 82,800, but still below the resistance of 1 to 3 months of $ 92,000. In addition, the two basic cost levels have decreased in the past two months, reflecting an aggressive hesitation or lack of purchase from new entrants.

In particular, Kesmeci declares that the BTC must exceed $ 92,000 to confirm a strong bullish dynamic for a price reversal.

Bitcoin ETF discharge 1 725 BTC

In other news, Ali Martinez reports that the Bitcoin ETF have undergone withdrawals of 1,725 bitcoin, worth 146.92 million dollars, during last week. This development illustrates a high level of negative feeling among institutional investors, adding to the uncertainty of the market in the BTC market.

Meanwhile, Bitcoin is negotiated at $ 85,249 following a price variation of 0.89% in the last day. The first cryptocurrency also reflects a loss of 0.58% on the weekly graph and a gain of 1.06% on a monthly graph.

Adobe Stock functionality image, tradingView graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.