Crypto Giant Bitwise says that certain parts of the digital asset ecosystem experience “unleashed bull markets” despite a disappointing feeling in the class of assets as a whole.

In a new report of the first quarter, the director of chief investments of Bitwise, Matt Hougan, says that “frustrating” would be the best word to describe the first quarter of 2025, but that it was still “historically positive”.

Hougan notes that in addition to the rise of the adoption of stables and the Bitcoin term trading volume, the tokenization of active world (RWAS) became parabolic in the first quarter.

“What attracted my attention is that, despite the maintenance of prices, certain parts of the market of cryptography are experiencing unleashed bull markets. For example: Stablecoins AUM (active in management) increased to a higher time of more than $ 218 billion, up 13.50% of tride district-district to a new summit of all time.

As we enter the second trimester, I would expect these areas and related areas to rise above. »»

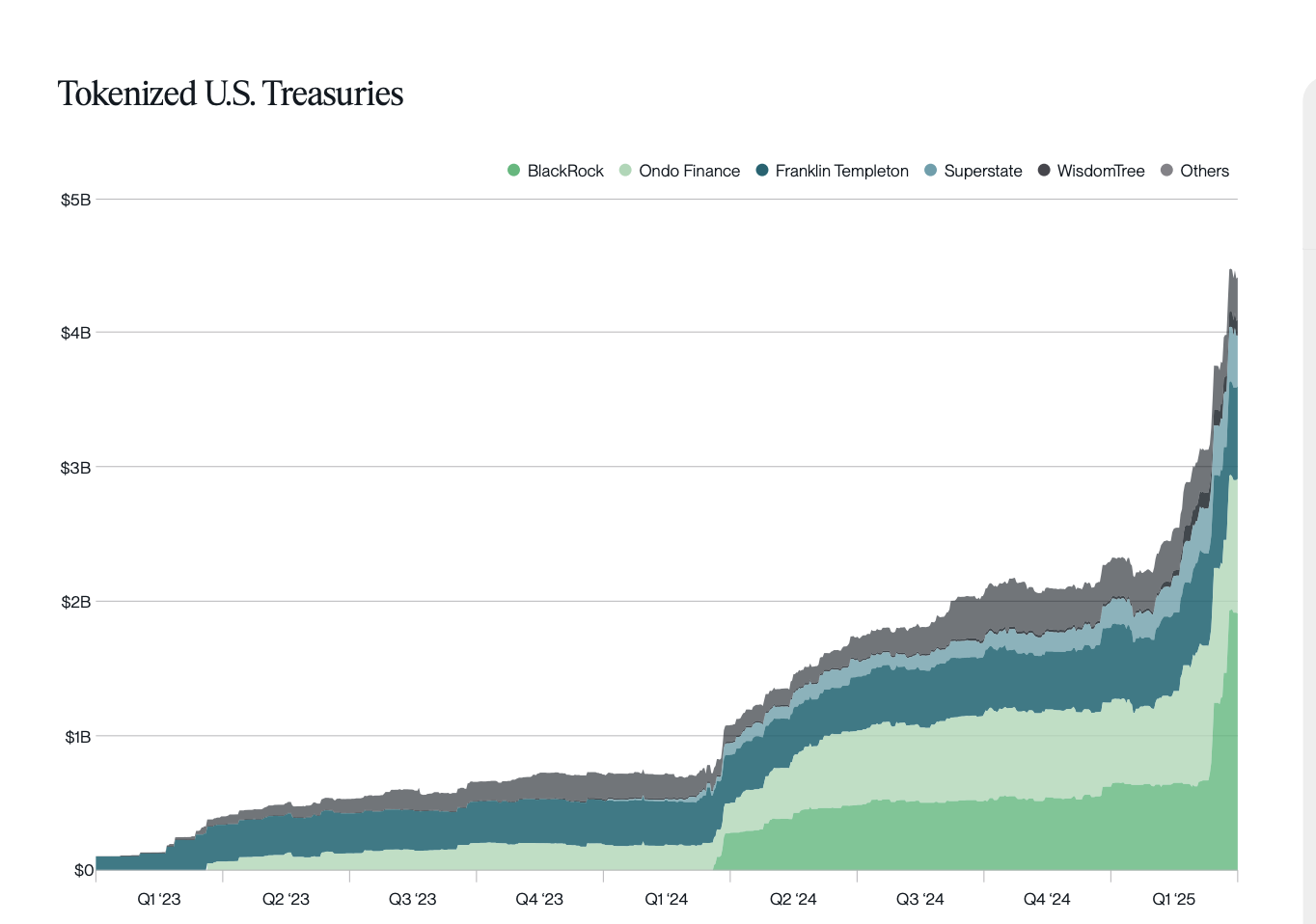

Bitwise data show an explosive rise for RWA in recent years, the one that has accelerated in 2025 so far, widely motivated by the tokenization of private credit and American treasury bills.

According to Bitwise, Ondo Finance (Ondo) competes in Blackrock for the tokenization of American treasury bills and eclipses other traditional financing companies (tradfi) such as Franklin Templeton and Wisdomtree.

Bitwise also says that after years of tightening, central banks around the world signal a pivot to more loose monetary conditions and an expansion of the money supply of M2, which, historically, was “favorable to risk assets, in particular for digital assets”.

Read the full report here.

Follow us on X, Facebook and Telegram

Do not miss a beat-Subscribe to obtain alerts by e-mail delivered directly in your reception box

Check price action

Surf the daily Hodl mixture

& nbsp

Warning: Opinions expressed at Daily Hodl are not investment advice. Investors should make their reasonable diligence before making high-risk investments in bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and that all the losses you may undergo are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, and the Daily Hodl is an investment advisor. Please note that the Daily Hodl is participating in affiliation marketing.

Image generated: slab3