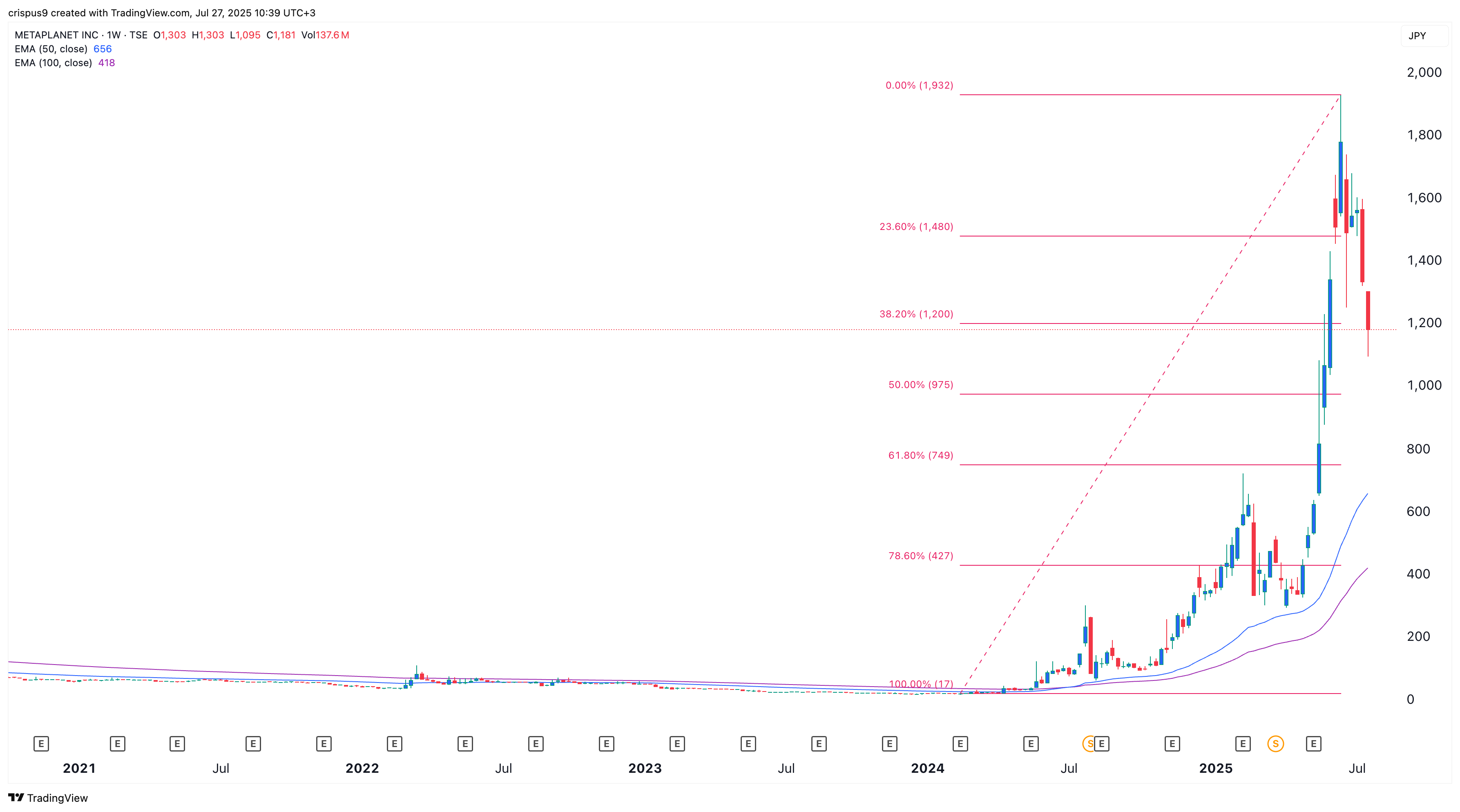

Metaplanet’s stock price collapsed on a lower market this month, falling by almost 40% of its highest point this year.

Summary

- The course of the Metaplanet action has entered a lower market while Bitcoin hovers near its top of all time.

- A likely reason is that its Nav of 2.79 is greater than that of other companies.

- The techniques indicate a possible Metaplanet stock rebound.

Why Metaplanet Stock while Bitcoin jumps

Metaplanet, one of the largest Bitcoin (BTC) holders, crashed at ¥ 1,180, down from the early year of ¥ 1,934. He plunged at the lowest level since June 3 of this year.

Metaplanet’s share price has plunged even if his Bitcoin holdings have become more precious. The data show that the company holds 16,352 bitcoin, currently valued at $ 1.9 billion.

The average cost of its Bitcoin purchases was $ 99,502, which means that its assets jumped almost 20%.

There are three possible reasons for which the stock has crashed in recent weeks. First, it is feared that its activities have become very overvalued this year. It has a net asset value or a multiple NAP of 2.79, much higher than other similar companies.

For example, the strategy, the OG of Bitcoin cash companies, has a multiple NAP of 1.6. Other companies such as Digital Marathon, Riot Platforms and Semler Scientific have a multiple nav of less than 2.

Second, Metaplanet’s share price crashed, perhaps due to the current dilution of the shares. Like the strategy, the company has issued actions to buy Bitcoin. Although this strategy is solid and its investors are better off, there are concerns about the continuous dilution because it aims to have 100,000 pieces.

The data show that the actions in circulation of the company are 459 million, which is significantly higher than the 57 million reported in 2022.

Third, the underperformance of Metaplanet’s actions reflected that of other Bitcoin cash companies. For example, the MSTR course course remains 25% below its top of all time, while Bitcoin hovers near its top of all time.

Finally, Metaplanet’s equity price has plunged, perhaps investors reserve profits after the recent increase. At its record level, the stock increased by more than 12,900% compared to its lowest level in 2024. It is common for an asset to retire after a major rally.

Metaplanet Action Price Technical Analysis

The weekly graph shows that the Metaplanet action course increased from ¥ 1,932 in June to ¥ 1,150 from today. It went to the Fibonacci retracement of 38.2% to ¥ 1,200.

On the positive side, the stock remains much higher than the 50 weeks and 100 weeks mobile averages. He also formed a pattern of hammer candlestick, composed of a small body and a long lower shadow.

Consequently, it is likely that the course of the Metaplanet action rebounds, especially if the price of Bitcoin rebounds.