- BNB gained 22% in November, fueled by a broader rise in cryptocurrencies.

- The Money Flow Index at 61 showed strong buying interest, with more room for gains.

Binance Coin (BNB) has been forming higher highs and lower lows on the daily time frame since August, suggesting the possibility of hitting new all-time highs before the end of the year.

During the first week of November, BNB gained 22%, fueled by the rise in cryptocurrencies following Trump’s victory.

However, BNB faced a roller coaster ride this week, falling 7% to settle at the key $606 support zone. This pullback allows traders and investors to participate before a major bull run.

Indicators show room for further bullish momentum in BNB

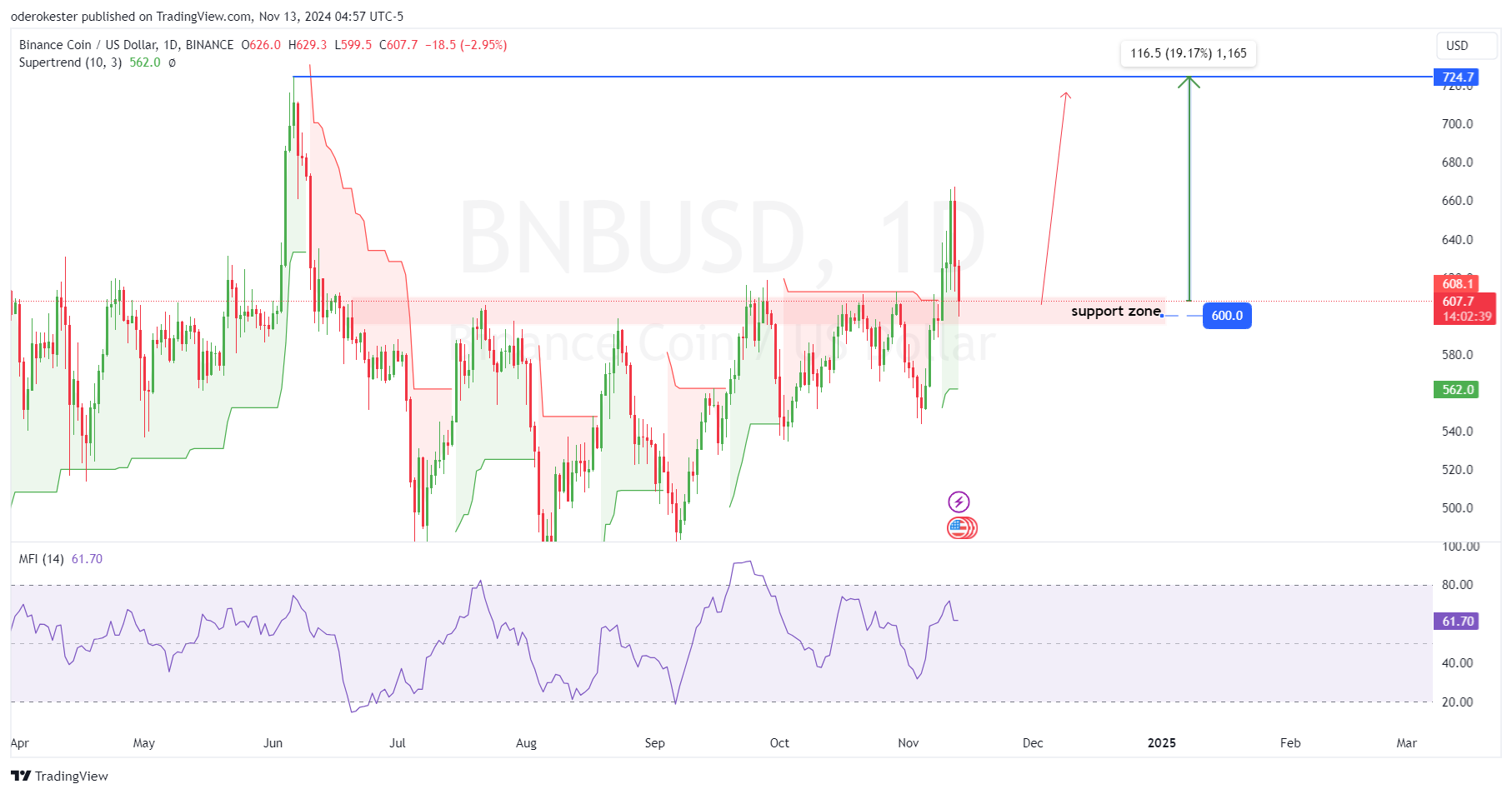

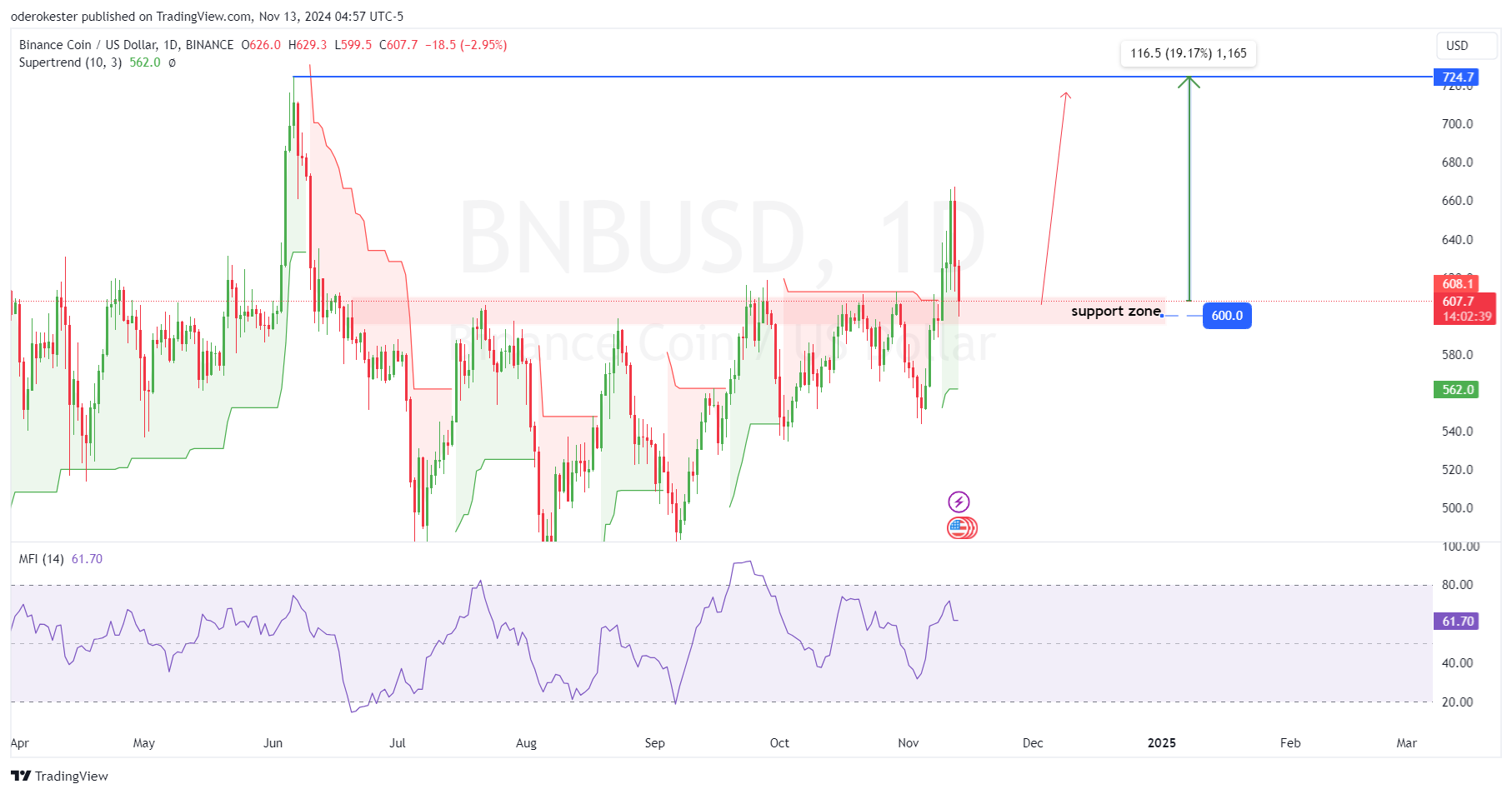

At press time, BNB was holding above a key support area at $600, which previously served as a strong level for support and resistance.

This support forms the basis for a potential upward move towards resistance at $724.7, which marks BNB’This is the previous high and all-time high, approximately 19% above the current price.

Additionally, the Supertrend indicator remains in bullish territory, with price positioned above the green Supertrend line near $562, providing dynamic support in the event of a pullback.

The Money Flow Index at 61.70 suggests healthy buying interest without yet reaching overbought territory, leaving room for further upside momentum.

Source: Tradingview

As long as BNB maintains the $600 support level, there is potential for a rally towards the $724.7 resistance, especially if bullish sentiment persists.

Open Interest and Market Sentiment Outlook for BNB

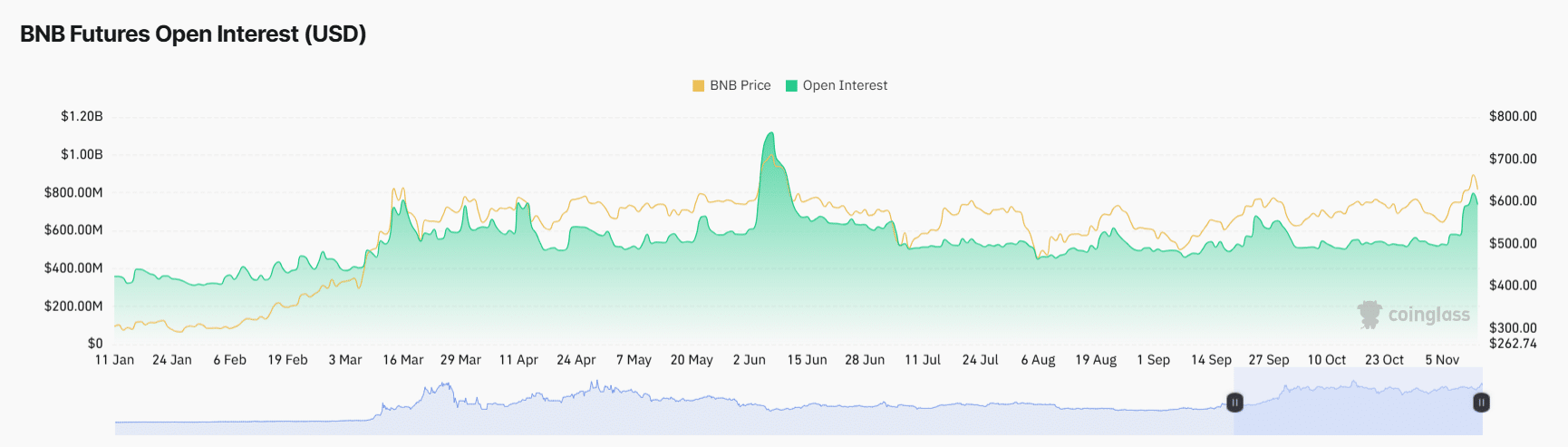

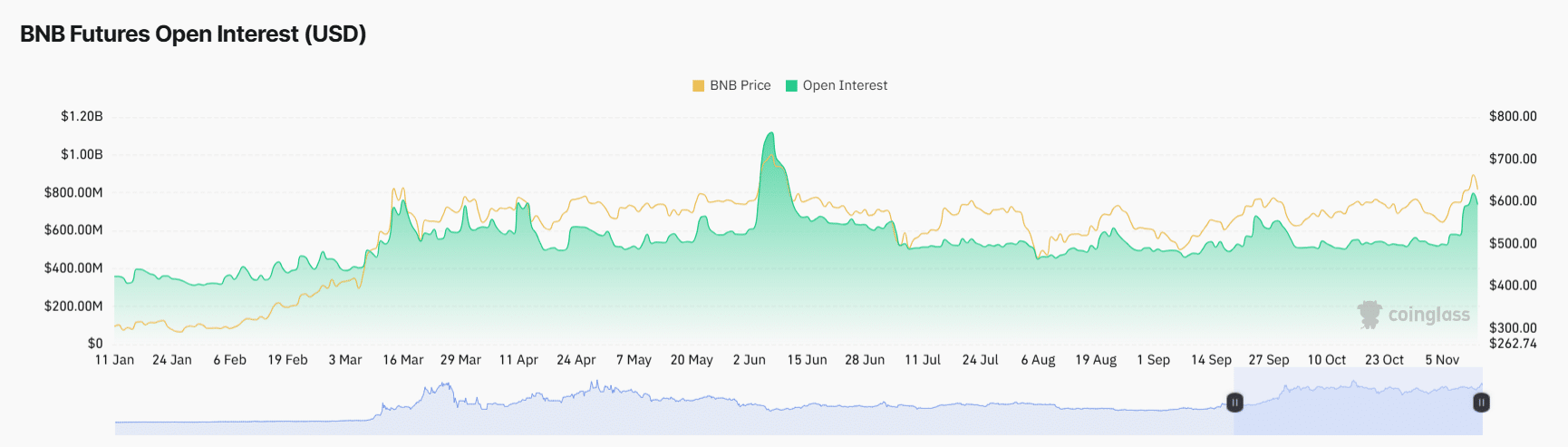

BNB has shown strong bullish signals since August, forming higher highs and higher lows on the daily chart. This price action, combined with the rise open interestst from August to present, suggests increasing market participation and confidence in the uptrend.

Source: Coinglass

Although OI has been increasing steadily, it has not yet reached the peak levels seen in June, indicating that there is still room for growth in terms of interest and price action.

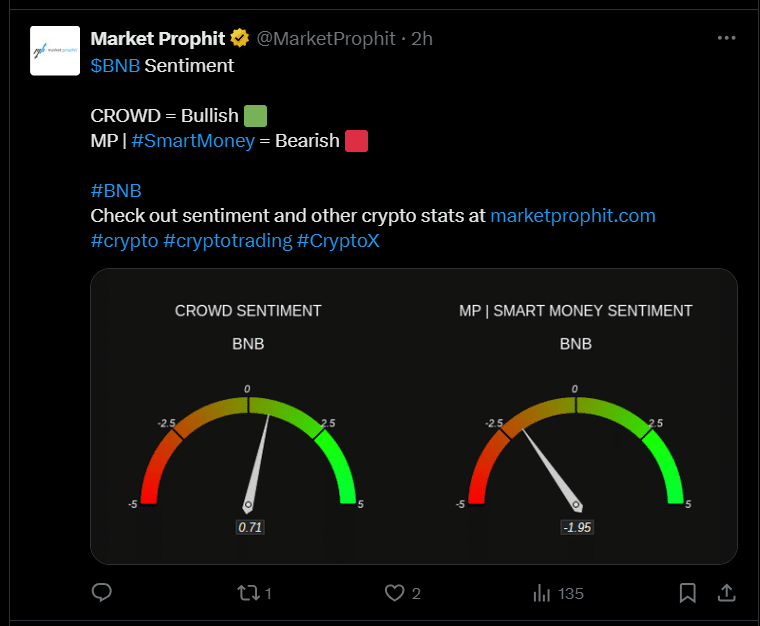

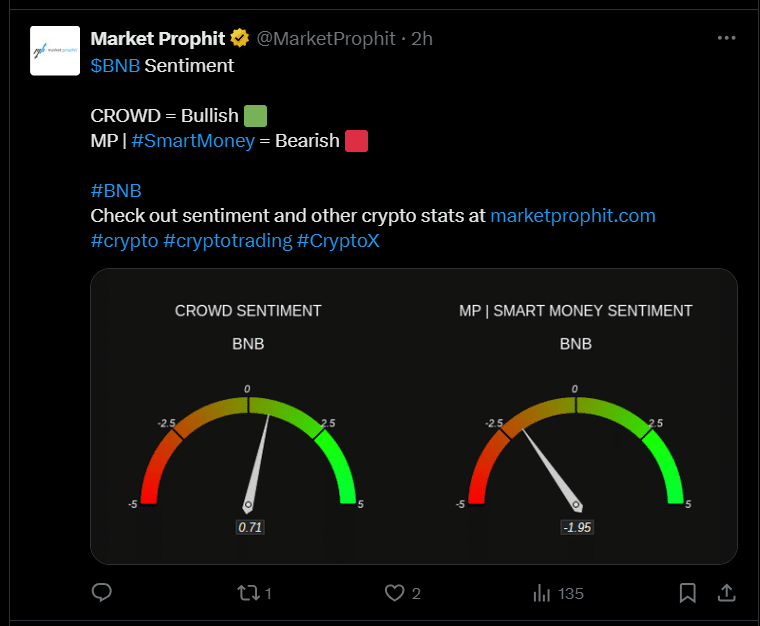

This sentiment analysis reveals contrasting views on BNB. Public sentiment is bullish, with a score of 0.71, suggesting general optimism among retail traders.

On the other hand, smart money sentiment, reflecting institutional or experienced investors, is bearish, with a score of -1.95.

Source:

This divide indicates a cautious stance from seasoned investors, perhaps hinting at underlying concerns, while retail traders maintain a more optimistic outlook.

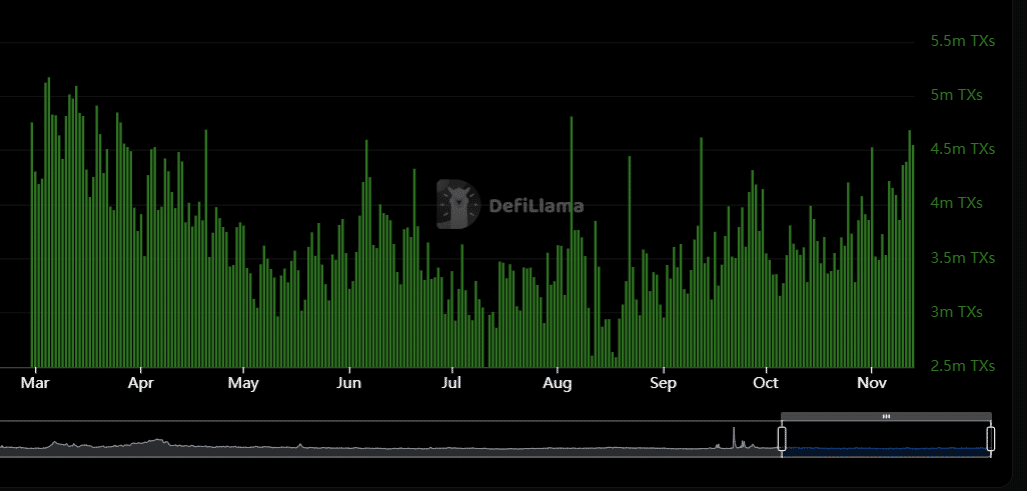

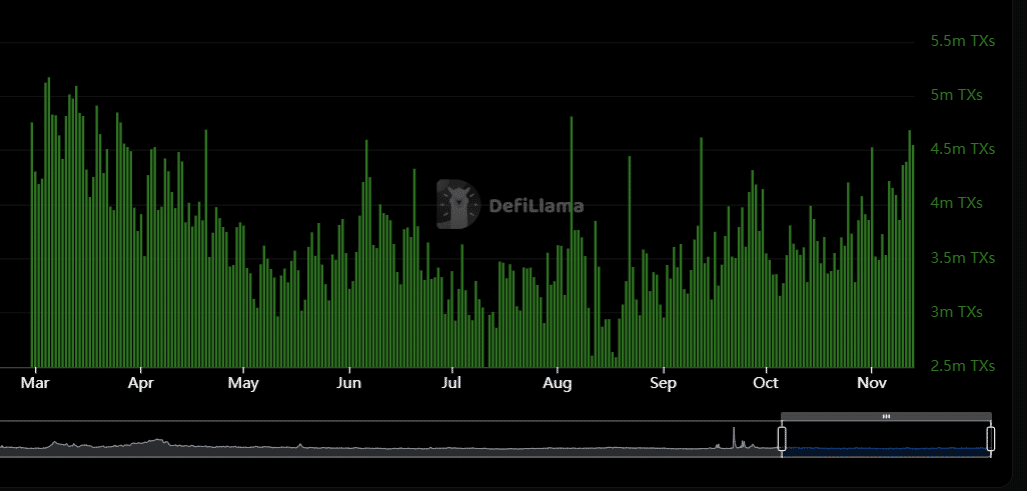

BNB trading activity rebounds in Q4

In March, trading volume reached its highest level, frequently exceeding 5 million issuances, indicating a period of increased activity and engagement.

However, after this peak, trading volumes gradually declined in April and May, reaching a more moderate level during the summer months.

Source: DeiLamma

Read Binance Coin (BNB) Price Prediction 2024-2025

From July onwards, trading volume resumed, although less dramatically than in March. The recent trend from October to November shows a steady increase in transactions, often reaching around 4.5 million transactions.

This steady growth in activity suggests renewed interest or increased usage, potentially due to market events or protocol upgrades.