- SAND recently found strong support as bulls looked to trigger a break above its current pattern.

- Derivatives data showed a bearish trend, with some hopes of a bullish recovery.

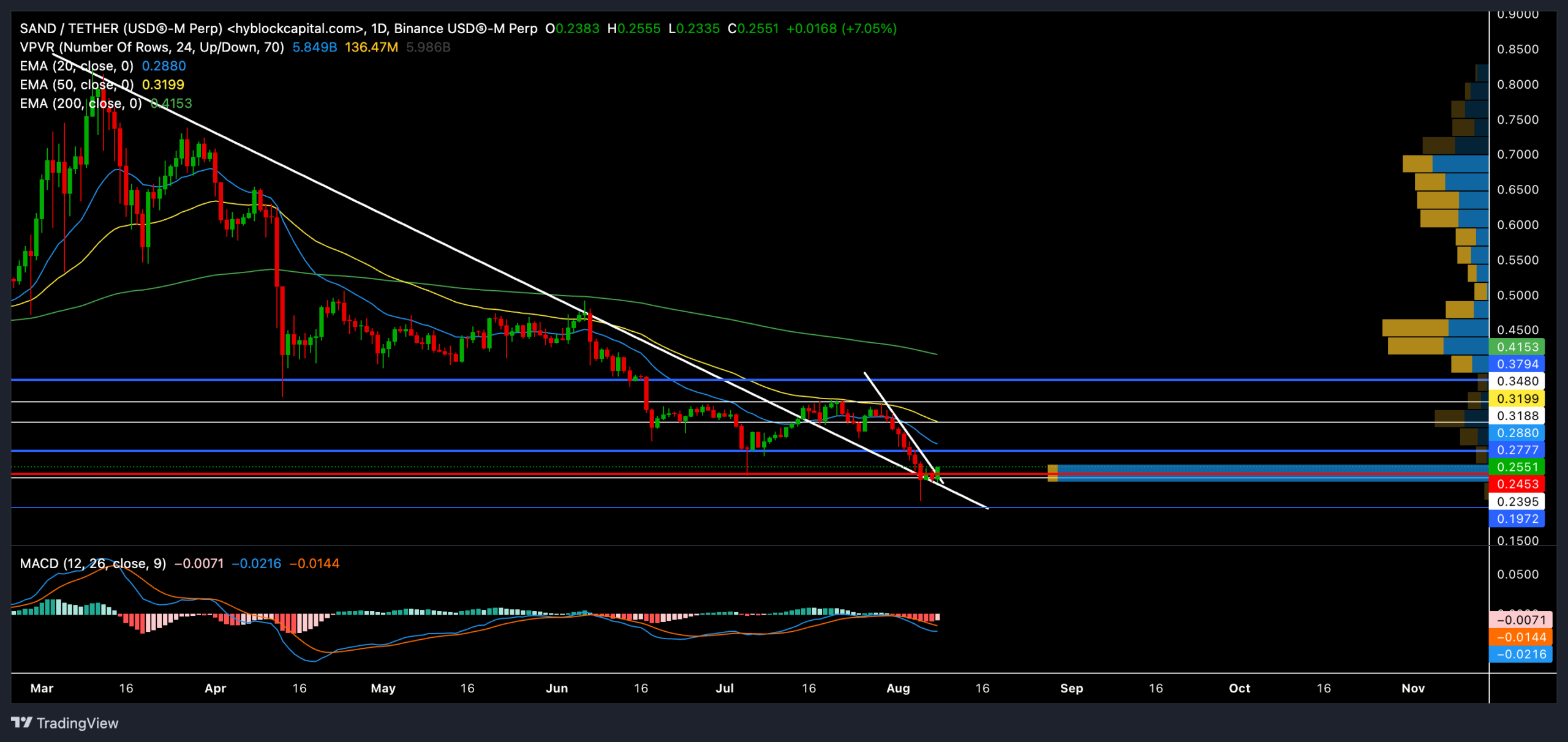

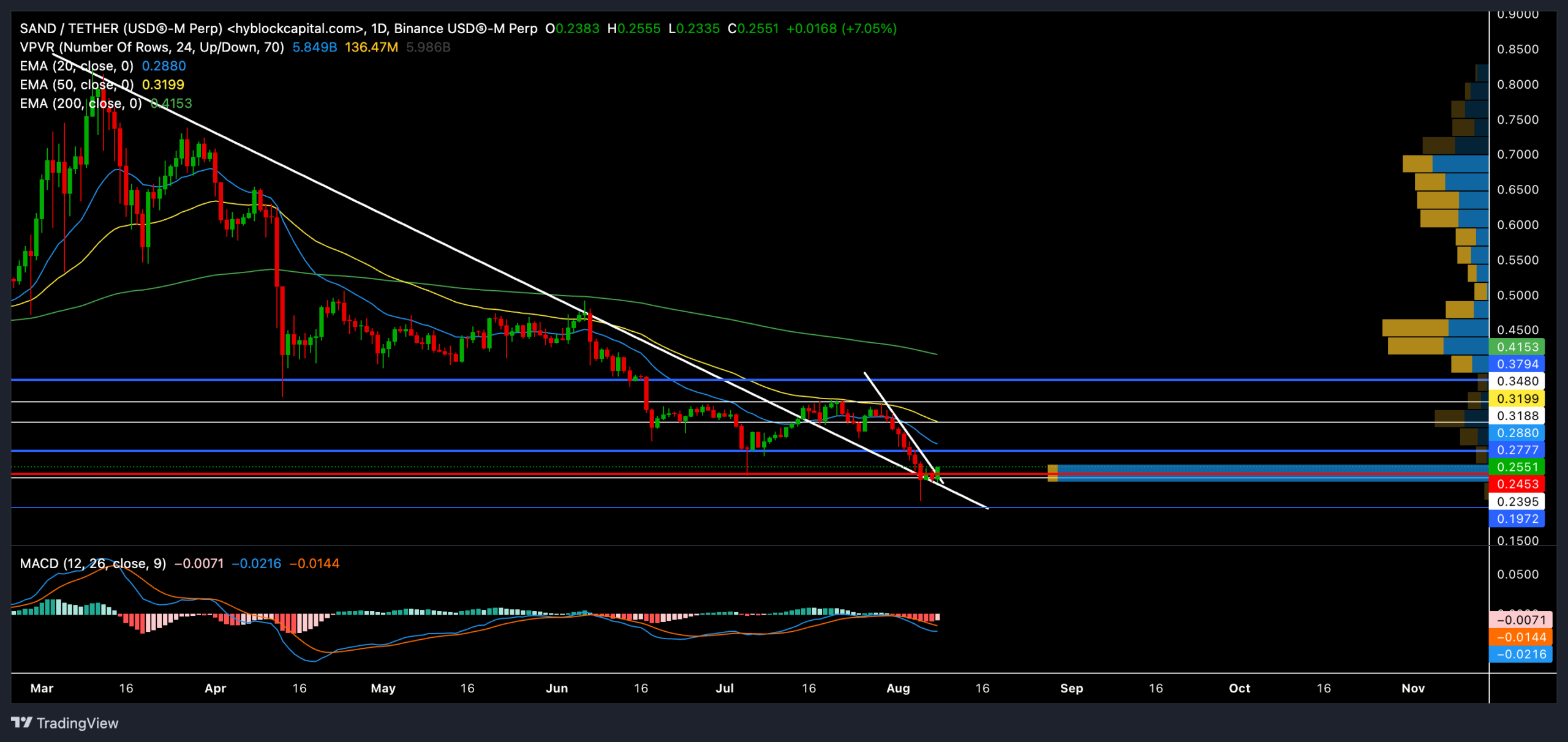

As bears spark a fresh sell-off rally in The Sandbox (SAND) market, price action has struggled to stay above crucial support levels.

The bounce off the 50 EMA triggered a downtrend towards the $0.23 support at press time.

The bulls would now look to break the downtrend, especially as the price approaches a zone of high liquidity. At the time of writing, SAND was trading near $0.24, up nearly 5% over the past day.

Can bulls step in to stop the bleeding?

Source: TradingView, SAND/USDT

SAND bears have regained strength after bouncing off their 200-day EMA (green) in early June. During its decline, the stock price also fell below the 20-day and 50-day EMAs, reflecting a strong downtrend.

It is worth noting here that the 200-day EMA coincided with the trendline resistance of the time (white), which caused some bearish pressure.

The resulting downtrend has seen a decline of nearly 49% in just two months. However, the $0.23 support level has rekindled some hopes of a bullish recovery at the time of writing.

Meanwhile, SAND found a close above its long-term trendline resistance and reversed it to support its daily chart.

The altcoin has also formed a classic falling wedge pattern. The recent bullish bounce from the $0.23 support may pave the way for the bulls to break out of this pattern.

If the bulls find a strong close above the current pattern, SAND could find a way to test the $0.28-$0.31 resistance zone before any bearish reversal.

On the other hand, if the price drops below the immediate support level at $0.23, the altcoin could see an extended decline before rebounding.

The MACD lines have confirmed the overall bearish trend in the SAND market. However, buyers should keep an eye out for a possible bullish crossover in the MACD lines.

This crossover may confirm a release of selling pressure and help SAND retest its EMAs in the short term.

The derived data revealed THIS

Source: Coinglass

The overall long/short ratio is 0.9869, indicating a slight bias towards short positions. However, the best traders on Binance (BNB) have a long/short ratio of 2.6873.

Realistic or not, here is the market capitalization of SAND in terms of BTC

Despite the slight overall short bias in the long/short ratio, other indicators like account ratios, major traders’ positions, funding rates and liquidations suggest a generally bullish sentiment for SAND.

The increase in volume and open interest shows growing market interest, which could potentially fuel further price movements.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and represents the opinion of the author only.