Bitcoin recently plunged after hitting a two-month high, with market veteran Peter Brandt highlighting an unusual trading trend.

While the main cryptocurrency is struggling to regain its footing after a strong correction, Brandt recently presented the investing public with a model he calls “Three blind mice and a piece of cheese”.

Bitcoin faces a sharp retracement

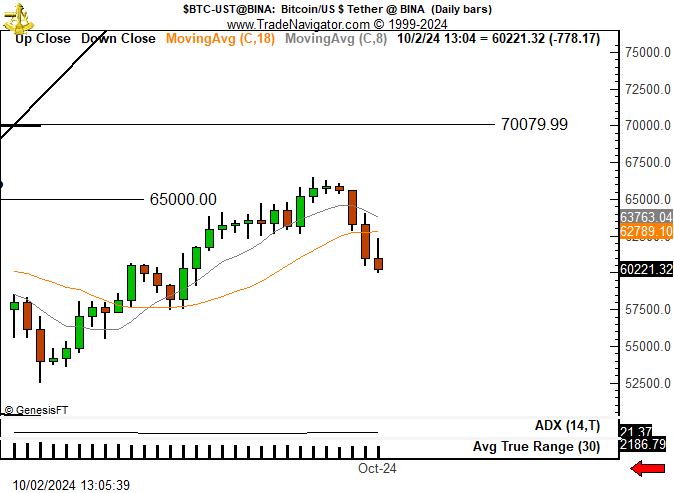

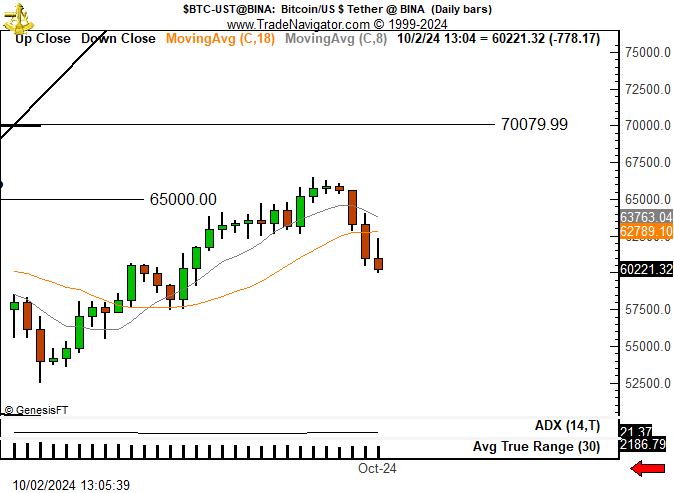

Towards the end of September, Bitcoin reached a high of $66,508, marking its best performance in two months. However, the enthusiasm was short-lived, as the leading cryptocurrency fell more than 7.7% over the following days, falling to around $60,221 yesterday.

Brandt’s 1-day chart shows three consecutive bearish daily candles, with prices slipping below important technical levels. Amid the correction, analysts are wondering if the worst is yet to come or if Bitcoin is preparing for another breakout.

This slowdown coincides with growing global uncertainty, particularly around tensions in the Middle East, which has led investors to shy away from riskier assets like cryptocurrencies. The bearish resolution neutralized the bullish momentum expected for “until October”.

Brandt’s “three blind mice” model has further heightened concerns about Bitcoin’s price action. Although he has not fully explained this term, some analysts suggest this can refer to a continuation trend, in which the price is likely to follow the downtrend established from the three bearish candles.

Analysts call similar patterns, such as the “three black crows” pattern, a bearish signal that a market is losing steam and could face continued selling pressure. With Bitcoin now trading below two key moving averages, the near-term outlook appears bleak.

Bitcoin Technicals Look Dark

Brandt’s chart shows that the current Bitcoin price is below the 8-day and 18-day moving averages. This signals short-term weakness, implying that sellers have taken control. If Bitcoin does not rise above these levels soon, further losses could occur.

Meanwhile, ADX is hovering around 21.37. This figure suggests that the current trend lacks strength. The positioning indicates that the market is in a consolidation phase, but the risk of further downward movement remains high. Brandt previously suggested BTC is still in a bearish phase.

Despite the recent slowdown, Bitcoin’s psychological and technical support at $60,000 remains intact for now. If the price falls below this level, it could lead to another wave of selling. This new wave could push Bitcoin towards the $58,000 mark.

However, ATR is showing increasing volatility, which means traders should expect larger price swings in the coming days. Despite the difficulty of predicting Bitcoin’s next direction, indicators suggest that a deeper correction is still possible.

Even though Bitcoin’s decline has disappointed the bulls, the market could still see a reversal. Historically, October has been a strong month for crypto, and if Bitcoin May Hold Over $60,000there is potential for a rebound towards $65,000.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.