The cryptocurrency market has been hit by a new wave of selling pressure as Bitcoin and Ethereum prices fell sharply, triggering widespread panic and uncertainty. With more than $536 million in Spot Bitcoin ETF outflows in a single day, the slowdown has sparked new fears of a prolonged bearish phase. Analysts are calling this correction a “Bloody Friday,” a less but still severe reflection of last week’s brutal selloff that wiped billions of dollars from the market and saw BTC and ETH fall.

Related reading

ETF Outflows Trigger Bitcoin, Ethereum Price Drop

The recent price crash of Bitcoin and Ethereum is attributed to recent US Spot Bitcoin ETF exits. Crypto analyst Jana on social media describe the event as one of the bloodiest weekly slowdowns of the quarter, with Bitcoin collapses 13.3% in seven days and Ethereum has slipped 17.8% over the past month. At press time, Bitcoin is trading slightly above $106,940 while Ethereum is hovering around $3,870, both undergoing strong retracements from their recent highs.

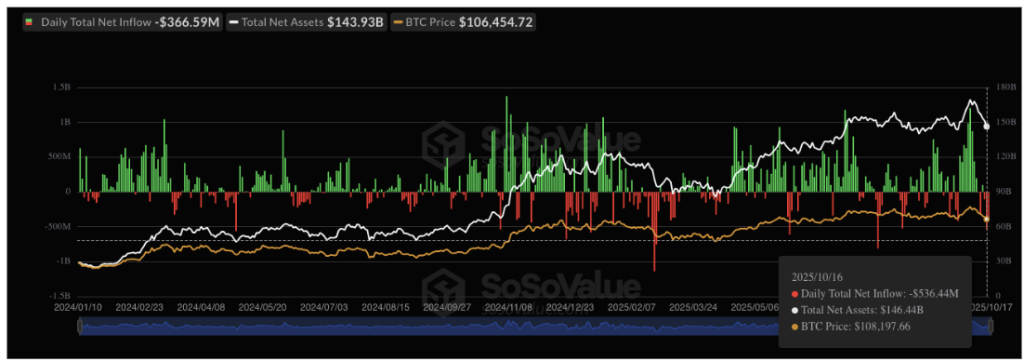

Data from SoSoValue watch This Thursday, October 16, daily net outflows from Spot Bitcoin ETFs reached $536.4 million, representing the largest one-day negative flow since August 1, when $812 million left the market. Of twelve American Bitcoin ETFseight major outflows were recorded, led by $275.15 million outgoing Ark and ARKB from 21Sharesfollowed by $132 million from Fidelity’s FBTC. Notably, funds managed by other major firms like Grayscale, BlackRock, Bitwise, VanEck and Valkyrie also reported significant withdrawals.

These persistent outflows are now on their third consecutive day, October 17, just a day ago, recording a massive outflow of $366.5 million. THE persistent negative ETF flows highlight the loss of investor confidence and suggest that the general market slowdown could continue in the short term. Combined with the $19 Billion Liquidation Event Last Friday, increased capital outflows from ETFs could put even greater selling pressure on an already fragile market.

Experts warn of deeper market challenges ahead

Many experts believe that the crypto market could still have more room for decline. Data from Polymarket, one of the world’s largest prediction platforms, to show that 52% of participants expect Bitcoin to fall below $100,000 before the end of October. Veteran economist and Bitcoin critic Peter Schiff also warned that the coming months could be catastrophic for the industry, predicting bankruptcies, defaults and widespread layoffs as Bitcoin and Ethereum face another major decline.

Meanwhile, technical analysts point to signs of deeper weakness in Ethereum structure. According to Crypto Damus, Ethereum has broken key weekly support and is showing a bearish pattern on the charts. He said that MACD is about to “go red,” leaving significant room for a crash.

Other analysts like Marzell have echoes similar concerns, stating that Ethereum is now approaching a “crash zone.” However, he also highlighted the $3,690-$3,750 range as a possible near-term demand zone where buyers could step in again and trigger the next move higher.

Related reading

Featured image from Unsplash, chart from TradingView