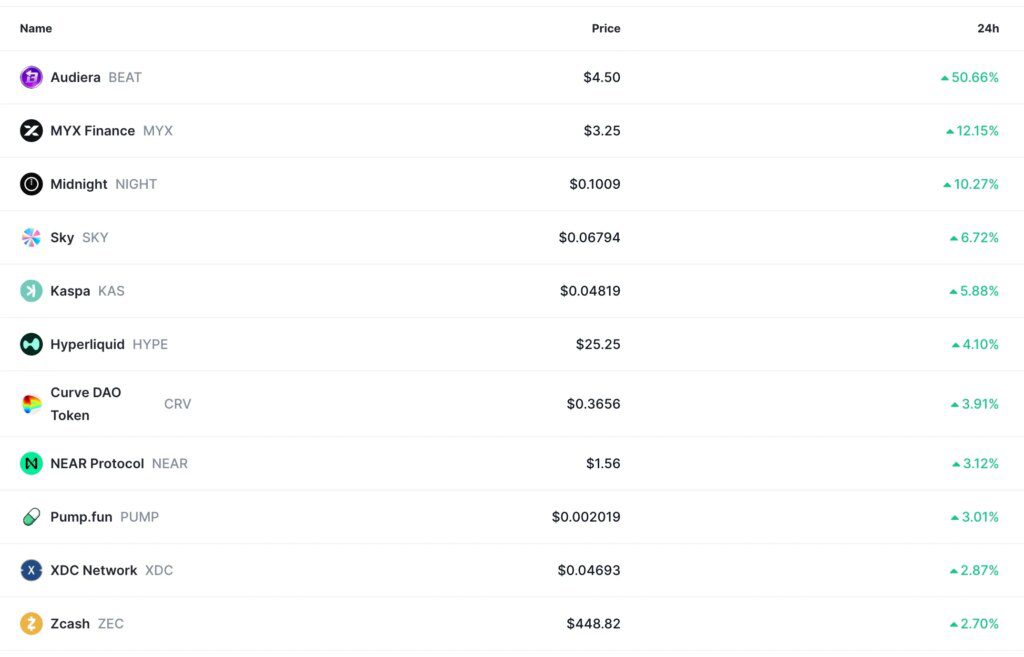

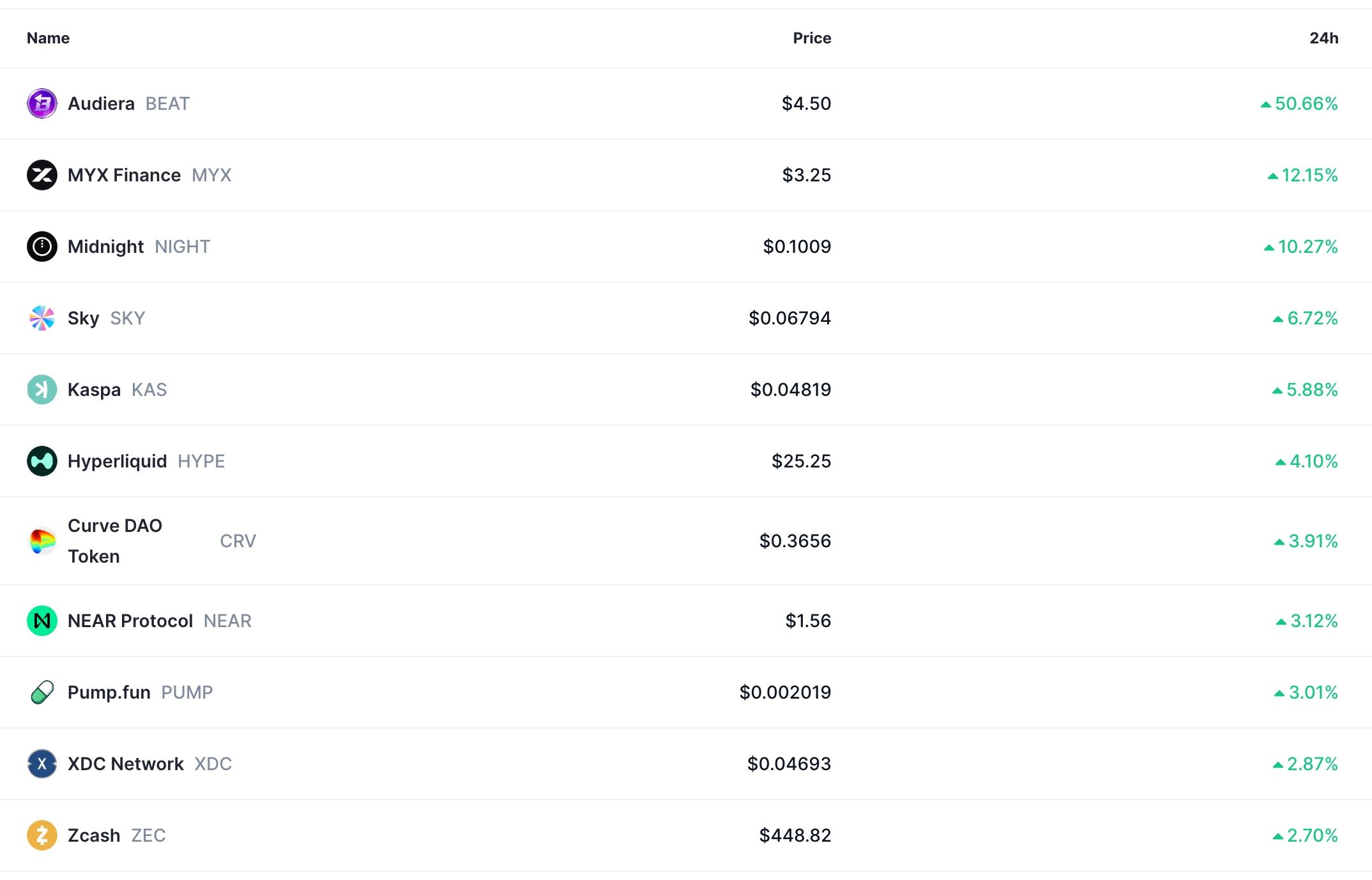

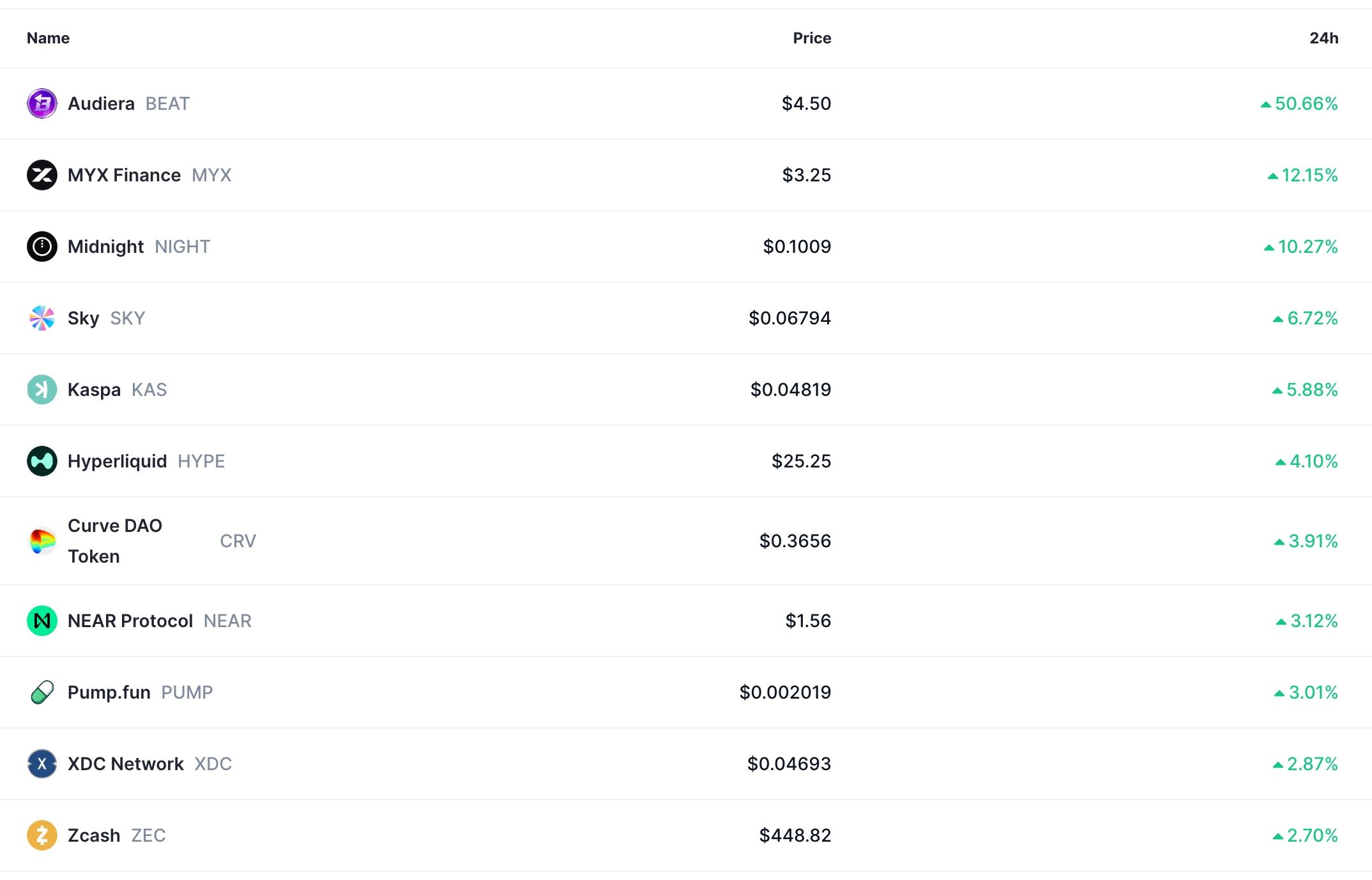

The crypto market is rising today, with Bitcoin and top altcoins continuing the bull run that began over the weekend. Bitcoin surged to $90,000, while Midnight (NIGHT) surged 11%, with 24-hour volume reaching $8 billion.

Other top leaders in this crypto market rally include Avantis (AVNT), Audera (BEAT), and Meteora.

Crypto Market Rises Amid Santa Gathering Hopes

One of the main reasons for the current crypto market rally is the growing hope of a Santa Claus gathering. This rally is defined as a situation in which Bitcoin, cryptocurrencies and other assets surge a few days before Christmas Day.

Historical data on whether this rally is happening is mixed, with some reports suggesting that it is. Others dispute this, pointing to periods where stock and crypto markets plunged during the Christmas period.

Nonetheless, the rally could be because investors are buying coins, hoping that the uptrend will resume.

READ MORE: AVAX Price Prediction: Avalanches Eye All-Time High Despite Bullish Catalysts

Buy the BoJ rate hike decision

The crypto market is rising as investors continue to buy amid the BoJ’s rising interest rates. As expected, the bank decided to raise its rates by 0.25%, pushing them to their highest level in three decades. More importantly, the bank has sent mixed signals about what to expect in the coming year.

Although the BoJ rate hike is bearish for Bitcoin and other cryptocurrencies, it was already priced in. Indeed, Polymarket data showed the chance of a rate hike was 99%.

Thus, assets that had fallen before the rate hike rebounded. For example, the Nikkei 225 index jumped more than 1% today, while the Japanese yen fell.

Open Interest Rising for Futures

Meanwhile, the crypto rally is underway as the sector’s futures open interest continues to rise. Its interests rose 60 basis points on Monday to more than $130 billion. Bitcoin’s open interest reached $60 billion, while Ethereum’s opened interest exceeded $38 billion.

The surge in futures open interest is a sign that bulls are starting to deploy leverage in the crypto industry, generating increased demand. At the same time, short liquidations jumped 146% to $200 million.

Nonetheless, as we have seen in the last few crypto rallies, this bounce could be a dead cat bounce or a bull trap. A dead cat bounce is a situation in which investors buy an asset that is in free fall, only to have it resume the downward trend.

READ MORE: Overnight Crypto Price Prediction as Cardano’s Midnight Token Hits $6 Billion Milestone