In just 24 hours after its debut, Hyperliquid Perpetual Shares (equity perps) generated nearly $100 million in trading volume. Despite this success, open participation was capped at $66 million.

The launch has sparked a heated debate within the crypto and DeFi communities, with many questioning whether it is a “golden opportunity” for the on-chain equity market. Others wonder if this is simply a high-stakes experiment built on flimsy assumptions.

Sponsored

Sponsored

New opportunity: 24/7 liquidity and evolution of Zero-Day options

The impressive launch of Hyperliquide’s perpetual equity product is sparking debate in the investment community. What sets equity players apart is their ability to transform the traditional stock market into a fully on-chain, 24/7 trading ecosystem.

Unlike conventional exchanges that operate only a few hours per day, on-chain equity derivatives enable continuous, borderless and transparent trading, aligning with DeFi’s philosophy of open, permissionless markets.

Analysts say the shares are not designed to replace traditional stock futures, but to disrupt zero-day options (0DTE), products favored by short-term speculators seeking leverage. As Kirbyongeo explains, stock investors “are not replacing stock futures, they are replacing zero-day options.”

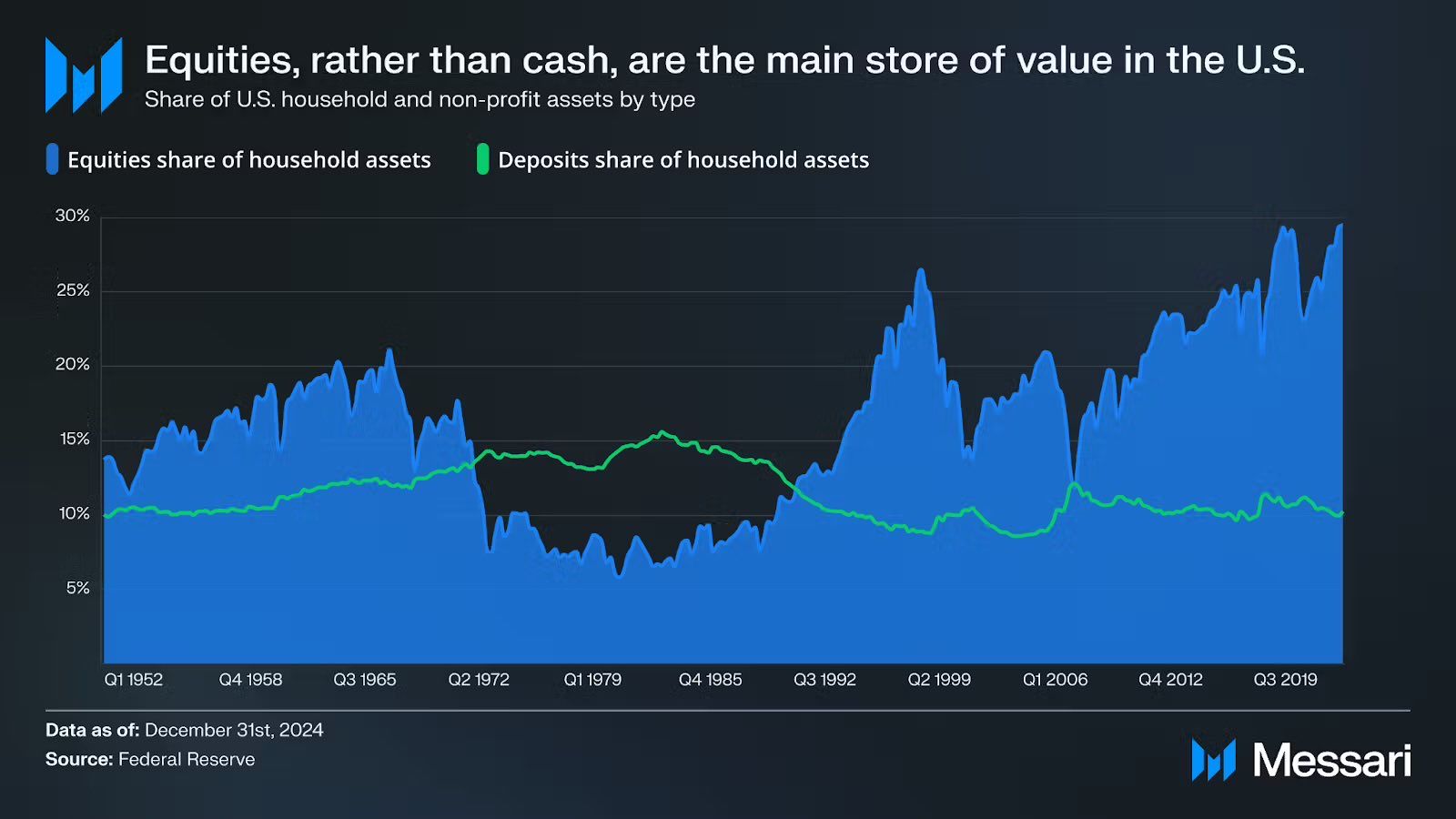

This shift aligns with the broader appetite for leverage in modern markets. José Maria Macedo pointed out that Robinhood makes almost $1 billion a year, or about 25% of its total revenue, from options trading alone, demonstrating vast demand for leveraged exposure. Capital players could fill this gap on-chain, offering a simpler, decentralized alternative.

Some industry observers even believe that equity players could rival crypto or stablecoin players in terms of scale. Ryan Watkins predicts that global stocks could represent crypto’s most significant growth opportunity over the next 12 to 18 months, potentially surpassing stablecoins. Echoing this view, Dylan G. Bane suggests that the total addressable market (TAM) for equity investors could eventually “surpass stablecoins” once mainstream adoption begins.

Sponsored

Sponsored

Risks and realities: legal gaps and market depth

Despite the enthusiasm, several prominent voices are cautious. DCinvestor has criticized perpetual contracts as inherently biased, warning that exchanges often have visibility into traders’ liquidation points, enabling “liquidation hunts” in low-liquidity environments. Such dynamics could become even more problematic in early-stage on-chain equity markets, where liquidity and volatility are low.

“Criminals is actually a rigged game. Even if it wasn’t actually rigged, the rules virtually guarantee that you will end up losing and losing big unless you have extreme risk management and portfolio management skills,” he wrote.

Additionally, stocks differ fundamentally from cryptocurrencies. Stocks carry dividends, shareholder rights, and legal protections, none of which translate clearly to decentralized derivatives. One analyst warns that detaching stocks from their legal framework could conflict with long-term investment interests, while Sam warns that current adoption expectations are “far higher than reality.”

“The shares could be a defining moment for Hyperliquide. But the path to adoption is murky and today’s expectations are far higher than reality.” » Sam remarked.

Operationally, the main challenge lies in establishing transparent systems for risk management, liquidation protection and regulatory alignment. Without these safeguards, similar to the “circuit breakers” of traditional stock exchanges, investors in blockchain stocks could quickly face skepticism and stricter oversight from regulators around the world.

In summary, on-chain equity investors are a strategic innovation with immense potential, bridging the gap between traditional finance and decentralized commerce. The appeal is undeniable: 24/7 liquidity, high leverage demand, and globally accessible infrastructure. Yet success will first depend on solving difficult problems: liquidity, transparency, compliance and investor protection.