Can a single click really migrate billions of DEFI liquidity?

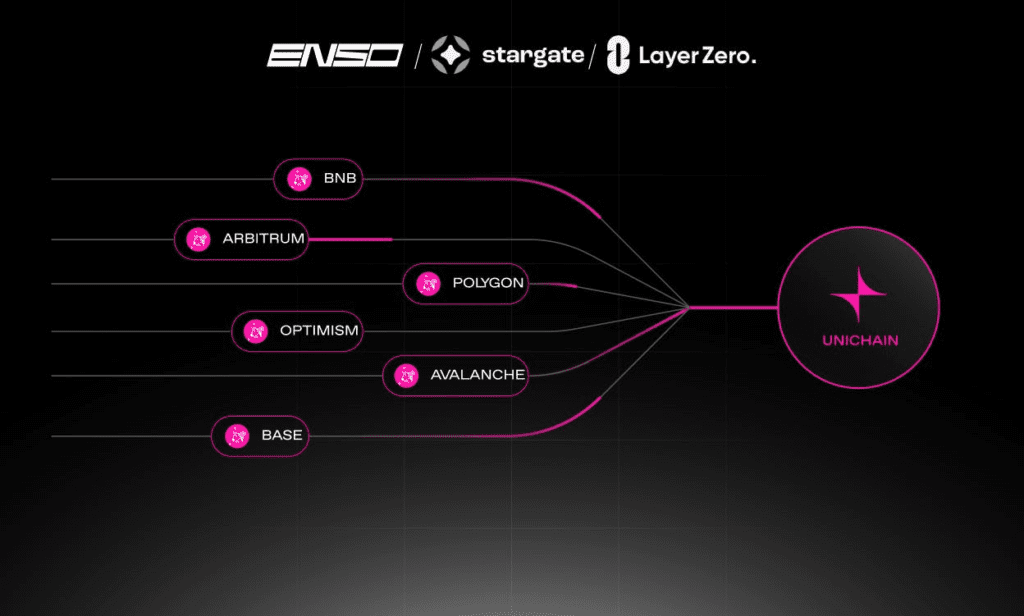

This is the question that is answered by a new major partnership in the blockchain space. ENSO, Stargate and Layerzero have collaborated to create a new infrastructure that allows UNISWAP (LPS) liquidity suppliers to migrate their positions to Unichain with one click. The announcement suggests that up to $ 3.5 billion in liquidity could soon be moved to Unichain using this method.

This development marks a significant change in the way the liquidity is transferred through blockchains and highlights the growing need for composable infrastructure that summarizes the complexity of the blockchain of end users.

Understand the problem in several stages of transversal liquidity migration

Before this tool exists, the liquidity migration of Ethereum and other compatible EVM blocks to Unichain was complex and was often necessary up to nine manual stages. These steps included:

- Elimination of liquidity from a swimming pool on Ethereum,

- Punching the active ingredients through the chains,

- Re-add liquidity to a new protocol on Unichain,

- Confirming the transactions at each layer, and

- Ensure the consistency of security and execution throughout the process.

Each of these steps has introduced friction and risk, especially for non -technical users. An average LP managing liquidity in several pools had to interact with several intelligent contracts and tools, often causing missed delays and opportunities during volatile market conditions.

Enso’s “shortcut” and what he really does

The ENSO is a tool for developers who maps complex blockchain operations in “shortcuts”. Think about it as using a macro on a computer. Instead of performing several manual steps, the user clicks once and the tool runs all the blockchain transactions required in the correct sequence behind the scenes.

In this case, the ENSO migration tool takes care of:

- Removing LP tokens from UNISWAP V2 or V3 on Ethereum,

- Bridle underlying assets via Stargate,

- Relaying Instructions and State updates via Lowerzero, and

- Taking up assets in the UNISWAP V4 swimming pools on Unichain.

From the point of view of the LP, they only have to authorize a single transaction.

Connor Howe, co-founder of Enso, said:

“Thanks to the engineering of a unified solution using Stargate and Layerzero, ENSO added the missing piece to the puzzle. With the possibility of transferring their positions with one click, the LPS Uniswaps are about to trigger one of the biggest liquidity migration events in the history of Ethereum.”

Role of Stargate and Layerzero in the migration battery

To understand this collaboration, it is important to break the responsibilities of each partner. Stargate is a layer of liquidity transport built on a layerzero. It allows users to fill the assets on several channels with a guaranteed purpose. For example, if you move 100 USDC from Ethereum to Avalanche using Stargate, you can be sure that the exact amount will arrive at the destination chain without delay or unexpected costs.

CALALZERO acts as the communication protocol. It does not move the assets itself but rather relays the changes of state and the execution controls between the chains. It is like the mail that carries the message signed between two parties, guaranteeing the correct execution of a transaction.

In this migration event, Enso manages the execution of the DEFI transaction. Stargate moves assets. Layerzero ensures that messages and status changes are correctly communicated between the original and target chains.

Why this counts for the future of Defi

This collaboration is important for three main reasons:

1. Operational simplicity: The blockchain is known to be difficult to use. Tools like the ENSO migration solution are essential to conduct mass adoption because they make complex transactions accessible to anyone with a portfolio.

2. Liquidity concentration on Unichain: UNISWAP V4 on Unichain should make improvements such as hooks, improved routing logic and dynamic costs. By reducing friction to migrate, this partnership encourages LPs to quickly move capital and in mass, which could be cool when the major challenge activity is concentrated.

3. Proof of composability: Defi has long promised composability, the idea that different applications can connect to each other like Lego blocks. This is a practical demonstration of this principle. Three independent teams have created a transparent experience which would not have been individually possible.

My opinion and the latest thoughts

This partnership is less a matter of marketing and more infrastructure innovation. If the migration tool operates as claimed, it will probably be studied in the case of reducing challenge friction without compromising decentralization or control. However, this also raises questions about trust and abstraction. The more invisible complexity, the more the responsibility is moved to the developers and suppliers of Middleware. Users must trust intelligent contracts, execution logic and relays without fully understanding them.

That said, the component shown here is what many in space were waiting. For the construction of developers in web3, this could serve as a new standard on how liquidity must be migrated, not only towards Unichain but towards any new blockchain architecture in the future.

Do not forget to love and share the story!

Disclosure of acquired interests: This author is an edition of an independent contributor via our