- The XRP price is gradually extending gains because the cryptocurrency market is stable.

- XRP holds above the critical support at $ 2.22, reinforced by the EMA of 100 days.

- An escape from the descending chain could trigger a significant bullish momentum, potentially leading a rally beyond $ 3.

- The increase in long -position liquidations while open interest remains unchanged from the signals of lower interest and a potential withdrawal.

RIPPLE (XRP) CONSOLIDATE GAINS PRICE when writing Tuesday editorial staff, following three consecutive daily green candles. Trading at $ 2.26, XRP is down more than 1% during the day, reflecting stability on the wider market of cryptography. A decline in the current market level seems possible, but it may not dissuade investors from requesting exposure, increasing the rear wind for a break with $ 3.00.

Bitcoin (BTC) remains greater than $ 94,000, with its upward trend by the rise in net entries in the BTC ETFs, softening trade tensions between the United States (United States) and China, as well as short compressions.

Select altcoins, including Virtual, Floki and hyperliquid protocol (hype)extend their advance, suggesting that investors turn their attention to less known parts that reach higher beneficiary margins.

The XRP price nourishes a potential escape at $ 3

The price of XRP generally decreases within the limits of a descending channel. However, since the cross-border token of money funds rebounded from its annual rate to $ 1.61 on April 7, the potential of a rally beyond $ 3.00 has increased considerably.

Despite the rejection of $ 2.36, a level tested on Monday, XRP maintains its position above the exponential averages of 50, 100 and 200 days (EMAS), confirming the bullish momentum. The EMAs are sloping upwards, further strengthening a strong upward trend.

The 50 days and 100 days EMA provide immediate support at $ 2.20 and $ 2.22, respectively. A reversal at these levels is possible, and XRP could perceive more liquidity as merchants buy the decline.

The neutral position of the relative resistance index (RSI) to 58.11 could maintain the scales in favor of the bulls, especially if it remains above the midline by 50. This could increase the potential of an escape over the downhill canal.

Beyond the seller’s congestion at $ 2.40, supply areas at $ 2.80 and $ 3.00 deserve to be recalled because they could slow down the potential Rally of XRP. A higher volume on ascending movements will be crucial to push XRP to $ 3.00.

XRP / USDT daily table

Factors that could maintain the high XRP price

Several developments could support the upper -term XRP perspectives, including the current talks between Ripple and the Securities and Exchange Commission (SEC) concerning potential regulations. Earlier this month, Ripple and the SEC obtained a temporary suspension of the call process, allowing settlement negotiations and allowing the SEC commissioners to vote on the issue.

Recently approved term contracts ETF XRP could help strengthen the upward perspectives of the token in the coming months. In addition, Ripple’s intentional thrust on the Stablescoin market and tokenization services increases feeling.

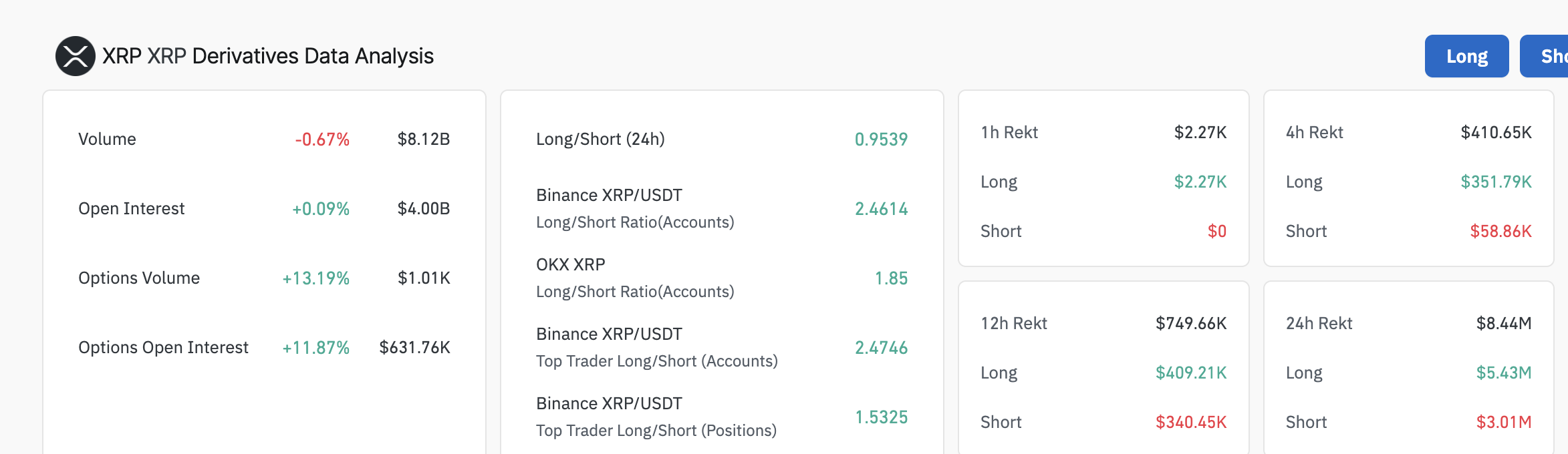

Co -Coin derived data highlights a slight increase in open interest (OI) from 0.09% to $ 4 billion, which indicates that new positions are open, which reflects the growing interests of the trader.

The long / short ratio of 0.9559 leans towards shorts rather than long, which indicates that confidence between traders is declining. More than $ 350,000 have been liquidated in a long position against around $ 59,000 in short positions in the last four hours, which suggests that the bulls are shaken, which can potentially weaken upward perspectives.

Open interest in XRP derivatives | Source: Coringlass

Beyond the support provided by the EMAs of 50 days and 100 days, XRP could extend the leg at the bottom to retest the EMA from 200 days to $ 1.98. A deeper correction at $ 1.80 is possible if the wider feeling of the cryptography market becomes a lower.