HYLQ Strategy Corp has made a strategic digital asset investment in qLABS, acquiring qONE tokens in an over-the-counter transaction with the Quantum Labs Foundation.

The qONE token trades on the growing Hyperliquid platform and is the native token of the qLABS ecosystem. HYLQ Strategy is the second public company to invest in quantum-secured tokens. qLABS partner 01 Quantum, as a founding member, is also a holder of qONE tokens.

Under terms of the deal shared in a company press release, HYLQ purchased 18,333,334 qONE tokens for an aggregate purchase price of $0.006 as part of a total investment of $100,000, including bonus tokens.

The transaction was executed directly with the Quantum Labs Foundation and settled in USDC. This strategic investment represents HYLQ’s commitment to supporting quantum resilient infrastructure within the Hyperliquid ecosystem, making it the first institutional investment in quantum-secure cryptographic solutions built natively on Hyperliquid.

qLABS is the world’s first native quantum cryptography foundation, developing blockchain solutions resilient to quantum computing threats.

qLABS Launches Quantum-Safe Protection for Digital Assets

The foundation will launch the Quantum-Sig smart contract wallet to provide quantum protection of digital assets at the user and asset level.

A separate L1 migration toolkit is in preparation. Its design will help Layer 1 blockchains evolve their core infrastructure towards quantum-resistant cryptography ahead of Q-Day. Q-Day is the anticipated moment when quantum computers will have the computing power to break cryptographic systems.

The qONE token, launched on Hyperliquid on February 6, 2026, serves as an ecosystem utility token, providing access to quantum resilient wallet functions, protocol governance, and the broader quantum infrastructure developed by qLABS.

qLABS leverages IronCAP by 01 Quantum Inc. (TSXV: ONE), a NIST-approved post-quantum cryptography system.

by 01 Quantum Inc. (TSXV: ONE), a NIST-approved post-quantum cryptography system.

Matt Zahab, CEO of HYLQ Strategy, commenting on the company’s investment in qLABS’ Quantum Labs Foundation, said:

“As quantum computing advances toward Q-Day, protecting crypto assets from quantum threats becomes increasingly critical.”

He added: “qLABS is natively building critical quantum-resistant infrastructure on Hyperliquid, addressing a systemic risk that threatens the entire blockchain industry. This investment perfectly aligns with HYLQ’s mandate to support innovative companies in the Hyperliquid ecosystem that are building foundational infrastructure for the future of decentralized finance.”

HYLQ stock price is up 28.5% year to date

Since the start of the year, the HYLQ strategy (HYLQ:CNSX CA) is up 28.5% to 0.90 CAD. In addition to its primary listing in Canada, the stock also trades over-the-counter in the United States (HYLQF: OTCMKTS US). HYLQ should not be confused with competing digital asset treasury company, Hyperliquid Strategies (PURR), which is traded on Nasdaq.

How qONE’s Staking Plans Could Provide a Source of Income for HYLQ Shareholders

According to Ada Jonuse, executive director of qLABS, qONE owners will be able to stake their tokens to earn yield and acquire protocol governance rights.

This means that HYLQ – at some point in the future – might be able to generate a return for its shareholders from its $100,000 investment in qONE. The exact date the staking will go live has not yet been revealed.

“Staking and governance participation are features that will be enabled further down the roadmap when our core products are up and running and implemented in a full operational environment,” says Jonuse.

“Since we are 100% focused on security, at the beginning of the ecosystem, key decisions will be made by the core team with gradual decentralization envisaged over the years.”

Centralization risk is recognized and mitigated through participation in staking-based governance, time- and activity-weighted voting, and gradual decentralization as issuances and releases occur.

Governance is expected to decentralize significantly as the use of protocols grows.

Staking rewards will be set dynamically, meaning yield is determined by staking pool size, protocol usage and fee generation, as well as the participant’s proportional contribution.

Jonuse says this approach “aligns incentives with real economic activity rather than fixed inflation.”

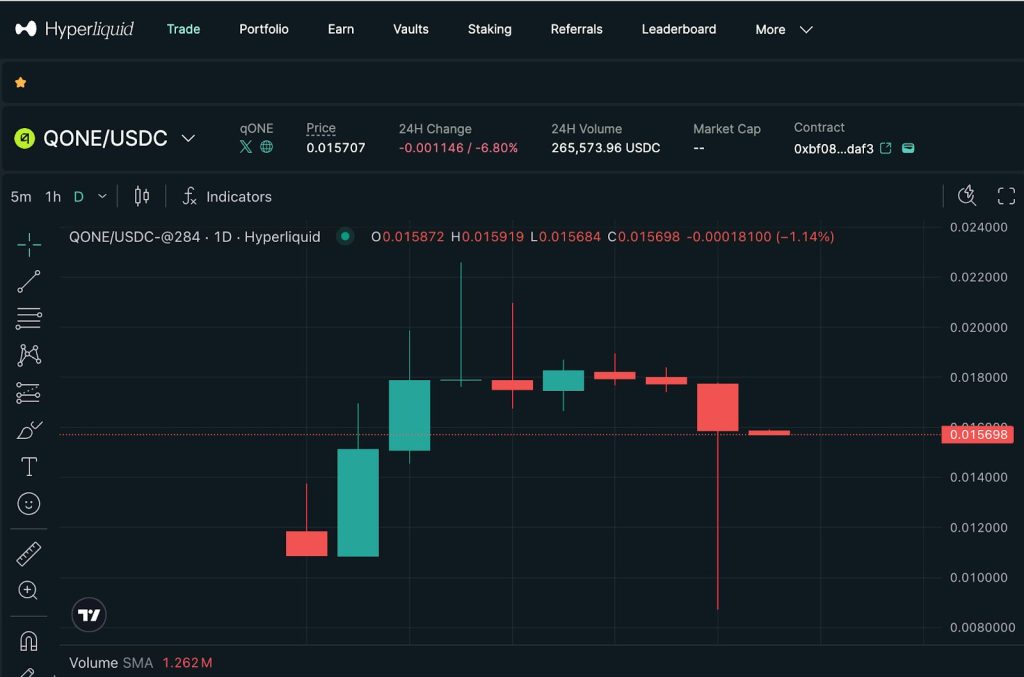

The price of the qONE token has been on an uptrend since its launch, but the reduced price of the token offered to HYLQ triggered a sharp pullback, followed by an equally large rebound. qONE was trading at $0.01569 in the morning European session.

Why launching qONE on Hyperliquid was probably a smart move

Since the record liquidation event on October 10 last year, which wiped out $19 billion in value and marked the start of the current bear market, Hyperliquid and its native token HYPE have decoupled from other crypto assets.

As Bitcoin and Ethereum struggle with institutional outflows, retail investor apathy, and price stagnation, HYPE has been hitting new highs, recently trading around $30.05.

Year-to-date performance comparison (January 1 – February 17, 2026)

Launching on Hyperliquide is looking more and more like a very smart move on the part of the qLABS team. As Jonuse points out, “Hyperliquide is a leading player in DeFi and soon a trading venue for almost all on-chain assets.

“While Quantum-Sig wallet technology protects any EVM or Solana assets and our core innovation can be used to upgrade any smart contract-based chain, we are launching Hyperliquid to highlight the importance of this chain.

“The launch of $qONE on Hyperliquid positions us at the intersection of a cutting-edge security infrastructure and a growing ecosystem, allowing $qONE to benefit not only from technical alignment, but also from narrative-driven adoption and visibility.”

The post HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Purchases 18,333,334 Tokens qONE appeared first on Cryptonews.