Hyperliquid (HYPE) breaks above $30.00 support on Monday, as prices generally rebound in the crypto market after last week’s turmoil. The decentralized exchange native token (DEX) is up over 5% on the day and looks set to extend the uptrend.

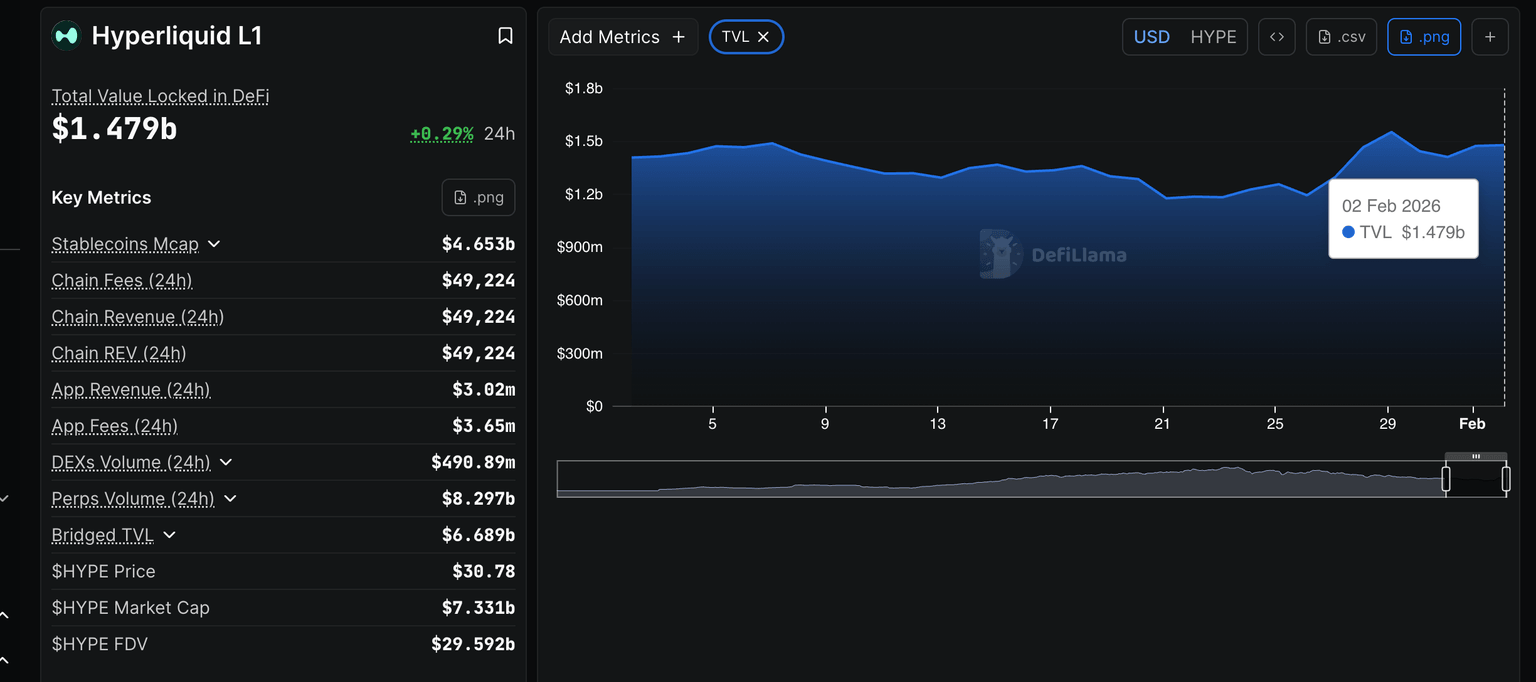

DeFi TVL supports Hyperliquid’s modest gains

The hyperliquid decentralized finance (DeFi) sector has remained relatively stable in recent days, with total value locked (TVL) rising to $1.5 billion on Monday, up from $1.41 billion on Saturday.

The rise in TVL, which tracks the total notional value of all coins held in on-chain smart contracts, suggests an uptick in speculative risk appetite and confidence in the token among participants.

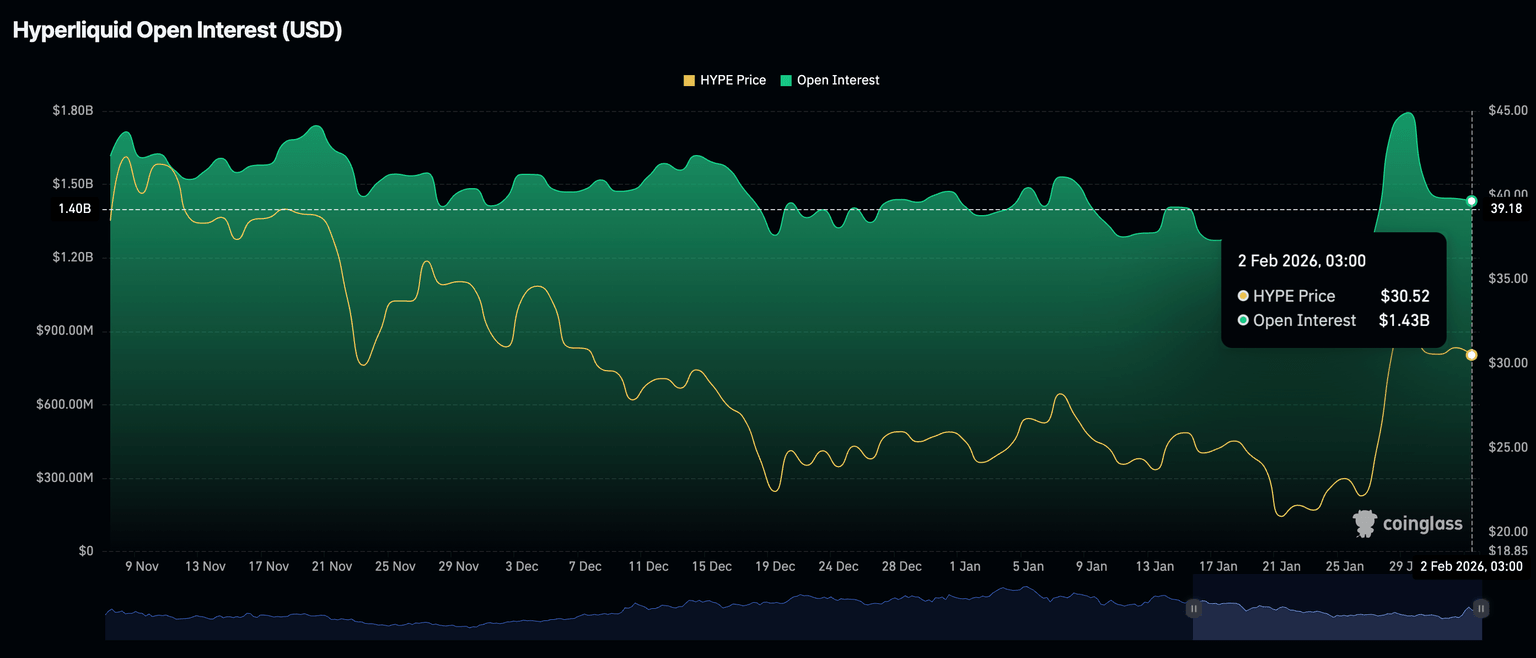

At the same time, retail interest remains relatively moderate as Open Interest (OI) futures contracts decline slightly, from $1.43 billion on Monday to $1.44 billion the day before. OI tracks the notional value of ongoing futures contracts, with persistent declines signaling a lack of investor confidence in the token.

Traders tend to close open positions rather than opening new ones, depriving Hyperliquid of the much-needed buying pressure to maintain an uptrend.

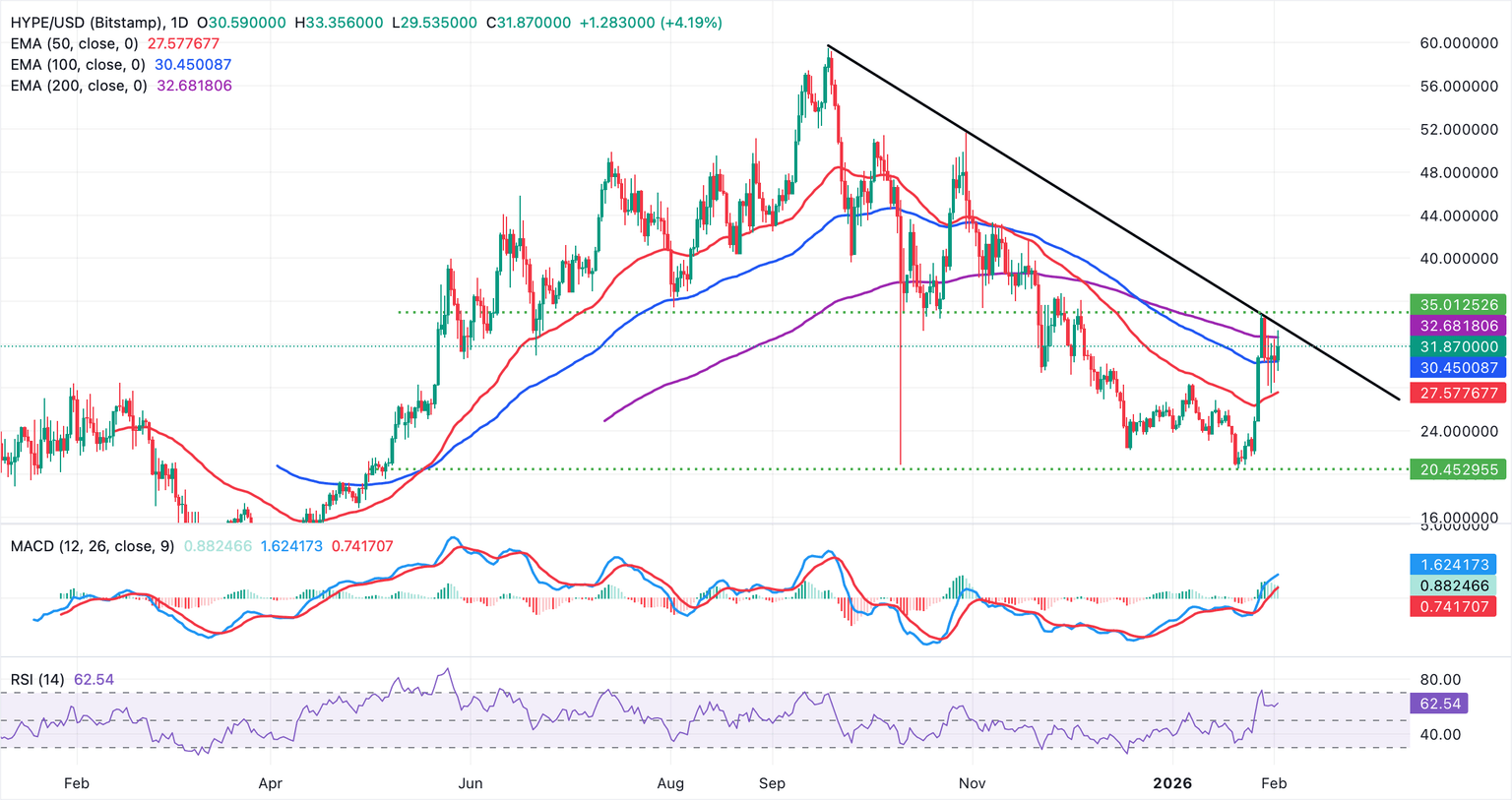

Technical outlook: HYPE extends recovery

Hyperliquid exhibits stability above $30.00, marking an improvement in the technical structure. The token is supported by the 50-day exponential moving average (EMA) at $27.58 and the 100-day EMA at $30.45.

Meanwhile, the Moving Average Convergence Divergence (MACD) is in positive territory with the MACD line above the signal line on the daily chart, although the histogram is contracting, suggesting momentum is cooling. The Relative Strength Index (RSI) is at 62.54 on the same chart, and is not overbought, supporting a push towards resistance at the 200-day EMA at $32.68. A break above this moving average could accelerate the uptrend to the next hurdle at $35.01, tested last week.

Nonetheless, the descending trendline from $59.71 limits gains and resistance is seen at $33.77. A close below the 100-day EMA at $30.45 could extend the downtrend towards support at the 50-day EMA at $27.58.

Open Interest and Funding Rates FAQ

(The technical analysis for this story was written using an AI tool.)