The price of hyperliquids has taken a back seat on social networks and the media lately. Is this the peak of the HYPE or is it building up for the next stage? Technical analysis reveals key price and risk information. Investors might be a little nervous, as competition from Aster has been fierce lately. But which project will survive?

Hyperliquid has been consolidated in this range for more than 135 days.

During this period, the relief fund purchased over 347 million worth of HYPE.

We all know that HYPE is fundamentally undervalued by at least 2x.

But I think it’s undervalued, even when looking at short-term flows.

1. There will be… pic.twitter.com/zbtZS5qaBh

– Arthur.hl (@ArthuronHL) October 8, 2025

A valid approach to HYPE price is this ascending/consolidating channel. I would move the upper boundary to match the three highest peaks, essentially making it a widened wedge. Regardless, Arthur explained his point pretty well.

DISCOVER: 20+ next cryptos that will explode in 2025

Hyperliquid Prices: Technical Analysis Reveals Key Levels

(Source – TradingView, HYPEUSD)

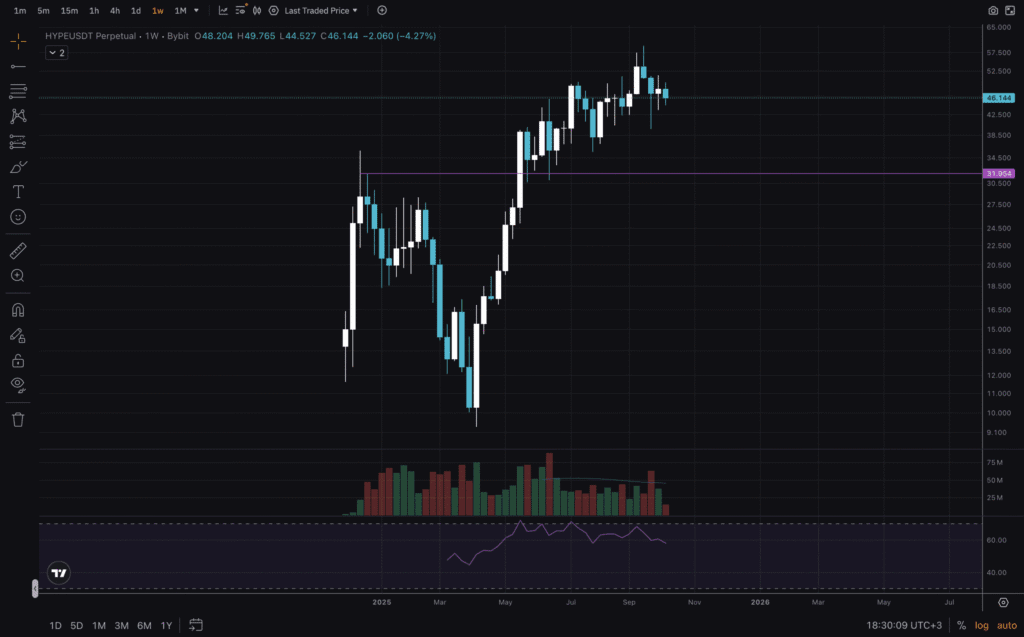

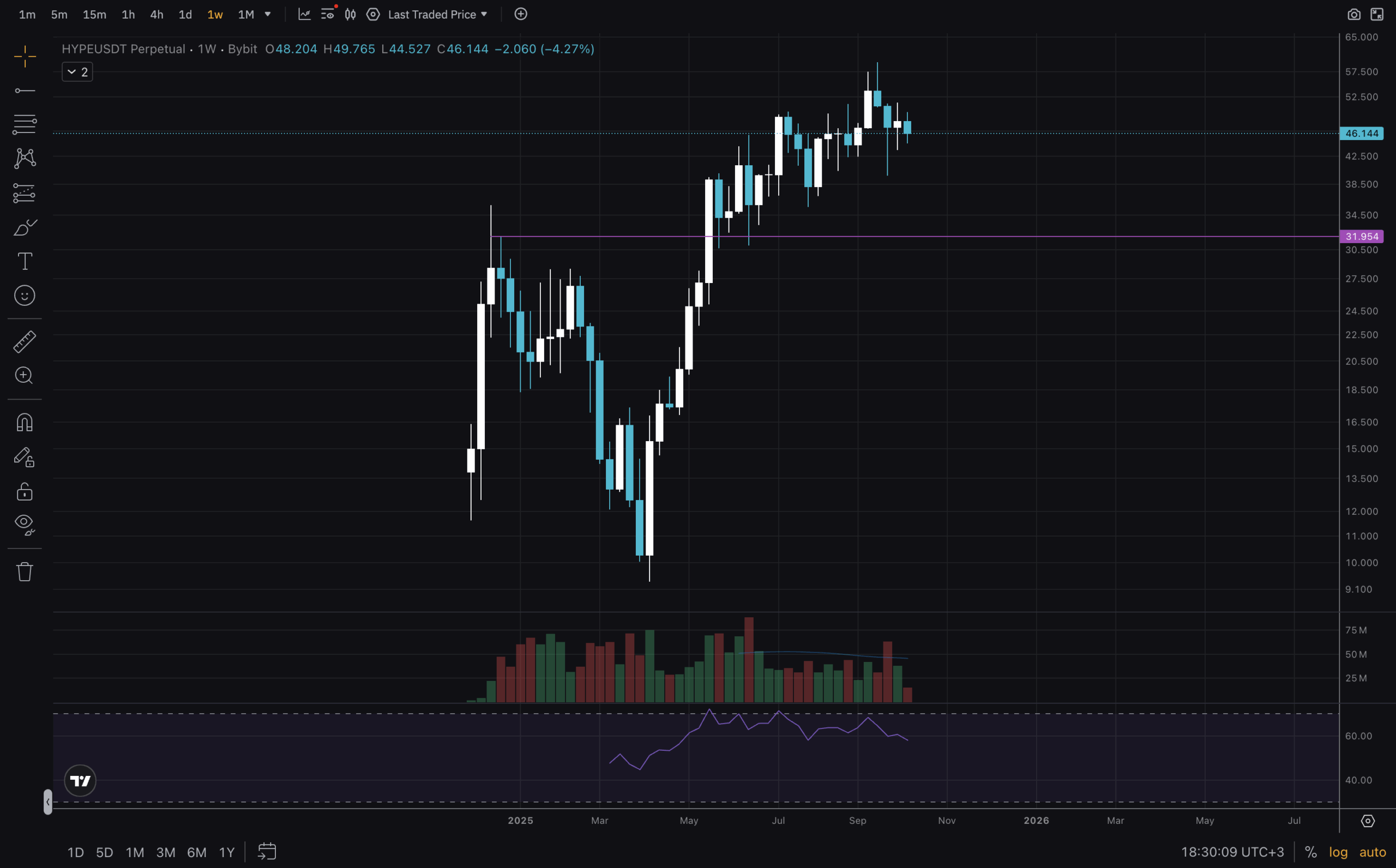

Let’s start today’s analysis with the weekly time series chart. Hyperliquide is still a rather new project. Worked surprisingly well and still generates $10-20 million in revenue every week (see more in DeFi Llama). Considering she has a team of 4 people, those are big numbers! For this chart, we don’t have much price history, although there is this $30-$32 level off the previous high. This is the support of the HTF. The RSI shows a hidden bearish divergence!

DISCOVER: 9+ Best High-Risk, High-Reward Cryptocurrencies to Buy in 2025

(Source – TradingView, HYPEUSD)

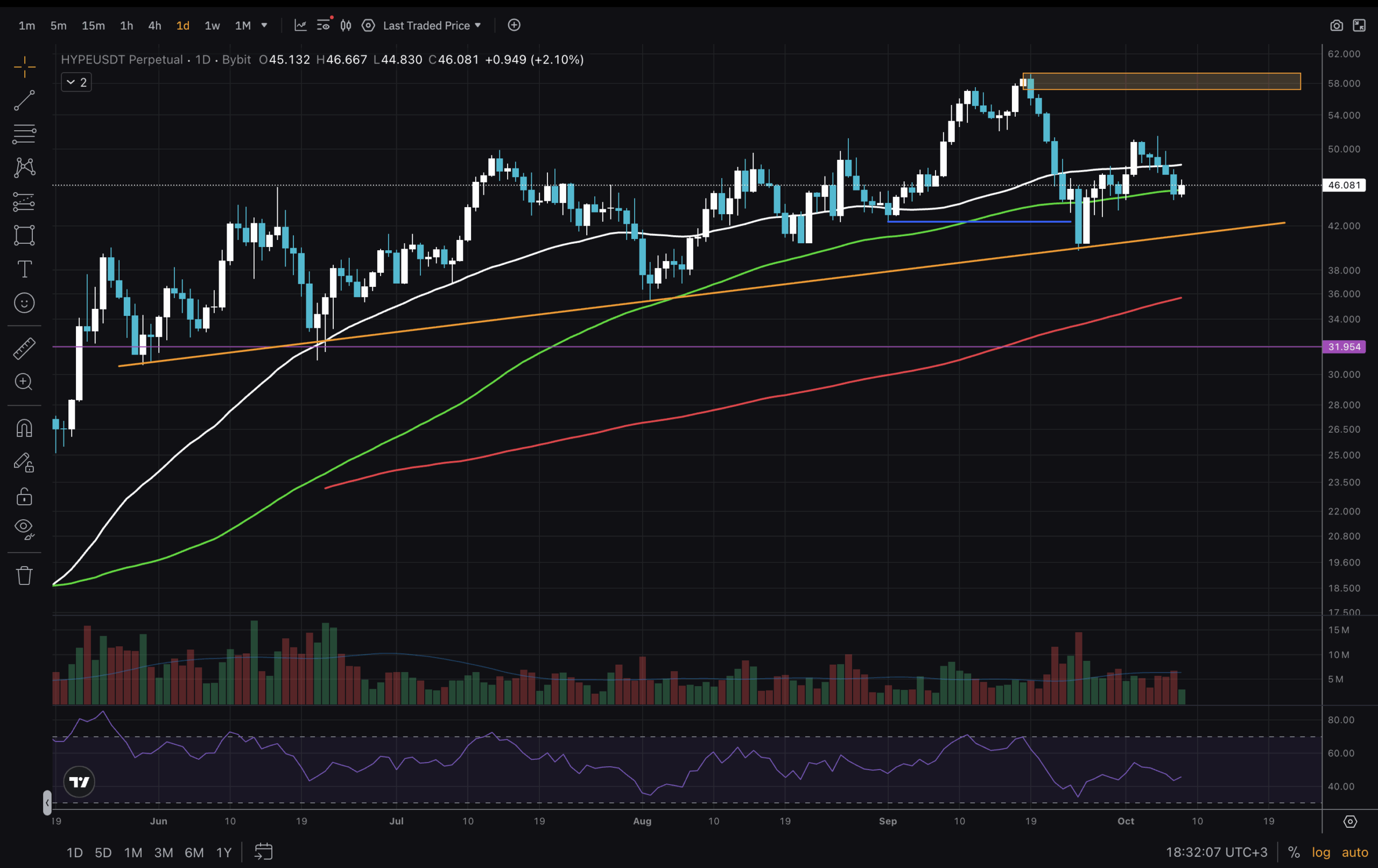

Next, you have to look at the 1D graph of the hyperliquid price. We have more pricing history to discover here. The RSI has reset and is in the lower half of its range. The price is around the MA100, recently broken below the MA50. In hindsight, the MA50 was no longer really respected from August onwards. The MA order is still bullish, as is the market structure. We have a clearly ascending support level. And with the blue line potentially showing an MSB.

DISCOVER: 9+ Best Memecoin to Buy in 2025

HYPE: next movements to predict

(Source – TradingView, HYPEUSD)

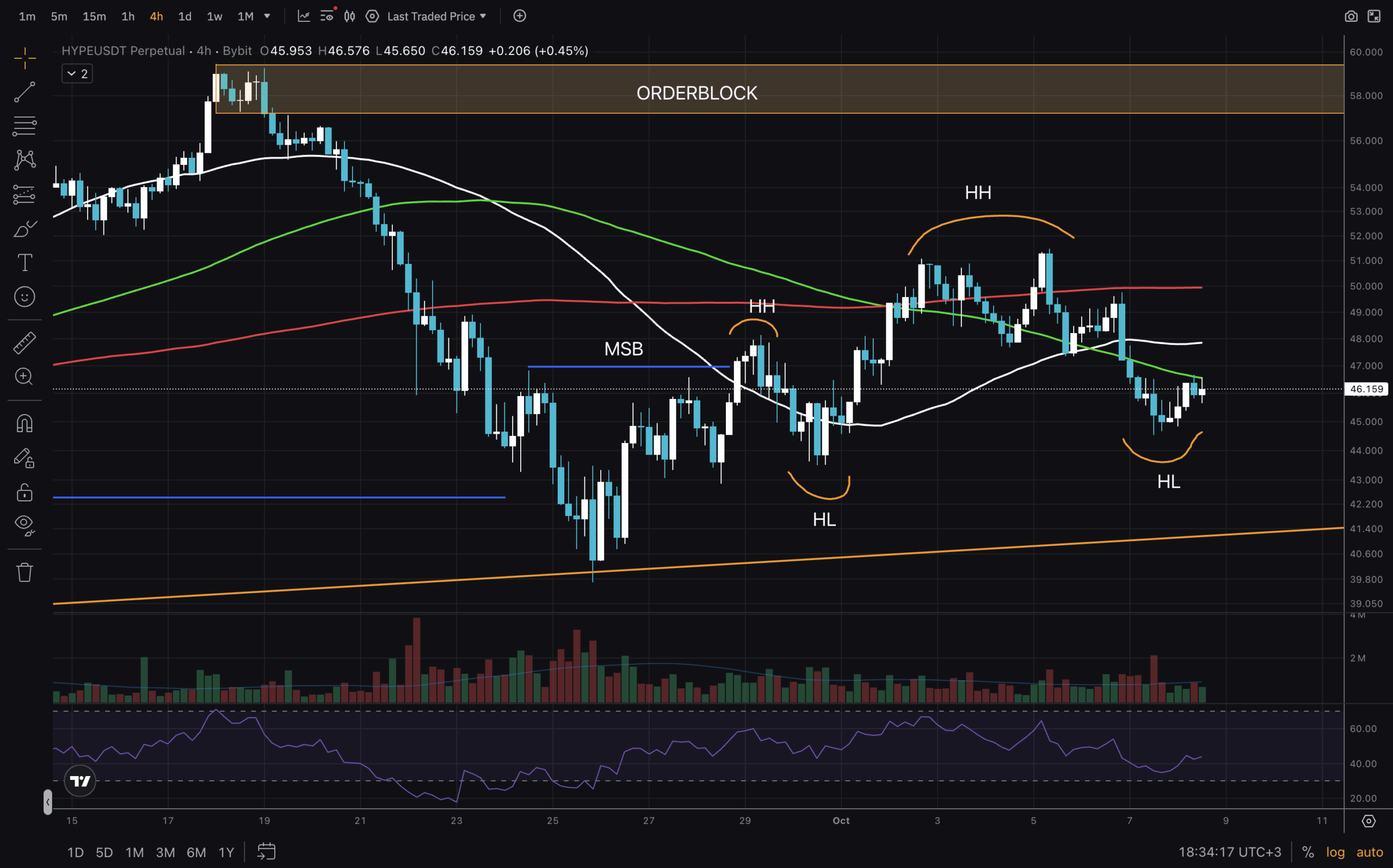

Finally, we will look at the 4H chart and see what we can expect in the near future. The blue line potentially indicating an MSB on the 1D creeps in on the left side over this period. We can see that price has bounced off support with two bullish engulfing candles, indicating strength. Additionally, on this LTF there is an MSB followed by a pair of higher highs and higher lows. The bulls would like to see the MAs and the $57-$59 order block reclaimed, and support around $40 to hold.

That’s all for today. Stay safe out there!

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Join the 99Bitcoins News Discord here for the latest market update

Hyperliquidity stops at the $40 mark: is it a quiet accumulation or a distribution?

-

The price of hyperliquids is between 40 and 55 dollars for more than a month.

-

The RSI on 1W hides a bearish divergence

-

Bearish order block between $57 and $59 needs to be broken

-

A break on either side of the Channel could be decisive

Hyperliquid stops in the $40s: is it a silent accumulation or a distribution? appeared first on 99Bitcoins.