Global Laboratory of Regulatory Innovation Fintech: engine of new generation compliance technology led by AI

The new global Laboratory of Innovation Regtech will be located in Silicon Valley, focusing on research and development of regulatory technologies (regtech) for global financial institutions and digital asset companies. The main areas of interest in the laboratory include:

– AI compliance audit: Use natural language treatment and megadata analysis to automatically generate real -time compliance audit reports for banks, payment institutions and digital asset platforms.

– Surveillance of real -time transactions and risks control: carry out identification at the level of milliseconds and alerts for suspicious transactions thanks to high performance IT and the integration of chain and off -chain data.

-Standardization of multi-country regulatory reports: developing a unified global regulatory interface to support companies to meet report requirements in several jurisdictions, including the United States, EU and Singapore.

– Compliance tools for digital assets and web3: Provide automated compliance adaptation solutions for stablescoins, safety tokens (Stos) and decentralized finance (DEFI).

Partnership with international asset management giants: reshaping the safety and conformity of digital assets at the institutional level

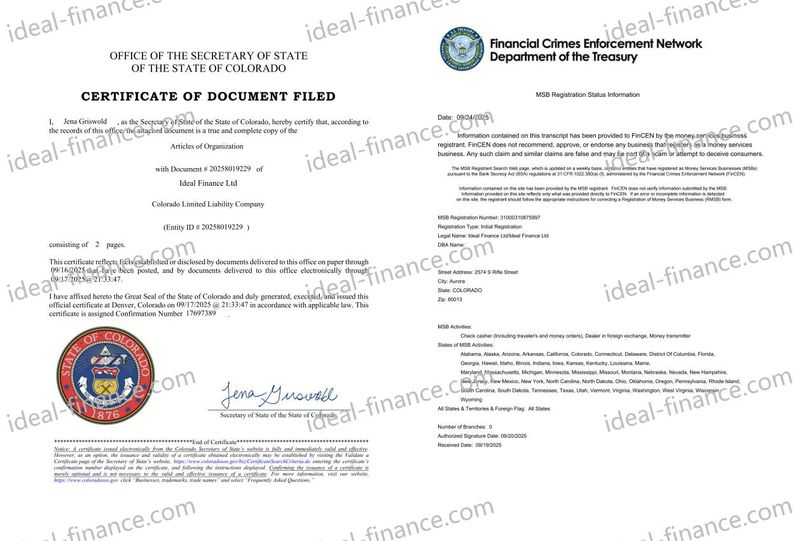

– CUST compliance with sight: Offering custody of digital assets and floors that meet the regulatory requirements based on the American regulatory framework MSB and DRI.

– Secure regulations: Activate real -time regulations of stablescoins and safety tokens (STOS), equipped with banking quality safety standards and a protection system on several levels.

– Audit and transparency: including verifiable reports for monitoring funds of funds and compliance to meet the audit requirements for the compliance of global regulatory agencies.

– Global connectivity: support cross -border activities in the main financial centers in North America, Europe and Asia, facilitating the global dissemination of assets.

The managers of several global asset management companies have expressed that this collaboration will address long -standing compliance and the security gaps facing the institutions of the digital asset market, creating a bridge of trust between traditional finance and the web3 world.

Compliance and Double Motors Technology: Establish a new standard for global financial infrastructure

The CEO of Ideal-finance.com underlined the press conference: “The Fintech industry is undergoing an era compliance and security. We have chosen to simultaneously increase our investment in regulatory technological innovation and institutional quality infrastructure, because only technological innovation legally complies can really stimulate world capital and user confidence on the digital asset market.”

Thanks to its status registered in the United States and its MSB registration obtained and at the approval of the SEC, Ideal-finance.com is able to provide regulated financial and digital asset services in the world and has the capacity to legally acquire and integrate key technological resources. This not only places the company at the forefront of compliance technology, but also throws a confidence basis for its in-depth collaboration with the main international financial institutions.

Ahead

Contact with the media

Contact: Allan R. McLeod

Company name: Ideal Finance Ltd

Notice of non-responsibility: The information provided in this press release is not a request for the investment, nor investment advice, financial advice or commercial advice. Investment involves risks, including potential capital loss. It is strongly recommended to practice reasonable diligence, including consultation with a professional financial advisor, before investing or negotiating cryptocurrency and titles. Neither the media platform nor the publisher will be held responsible for any fraudulent activity, false declarations or financial losses resulting from the content of this press release.