Everyone wanted a crypto moonshot. For OG Bitcoin holders dipping in the green, the FOMC event may not have mattered much. However, all the smart degens who bought the top, Jerome Powell and the Federal Reserve, were their only saviors. There was so much hope that the price of Bitcoin would rise until it didn’t, and when Murphy’s Law kicked in, the world’s most valuable crypto collapsed, falling -5% below $110,000.

The price of Bitcoin, and crypto in general, has not yet recovered from yesterday’s crickets. With hopes dashed, BTC USDT price is lower than this week’s open, and the only way to recover is to maintain the $110,000 level by the end of the day.

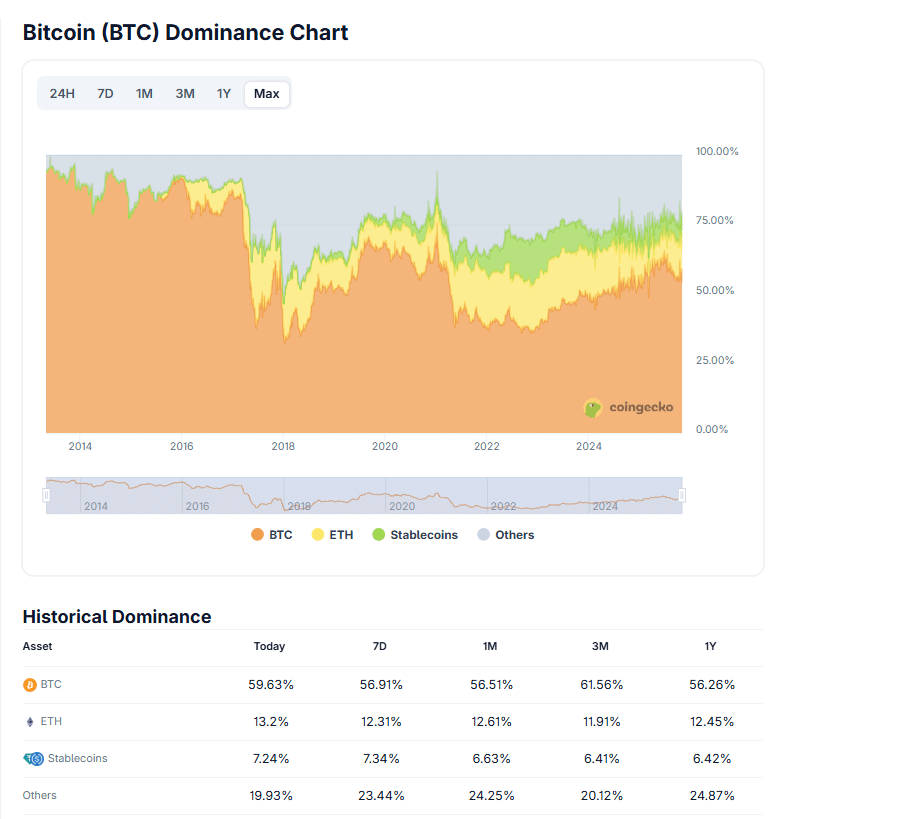

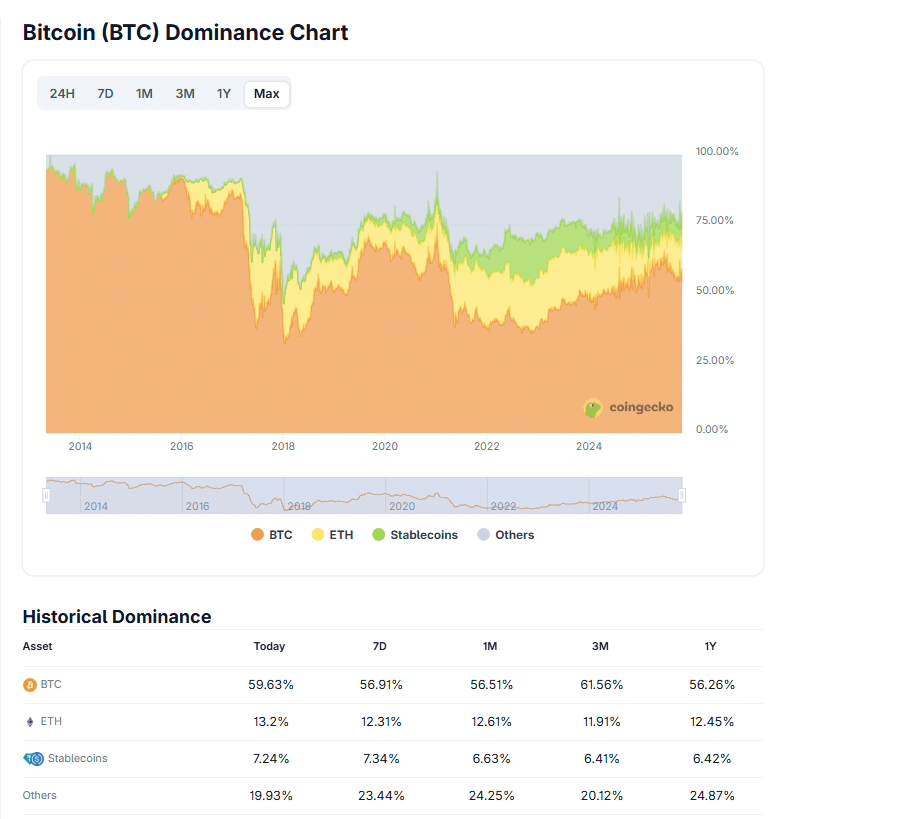

Before that, traders should closely monitor price action. Bitcoin dominance is still above the +59% level as of October 30. It is likely to increase if cryptocurrency prices do not meet the high expectations of late buyers. Meanwhile, the total crypto market cap declined by almost -2% to over $3.8 billion.

(Source: Coingecko)

DISCOVER: Best New Cryptocurrencies to Invest in in 2025

Jerome Powell and the FOMC cut rates as expected

There was a near +100% chance of a rate cut yesterday. Everyone expected the FOMC and central bank to ease policy for the second time this year. And Powell and the team did not disappoint.

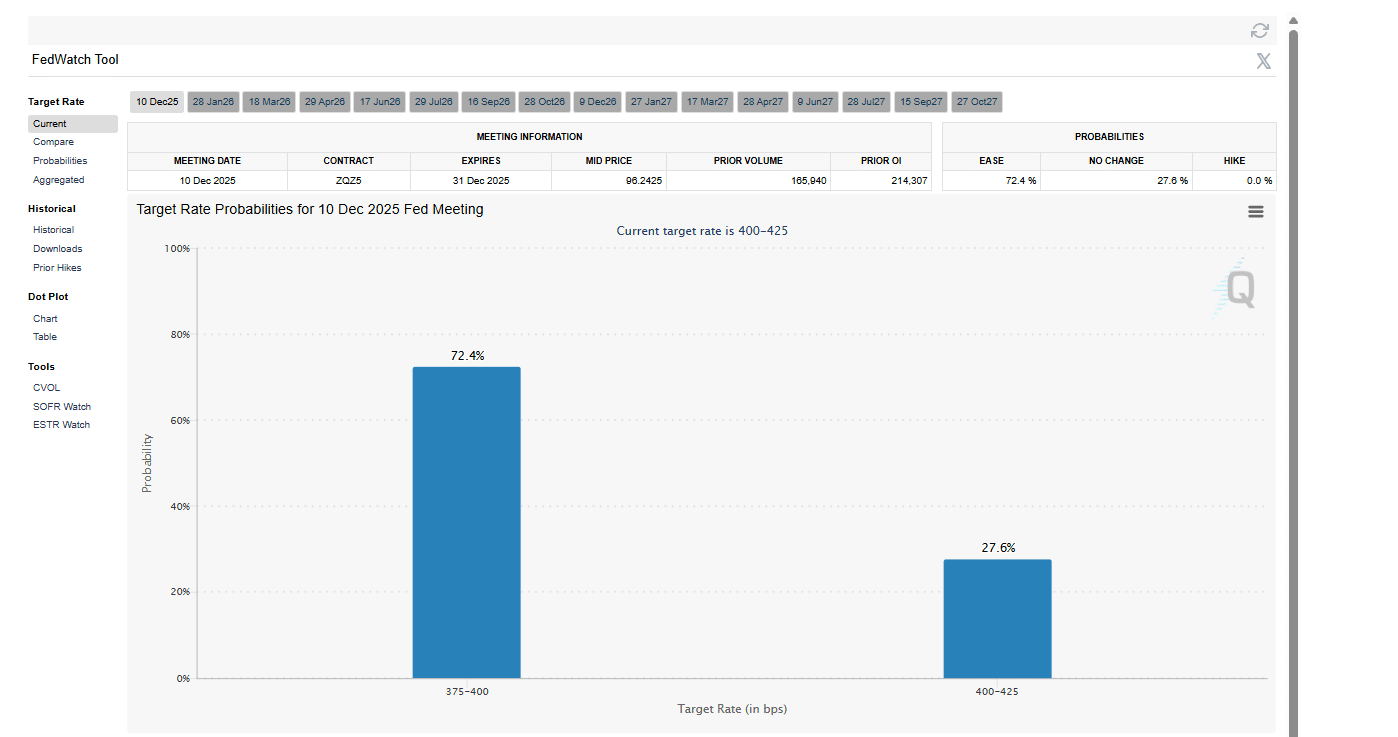

Even with the government shutdown, the central bank cut rates to the expected range of +3.75% and +4%, lower again, allowing more money to enter circulation.

Overall, the FOMC, charged with regulating monetary policy and curbing inflation while monitoring labor market conditions, aimed to support employment, which, unfortunately, has been struggling in recent months.

Their decision to cut rates comes as inflation remains “somewhat elevated”, above the ideal mark of +2%.

DISCOVER: Best Meme Coin ICOs to invest in 2025

What happened? Why did the price of Bitcoin fall?

Here’s the punchline, though.

Although the rate cut was in line with general market expectations, BTC USDT prices initially rose, but that was before Powell’s presser.

That’s when all hell broke loose.

During the press conference, Jerome said the FOMC remained data-driven, as always, but that further interest rate cuts in December were not a “foregone conclusion.”

The decision follows a division among FOMC members, with two dissenting in opposite directions. The Fed chairman added that the central bank would also watch “very, very carefully” changes in the labor market. Still, even if there are positive changes, they won’t rush to cut rates if inflation picks up again.

This statement was hawkish and bad for risk assets, primarily crypto assets, including all 100X pieces.

This surprised all analysts and traders because before this meeting the probability of a rate cut in December stood at over +90%. Since then, it has fallen below +75% and is expected to fall further.

(Source: FMC)

The question now is: what will cause the price of Bitcoin to change?

How the crypto and some of the best Solana coins carry out in the coming days depends on fundamental factors.

Yes, even if the rates are low and easier money could find its way to crypto, the stability of multiple agreements between China and the United States will play a role.

Additionally, institutional flow through spot ETFs will determine how quickly Bitcoin price moves above crucial resistance levels, currently at $115,000 and $120,000.

DISCOVER: 15+ Coinbase Lists to Watch in 2025

If an FOMC rate cut doesn’t move the price of Bitcoin, what will?

- The FOMC cut rates, aligning with market expectations

- Jerome Powell notes inflation still high

- The Fed is in no rush to cut rates again in December

- With the price of Bitcoin falling, will China and Trump stimulate demand?

The article If an FOMC rate cut doesn’t change the price of Bitcoin, what will? appeared first on 99Bitcoins.