Join our Telegram channel to stay up to date with the latest news

The International Monetary Fund (IMF) has warned that the growing adoption of stablecoin could weaken central banks’ control over monetary policy and threaten countries’ financial sovereignty.

Although stablecoin adoption makes payments faster and cheaper for people, “it diminishes the ability of a country’s central bank to control its monetary policy and serve as a lender of last resort.” the IMF declared in a blog post which highlighted the conclusions of a 56-page report on the subject.

The promise offered by stablecoins also comes with the risk that “countries lose control of capital flows,” he adds.

Stablecoins can “rapidly penetrate an economy”

Historically, investors who wanted to hold US dollars, or any other fiat currency other than that of their country, were required to hold cash or open specific bank accounts.

But stablecoins allow anyone to access the underlying asset they represent on-chain, which the IMF says allows cryptos to “rapidly penetrate an economy via the internet and smartphones.”

The cross-border nature of stablecoins could simplify remittances and payments, but also complicate monetary policy and financial stability in emerging markets. A new IMF report explores challenges and opportunities. pic.twitter.com/ERq3MwxPTz

– IMF (@IMFNews) December 4, 2025

“The use of foreign currency-denominated stablecoins, particularly in cross-border contexts, could lead to currency substitution and potentially undermine monetary sovereignty, particularly in the presence of unhosted wallets,” the IMF said.

He cites citizens in regions like Africa, the Middle East, Latin America and the Caribbean, who increasingly hold their money in stablecoins rather than local foreign currency bank accounts. It is often because of concerns about financial instability and even survival, he says.

The IMF also said it is increasingly difficult for central banks to guide their countries’ monetary policy because they do not have accurate data on local foreign exchange accounts.

CBDC struggles to compete with stablecoins

Since stablecoins operate on a distributed ledger and no central third party is needed to process and validate transactions, a central bank would have very little control if the adoption and use of stablecoins continued to increase.

In a bid to reclaim some of the control lost to stablecoins, many central banks have proposed creating their own central bank digital currencies (CBDCs). These tokens are similar to stablecoins, but are issued and held through a central bank. This means that a central bank would also be able to better monitor and restrict transaction activities.

But the IMF warned that if currency-denominated stablecoins gain a foothold in payment services, local alternatives such as a CBDC would struggle to compete.

US dollar stablecoins dominate the market

The stablecoin market has reached around $316 billion this year, according to CoinMarketCap.

It gained momentum after U.S. President Donald Trump signed the GENIUS Act into law, bringing clearer regulations to the United States for the first time.

This clarity has sparked a stablecoin frenzy, with several major traditional financial companies launching their own tokens.

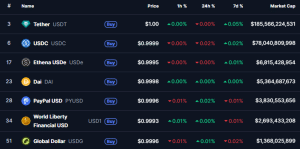

Currently, stablecoins linked to the US dollar represent more than 90% of the market. Tether’s USDT and Circle’s USDC are the industry leaders. Together, these two stablecoins have a capitalization of over $250 billion, according to data from CoinMarketCap.

Top stablecoins by market capitalization (Source: CoinMarketCap)

With the rise of stablecoins and the dominance of dollar-pegged tokens, the European Central Bank (ECB) recently flagged the potential risks of the continued growth of these cryptos.

“Significant growth in stablecoins could lead to retail deposit outflows, reducing an important source of funding for banks and leaving them with more volatile funding overall,” the ECB said.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news