Industry leader Tom Lee explained how the price of Ethereum could reach $12,000 in the coming months. He based his prediction on Bitcoin’s price action and how ETH could match the flagship crypto during a possible rally.

Tom Lee explains how Ethereum price could reach $12,000

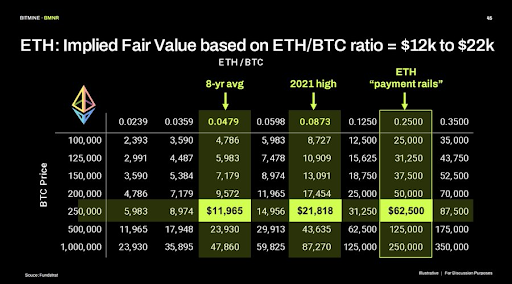

Speaking at Binance Blockchain WeekTom Lee predicted that the price of Ethereum could reach $12,000 while Bitcoin hits $250,000 in the coming months. He explained that ETH can reach the $12,000 target if the ETH/BTC ratio returns to its eight-year average of 0.0479. Lee described this potential rally to $12,000 as a “big step”.

Related reading

Tom Lee further predicted that Ethereum price could reach $22,000 if the ETH/BTC ratio hits its 2021 high of 0.0873. He added that he believes Ethereum will become the future of finance and payment rails. As such, Lee predicted that the ETH/BTC ratio could reach 0.2500, triggering a Ethereum Rally up to $62,500. On a related note, the expert said that ETH at $3,000 is “vastly undervalued.”

Tom Lee also noted that the larger the base, the greater the breakout in Ethereum price. He noted that ETH spent years building a base similar to its current price action before rising from $90 to its previous level. absolute record (ATH) of $4,866. The expert added that if the pattern repeats itself, the next step could be bigger than people expect.

It is worth noting that Tom Lee is the president of BitMine, the largest Ethereum treasury company. According to ETH Strategic Reserve Datathe company currently holds 3.73 million ETH, or just over 3% of the altcoin’s total supply. Lee remains optimistic about the price of Ethereum, although his company suffered an unrealized loss of $3.3 billion on its investment in ETH.

Rally to $62,000 is “ambitious”

Market commentator Description of the Milk Route Tom Lee’s Ethereum price prediction of $62,000 a few months from now is ambitious. The platform stated that a ETH/BTC ratio of 0.25 never happened. The highest level it has ever been is 0.15, and that was during the 2017 supercycle, making that figure less likely today given that market conditions have changed.

Related reading

Tom Lee based his Ethereum prediction on Bitcoin hits $250,000which Milk Road also described as a problem. The market commentator noted that BTC would need to rise by 177% from current prices to achieve this goal. The last time this happened was in 2020 when it went from $7,000 to $19,000 during “Peak mania”. Notably, BTC did not see a 100% gain, even when Bitcoin ETFs launched last year.

At the time of writing, the Ethereum price is trading at around $3,000, down more than 4% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Freepik, graphic from Tradingview.com