Early investors in Bitcoin, Ethereum or even XRP, including VCs and angel investors, are already rich. Bitcoin has increased by more than a million percent over the past decade, while Ethereum, according to some projections, could reach $10,000 before 2030. Solana, XRP and other top 10 cryptocurrencies have already risen several times from their all-time lows.

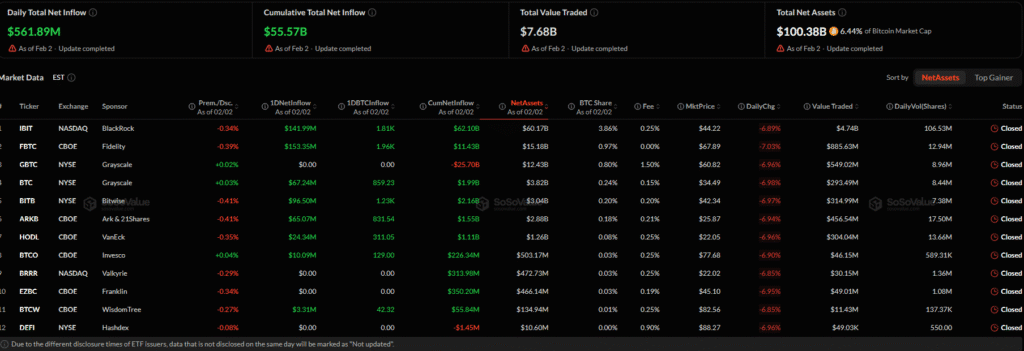

Given this, institutions will always follow the industry, looking for safe ways to make themselves known. While US-approved crypto products are already gaining traction, attracting billions from Wall Street, notable moves have been made in the otherwise restrictive EU. So far, as of early February, spot Bitcoin ETF issuers manage over $100 billion despite massive outflows in January.

(Source: SosoValue)

Recently, ING Germany rolled out crypto ETP trading for retail investors, providing direct exposure to Bitcoin, Ethereum and Solana through regular securities accounts. While the product is definitely attractive, the timing coincides with a period where crypto sentiment has taken a hit. Bitcoin, Solana and Ethereum are trading at ~2026 lows, extending losses from Q4 2025.

DISCOVER: 9+ Best Memecoin to Buy in 2026

What is a Crypto ETP and why does ING offer it?

The fact that ING Germany is issuing a crypto ETP, in partnership with VanEck, for retail investors is no surprise. More and more crypto companies in Europe are offering access to crypto through regulated products rather than exchanges. European banks can now treat cryptocurrencies like stocks or bonds, reducing the learning curve. It also shows how European regulation is reshaping who controls access to digital assets.

Big step forward for European adoption: ING Germany opens the doors of crypto to its 9.5 million customers. As the third largest bank in the world’s third largest economy, their new crypto ETN offerings mark a major milestone for retail access to crypto. pic.twitter.com/Vk8QGvV5cq

– Alouette Davis (@LarkDavis) February 3, 2026

A crypto ETP is a security that tracks the price of a coin without you having to hold it directly. In this arrangement, the bank takes care of custody and reporting. ING Germany can do this because BaFin regulates it as a licensed bank. Retail investors purchase a Bitcoin ETP, Ethereum ETP, or Solana ETP in the same account they use for stocks or ETFs. No wallets. No private keys. Less room for user error.

The ETP is available to trade through an existing ING securities account alongside ordinary shares and ETFs. However, there are certain procedures to follow before trading. For example, before placing an order, the trader must pass a mandatory suitability check to demonstrate understanding of the underlying risks, primarily volatility. Once approved, traders will pay a commission. At the same time, the underlying asset cannot be withdrawn and moved to third-party wallets like MetaMask.

DISCOVER: The best Meme Coin ICOs to invest in 2026

Changing the situation for retail investors in Europe?

The crypto ETP structure reflects the demand seen for spot crypto ETFs and ETPs from companies like VanEck and Bitwise. Big players that get in early typically signal where regulated money looks safest. This launch removes a common fear among beginners: the risk of custody. After the collapse of exchanges, mainly FTX, during the last bear market of 2022, many people decided that crypto was not worth it. A bank-backed crypto ETP directly addresses this concern.

It also integrates cryptography into existing European regulations. As an ETP is legally structured as a transferable security, it falls under the long-standing framework of the Markets in Financial Instruments Directive (MiFID II). The rules here are simple: if the offering, in this case ING’s, is traded on a stock exchange, then it will be governed by traditional securities laws, such as the German Banking Act, rather than MiCA. Traders will benefit from the protections of a regulated brokerage account, which are often more robust than early-stage crypto regulations.

By using ETPs, ING offers a product that integrates seamlessly into an institution’s risk management and tax reporting software. This makes sense because institutions are often legally prohibited from holding “raw” tokens because they cannot easily audit or secure them. And this trend is increasing; So far, banks like BPCE in France and Commerzbank in Germany are following ING’s lead.

DISCOVER:

- 16+ New and Upcoming Binance Announcements in 2026

- 99Bitcoins State of the Crypto Market Report for Q4 2025

Follow 99Bitcoins on X For the latest market updates and subscribe on YouTube for daily market analysis from experts.

The post ING Germany Opens Door to Bitcoin, ETH and Solana ETPs appeared first on 99Bitcoins.