The recent crash in the cryptocurrency market cost US President Donald Trump and his family millions of dollars. During Donald Trump’s second presidential term, digital assets significantly changed his family’s wealth and portfolio. But the perils and instability associated with cryptocurrency investments are now being felt by Trump and his supporters.According to a Bloomberg report, the Trump-associated memecoin has seen a whopping 25% decline since August. The Bitcoin mining investment owned by Eric Trump has fallen approximately 50% from its highest point. Additionally, Trump’s social media company, which began accumulating Bitcoin this year, is trading at near-record highs!The decline is part of a broader slowdown in the cryptocurrency market that has wiped out more than $1 trillion in value across digital assets. The Trump family’s net worth has fallen from $7.7 billion to $6.7 billion since the beginning of September, according to the Bloomberg Billionaires Index. This decline is mainly due to the expansion of their cryptocurrency investments.

Trump family optimistic about crypto

Eric Trump maintains his bullish stance on cryptocurrency. He continues to advocate for investment, especially during periods of market downturn.Eric Trump told Bloomberg: “What a great buying opportunity. People who buy the dips and embrace the volatility will be the ultimate winners. I have never been more optimistic about the future of cryptocurrency and the modernization of the financial system.”Since its launch in 2009, Bitcoin has shown resilience despite numerous significant declines, subsequently regularly reaching new highs. The Trump family’s cryptocurrency investments are advantageously structured. Although they own declining crypto assets and stocks, they obtain income through various industry engagements.Take their co-founded company, World Liberty Financial, as an example: even though the value of their token holdings has declined, they retain rights to revenue from token sales, regardless of market prices.Jim Angel, professor of finance at Georgetown University, observes: “Retail investors can only speculate. Not only can the Trumps speculate, but they can also create tokens, sell them, and make money from these transactions. »

Here’s how the Trump family’s crypto-related holdings are doing:

Trump Media sees $800 million loss in value

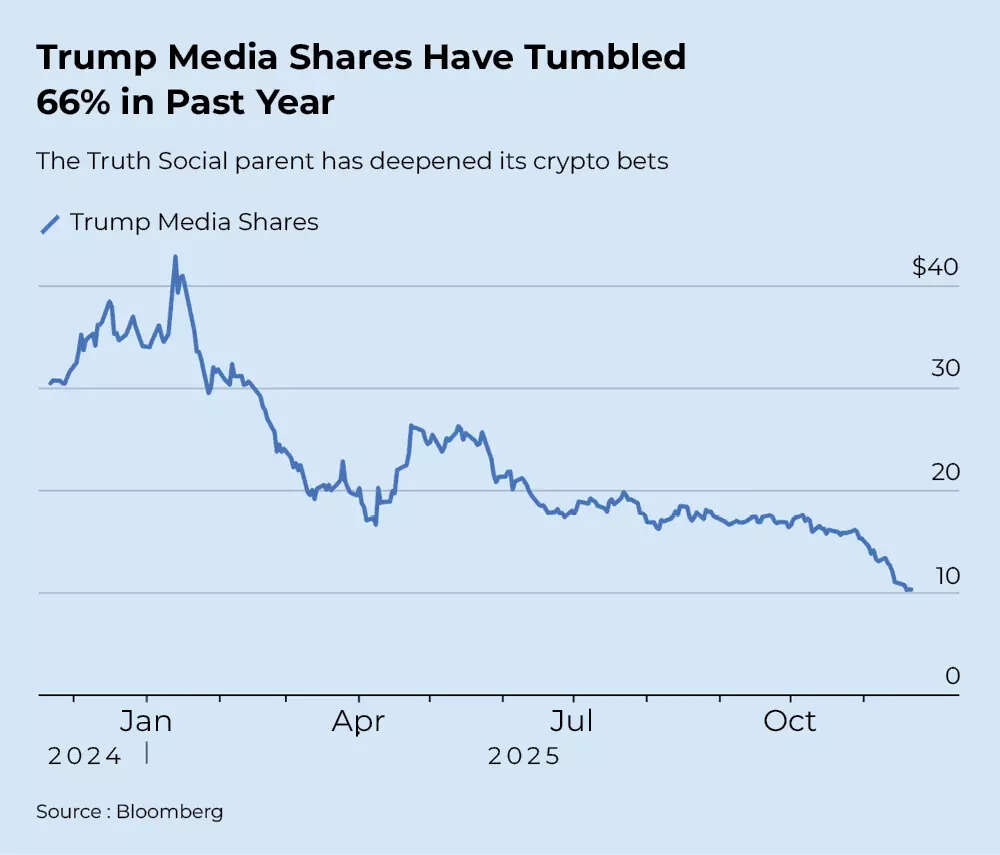

Trump Media & Technology Group Corp., owner of Truth Social, saw its shares fall to an all-time low on Wednesday. The decline appears partly linked to their recent cryptocurrency investments, according to the Bloomberg report.The value of Trump’s stake has declined by about $800 million since September. His holdings, managed through a trust under the supervision of Donald Trump Jr., make up the largest share of the company.

Trump Media shares have fallen 66% over the past year

The unprofitable company ventured into various sectors, including cryptocurrencies. Their investment includes approximately $2 billion in Bitcoin and related securities, as reported in July.Their Bitcoin portfolio of around 11,500 coins, acquired at around $115,000 per coin, is currently at a 25% deficit. Additionally, they invested in CRO tokens from a Singapore-based exchange. Their CRO holdings, valued at $147 million in September, have since depreciated by about 50%.The company is also developing Truth Predict, a sports and politics betting platform, through collaborative efforts with other companies.

World Liberty Financial: $3 billion paper loss

The WLFI token, the primary cryptocurrency offering from Trump family-backed World Liberty Financial, has seen a significant decline from 26 cents in early September to around 15 cents.The Trump family’s WLFI token holdings, previously valued at nearly $6 billion, have fallen to around $3.15 billion.Alt5 investors suffered considerable losses, with the stock’s value falling by around 75% following the announcement.The Trump family’s Alt5 investment through World Liberty has declined by approximately $220 million. However, they maintained profitability, receiving approximately 75% of the proceeds from the World Liberty token sale, totaling $500 million from the Alt5 transaction, according to Bloomberg calculations. Additionally, they earned around $400 million from previous WLFI token sales.“Crypto is here to stay,” a World Liberty Financial spokesperson said in a statement. “World Liberty Financial has a long-term belief in the rapidly maturing technologies underlying digital assets, which we believe will radically improve financial services.”

Shares of Bitcoin Buying Company Struggle After 2025 Peak

American Bitcoin: a drop of $330 million

About two months after Trump’s presidential inauguration, his family embarked on a new cryptocurrency initiative. Eric and Donald Trump Jr. has entered into a partnership with cryptocurrency company Hut 8 Corp., establishing complex business agreements. Hut 8 brought its Bitcoin mining infrastructure for a majority stake in a newly formed company, American Bitcoin Corp.Eric Trump owns an approximately 7.5% stake in American Bitcoin, currently listed on Nasdaq as ABTC. Donald Trump Jr. owns a smaller, unspecified share of the stock.ABTC shares reached their highest value at $9.31 in early September, valuing Eric Trump’s holdings at approximately $630 million. Subsequently, the stock price fell more than 50%, resulting in a reduction of more than $300 million in family assets. This business represents one of the most notable cases where the Trumps have generated significant cryptocurrency wealth through their recent business activities.Investors who acquired ABTC shares during the IPO experienced a 45% depreciation.

Trump Memecoin: loss of $120 million

The cryptocurrency associated with Trump saw a significant decline after its weekend launch during the presidential inauguration. Its value has fallen by around 25% since the end of August.The precise family farms remain unclear. Analysis by Gauntlet, which specializes in risk assessment, identified digital wallets linked to the creation of the cryptocurrency containing nearly 17 million tokens shortly after its launch. These wallets transferred an additional 17 million tokens to cryptocurrency exchanges. A subsequent 90 million tokens became available in July. The Bloomberg Billionaires Index attributes 40% of the total to the Trump family, based on its stake in World Liberty Financial.At current market rates, these holdings are valued at approximately $310 million, representing a reduction of $117 million since the end of August.The Trump family’s symbolic position has expanded significantly, according to the index’s calculations. Some tokens, initially banned from trading and held by founders and insiders, become available on a three-year release schedule.After the July release, approximately 90 million additional Trump tokens became available to insiders, with the Bloomberg Wealth Index attributing approximately 40% to the Trump family. These newly accessible tokens are valued at approximately $220 million, resulting in an overall increase in the family’s holdings. Information regarding token sales by the Trump family since July is still not available.

The Trump-associated memecoin has seen a whopping 25% decline since August. (AI Image)

The Trump-associated memecoin has seen a whopping 25% decline since August. (AI Image)