- Investors withdrew $ 795 million in cryptographic funds last week

- Only XRP and multi-network funds experienced a modest demand, while the others were faced with sales

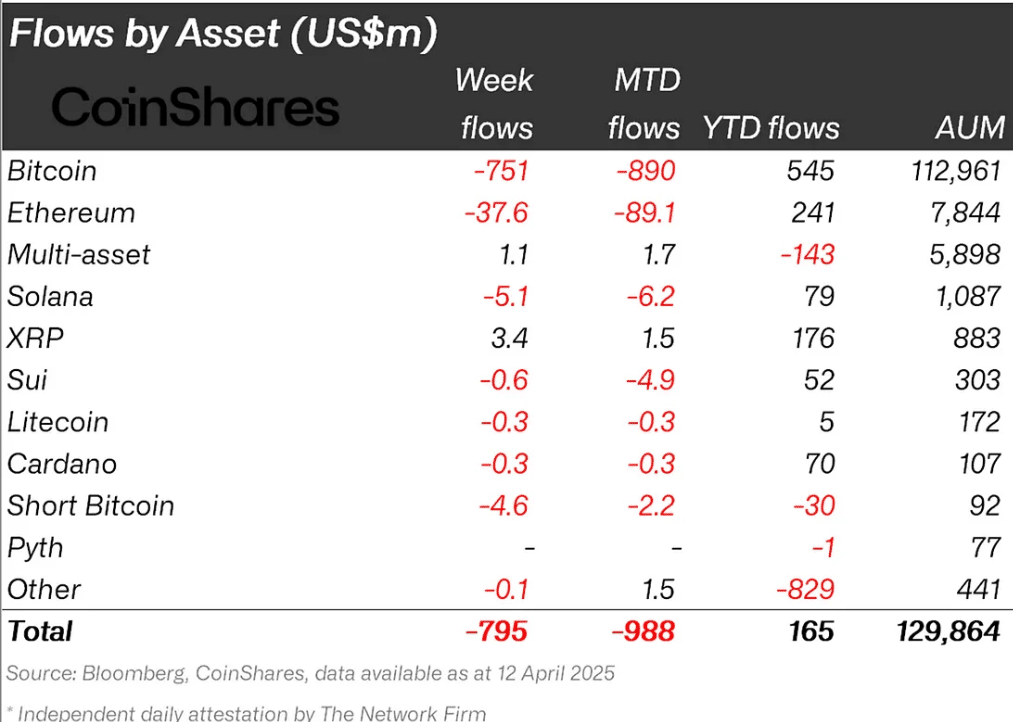

Investors pulled $ 795 million in cryptographic funds last week, marking the third week of sale. In fact, aThe Cording to Coinshares report of active flows, Bitcoin (BTC) led the outings with $ 751 million, while Ethereum bled $ 37.6 million. The report linked the prolonged decline to pricing uncertainty.

“Digital Asset Investment Products experienced a 3rd consecutive week of outings last week, totaling $ 795 million, while recent tariff activity continues to weigh the feeling towards the asset class.”

Source: Coinshares

Investors prefer XRP

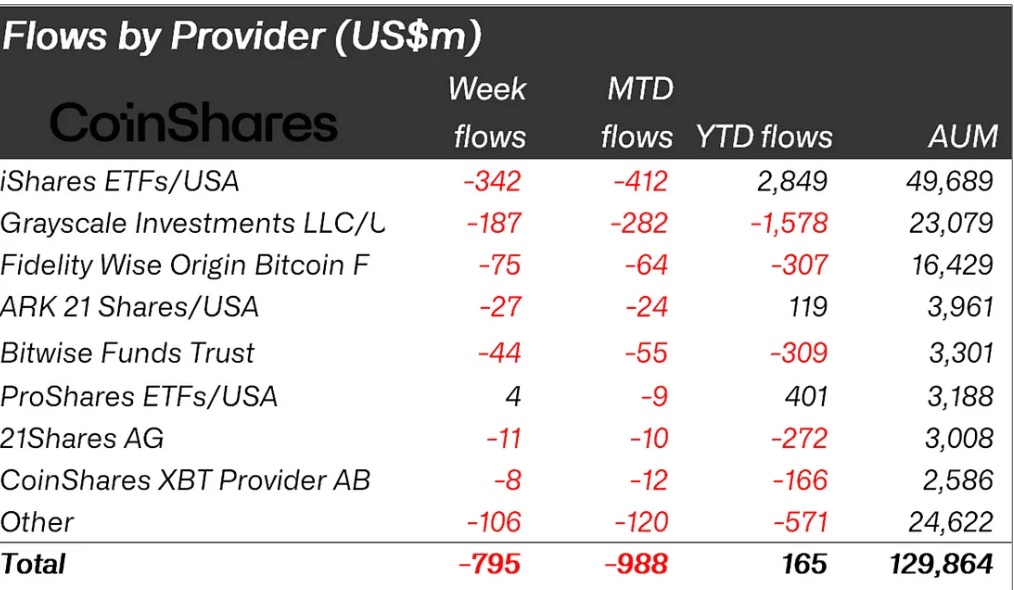

The Ishares ETF products from Blackrock have recorded the highest withdrawals from investors (sale). According to the report, the FNB BTC of Ishares and the ETH ETH, collectively, saw $ 342 million in outings last week.

From the point of view of one month on the date of the month (MTD), Blackrock has bled $ 412 million, almost half a billion in the past two weeks.

Source: Coinshares

Graycale products followed closely with $ 187 million in outings, almost half of the BlackRock dumping ground.

On the Altcoin Front, the products based in Solana ranked third after ETH in outings. The products have seen a sale of $ 5.1 million. Surprisingly, funds based on XRP and multi-active funds were the only aberrants when last week’s decline.

The report noted that XRP saw $ 3.4 million entries last week, and that global MTD flows amounted to $ 1.5 million. In simple terms, investors preferred XRP and Multi-Asset (Crypto Index ETF) to individual assets like BTC or ETH in the first half.

In addition, the above -mentioned idea was supported by record entrances In the new ETF 2x Terkium XRP.

It should be noted, however, that some macro-analysts have planned that the decline could continue. Quinn Thompson, founder of the Macro-axé hedge fund on Lekker Capital, declared That a recent speech by the president of the Fed Jerome Powell will be bad for risk assets in May, including the crypto.

“With the exception of a collapse of economic data before that, they (Powell and Governor Waller) prefer patience in the midst of high uncertainty. This is good for obligations but bad for risk assets. ”