Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Ethereum has experienced an essential increase above $ 2,000, a key psychological and technical brand that the bulls have had trouble recovering since March 10. This escape triggered optimism on the market, but the momentum was short -lived, while ETH quickly withdrew below the level and could not confirm a solid socket. Analysts are largely suitable that a strong and supported movement above $ 2,000 is essential for Ethereum to launch a wider re-recovery rally.

Related reading

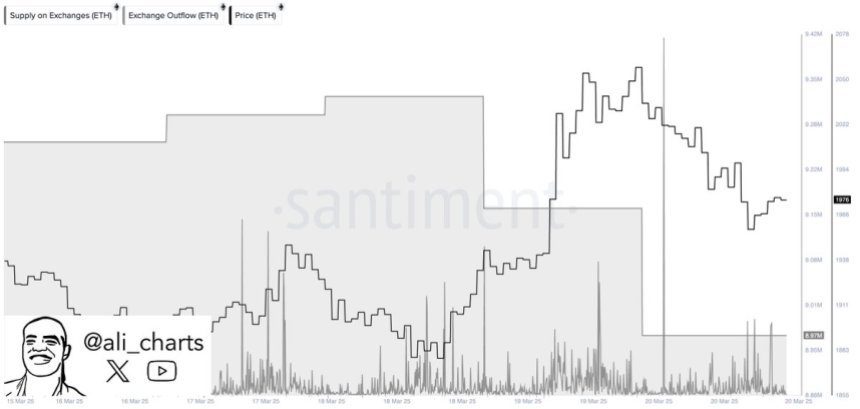

Despite the hesitation of the resistance, data on the chain show signs of increasing trust in investors. According to Santiment, investors have withdrawn more than 360,000 ETH from centralized exchanges in the last 48 hours. This change is often interpreted as a bullish signal, suggesting that large holders move their assets to private wallets, perhaps in anticipation of higher prices.

Meanwhile, the wider macroeconomic landscape continues to apply pressure. Trade tensions and unpredictable political decisions of the US government have weighed heavily on crypto and traditional markets, intensifying the volatility and uncertainty of investors. However, the latest Ethereum exchange releases refer to a change in potential trend – the one that could promote accumulation and prepare the ground for the next major movement, provided that the bulls can recover and maintain above the $ 2,000 threshold.

Ethereum faces a critical test in the middle of exchange outings

Ethereum has lost more than 57% of its value since mid-December, going from a summit of around $ 4,100 to recent stockings nearly $ 1,750. This strong correction has created a difficult environment for bulls, which failed to recover and have higher price levels.

Now the $ 2,000 brand is a psychological and technical battlefield. If Ethereum can firmly establish support above this level, it could provide the basis of a recovery gathering. However, the fact of not doing it would probably cause an additional drop and strengthen the downward trend.

Related reading

The landscape of the current market fight against uncertainty. On the one hand, continuous macroeconomic winds – trade tensions, inflation problems and political movements of the United States government – have weakened the confidence of investors and the volatility conducted by investments between risk assets. On the other hand, there are signs of potential recovery and accumulation.

Top Crypto analyst Ali Martinez shared health data, revealing that investors have withdrawn more than 360,000 ETH from centralized exchanges in the last 48 hours. Historically, large -scale withdrawals are considered to be a bullish signal, as they suggest that investors move assets in the storage of cold for long -term outfit rather than preparing to sell.

This decision could indicate growing confidence among large holders and report the first stages of a new accumulation phase – Ethereum supplied by Ethereum can maintain more than $ 2,000.

The price is stable below $ 2,000

Ethereum is currently negotiating at $ 1,960 after briefly attempted to recover the $ 2,000 bar during yesterday’s session. Psychological and technical resistance at $ 2,000 remains a crucial barrier that the bulls must overcome to change the momentum of the market in their favor. Despite a small rebound in recent hollows, Ethereum had a hard time gaining ground in a persistent uncertainty of the market.

The bulls must push ETH above $ 2,000 and recover higher levels such as $ 2,150 and $ 2,300 to confirm the start of a recovery phase. A decision supported above these levels would not only indicate a reversal of potential trend, but could also attract investors put aside in the market. Until it happens, Ethereum remains vulnerable to continuous pressure.

Related reading

If the bulls do not exceed the resistance of $ 2,000 in upcoming sessions, Ethereum could lose support at the current levels and review the demand zones of less than around $ 1850, even $ 1750. With the wider cryptography market still under the influence of macroeconomic volatility and weak feeling, the coming days should be essential for ETH’s short -term management. A decisive movement above or below this key beach will probably set the tone to the next main price action.

Dall-e star image, tradingview graphic