In a world where financial security is more fragile than ever, how do traders react?

This analysis plunges deep into the way professional traders think and act during critical moments.

Hello

Go for 3 minutes ⏰ Read this educational material.

🎯 Analytical overview on bitcoin:

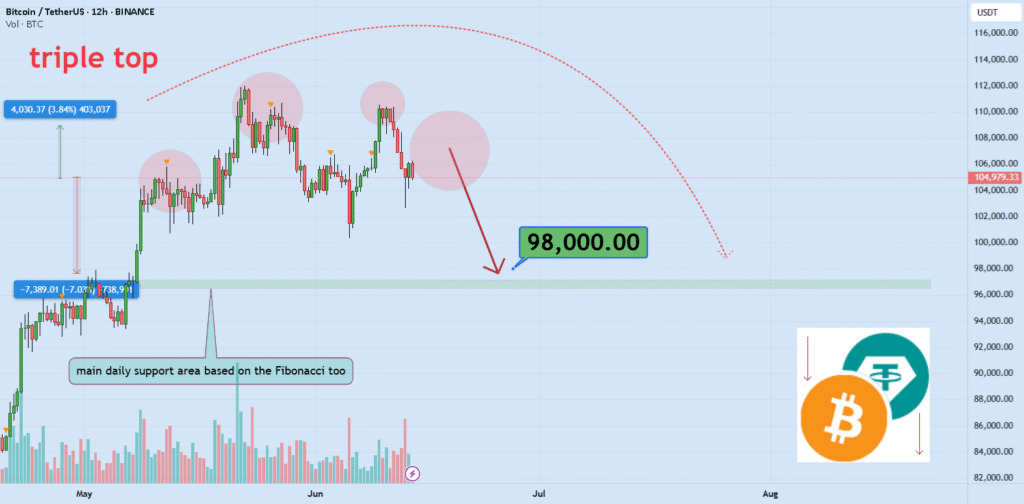

Bitcoin has a shock focused on fear in the middle of geopolitical tensions, triggering Potential volatility down to $ 98,000 level 📉. Despite this feeling of risk, the broader structure of the market remains intact and I maintain a bias bruise. Recovery of key support zones could open the way to a renewed rupture Above $ 100,000 in mid-term.

NOWLet’s dive into the educational section,

🧠 Fear, security or opportunity? Commercial psychology in crisis 🧨

The markets do not move according to the headlines – they move according to what the crowd feels of these titles. Political tension triggers emotional responses, in particular the sale of panic.

However, experienced traders have opportunities while others flee.

In such moments, two emotional extremes dominate:

🔸 Fear of losing capital (Fud)

🔸 Cupidity to grasp a rare opportunity (FOMO)

Both are dangerous if they are uncontrolled. Tools such as the RSI and FEAR & GREED index (via external APIs) can provide approximate estimates of the market feeling and potential turns.

📊 practical trade tools to analyze the markets focused on the crisis 🔍

When global tension increases, markets reflect collective emotion as a mirror. During uncertain moments, intelligent traders are based on tools that transform raw data into sharp information. TradingView provides several features that become extremely useful in times of strong uncertainty:

1. Crypto volatility index proxy (using ATR + Bollinger strips)

These indicators help detect the moment when the market is more motivated by fear than logic. They show increasing levels of volatility as tensions increase.

2. Sensation indicators – Funding rate and long / short ratios

These measures, drawn from the main exchanges, show whether the traders are too optimistic or lower. A sudden imbalance usually suggests the expectations of initiates or rare news.

3. Dxy and Gold (Xauuusd) side by side with BTC

The analysis of Bitcoin’s performance alongside the USD and gold gives an overview of the question of whether investors are at risk or in search of crypto as a cover.

4. Volume -based indicators – OBV profile and volume

Although the titles can lie, the volume does not do so. These tools highlight areas of serious purchase / sales interest and help identify where the smart money between or spell.

5. Multi-Notes layout function

TradingView allows you to analyze several assets together – BTC, gold, oil and stock indices like S&P 500 – on a single screen. Perfect for understanding the flow of macro-spaces during geopolitical events.

💣 Interconnected markets during regional conflicts 🌍

Crypto often acts as an asset at risk in global crises. If traditional markets fall, Bitcoin can follow – unless it is considered a safe refuge.

This is why watching the graphics Dxy, Gold and Oil alongside BTC is crucial.

Understanding these correlations using the tradingView comparison features gives you a better idea of the place where capital circulates during uncertain times.

⏳ What merchants should focus on crisis mode 💼

1. Concentrate on graphics confirmations, not the media threshing.

2. Use a multidimensional analysis with tradingView.

3. Pray more than ever risk management.

4. Money is a position. Sometimes the best movement is not a movement.

5. Always have a backup scenario – no analysis is guaranteed.

📌 Final advice:

When the titles play with your nerves, the data becomes your best ally.

With the right tools and a disciplined state of mind, traders can navigate even with confidence the most temporary markets.

The market rewards calm, not reckless.

✨ Need a little love!

We put so much love and time to bring you useful content and your support really makes us move forward. Do not be shy – make a comment below. We would be delighted to hear you! 💛

A big thank you,

Crazy whale 🐋

📜Arrify Do not forget to do your own research before making investment decisions. Also, don’t forget to check the warning at the bottom of each message for more details.