On Sunday, November 2, tech billionaire Elon Musk renewed his warning about the US fiscal outlook. He said the federal debt had become so large that it could not be resolved without a major increase in productivity.

“If AI and robots don’t solve our national debt, we will be toast,” Elon Musk warned, sparking new concern that US finances are heading towards a breaking point.

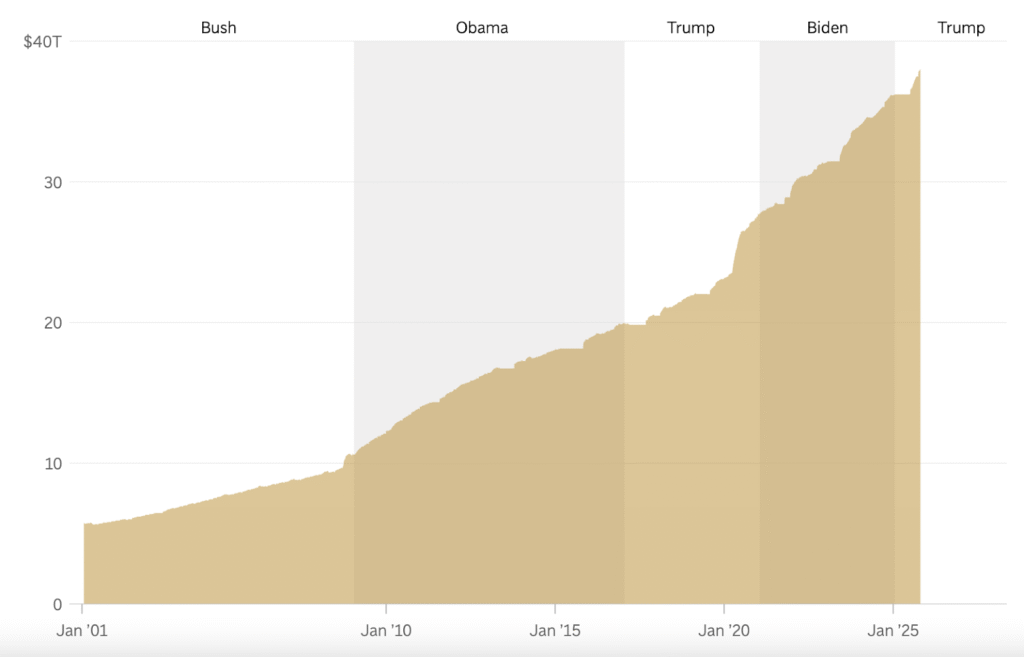

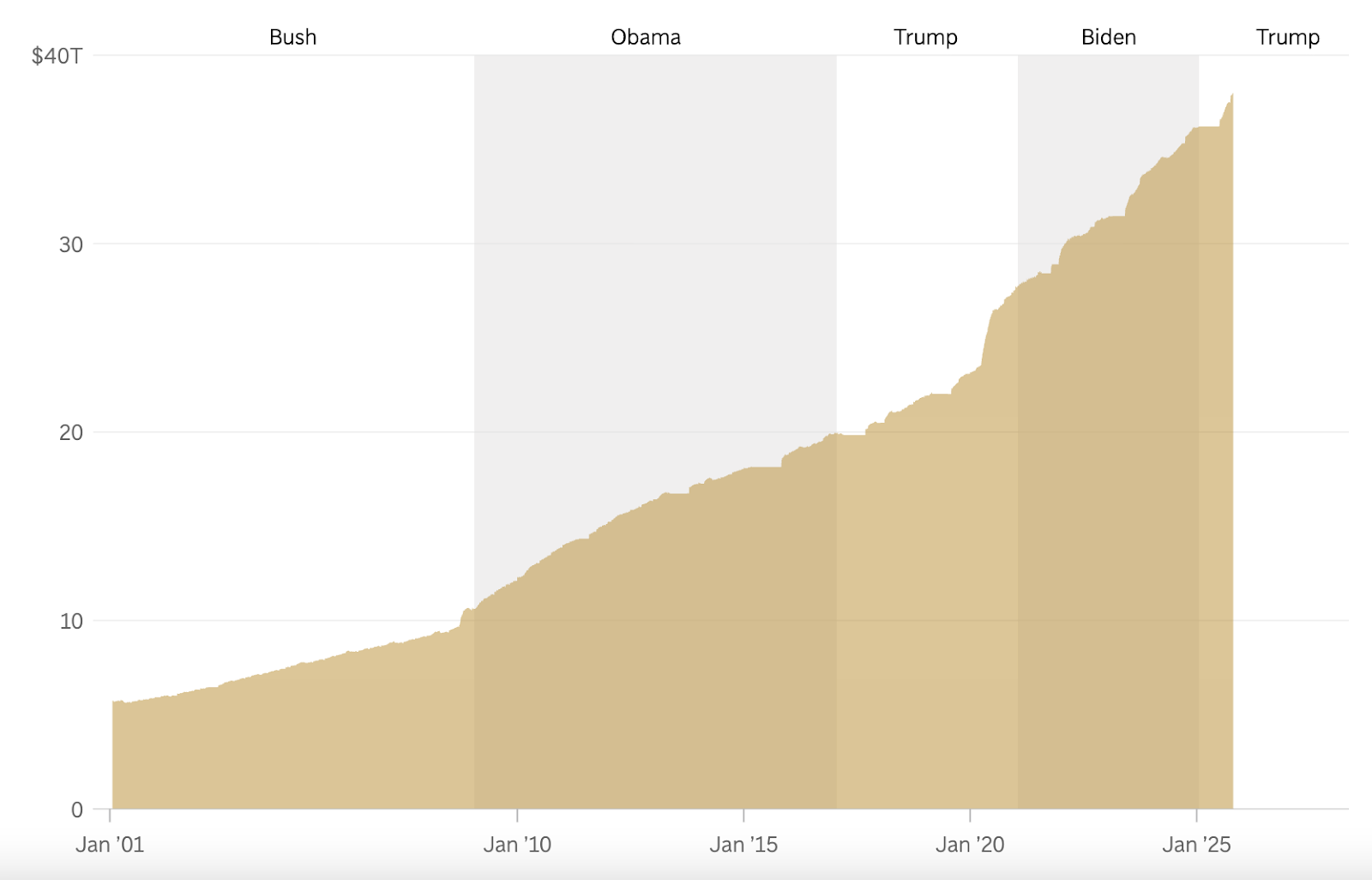

His comment resurfaced in new coverage of a recent podcast, at a time when the national debt exceeds $38 trillion and interest costs remain high.

It rose from $37 trillion in August to $38 trillion on Oct. 22, the fastest increase of $1 trillion outside of the pandemic period and comes during an ongoing federal shutdown.

US government data watch total public debt reached approximately $38.11 billion from October. 30, according to the Treasury’s “Debt to the Penny” database.

(Source: Congressional Budget Office)

EXPLORE: Best New Cryptocurrencies to Invest in in 2025

Does Issuing US Dollar Debt Protect America From Bankruptcy?

The deficit for fiscal year 2025 was about $1.8 trillion, according to Congressional Budget Office estimates.

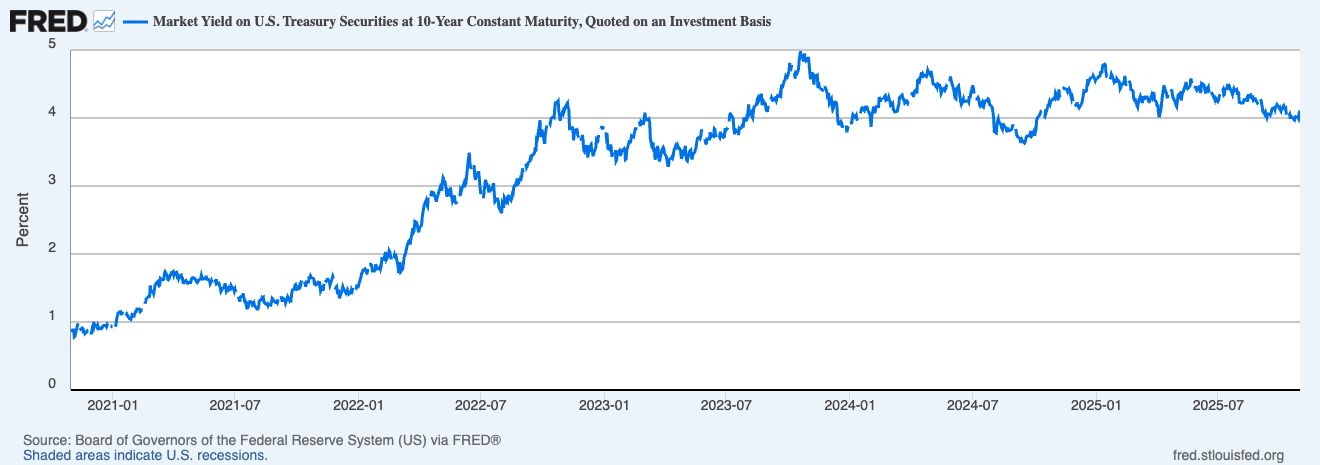

A growing part of the problem is interest. Budget analysts say those payments have at times matched or exceeded some of the nation’s largest programs over the past two years.

The Committee for a Responsible Federal Budget noted that interest costs have exceeded spending on national defense and Medicare through much of fiscal year 2024, and current tracking to show interest costs approach $1 trillion in 2025.

The 10-year Treasury yield ended last week near 4.1%, based on the Fed’s constant-maturity bonds. data.

(Source: Fred)

The spread between 10-year and 2-year yields is now slightly positive after a long reversal. Both suggest that borrowing will remain expensive even if the economy slows.

The Congressional Budget Office’s latest monthly review estimates the fiscal 2025 deficit at about $1.8 trillion. This represents about 6% of U.S. GDP and remains little changed from fiscal 2024, even after accounting for revenue and tariff changes.

Longer term CBO forecast indicate that federal debt held by the public will increase from about 100% of GDP in 2025 to about 107% by 2029. The report warns that this share will continue to rise if current laws remain in effect.

Critics say Musk is simply saying what bond markets are already worried about: Interest costs are definitely higher and Washington’s chances of stabilizing the balance sheet are diminishing.

Others argue that the United States is not on the verge of bankruptcy because it issues debt in its own currency and still benefits from strong global demand. Still, they say the country needs a credible plan to slow borrowing growth.

EXPLORE: Next 1000X Crypto – Here are 10+ crypto tokens that can hit 1000x this year

The article Is America on the Verge of Bankruptcy? Elon Musk Says US Has No Way to Solve Debt Crisis appeared first on 99Bitcoins.