- VanEck Analysts Believe BTC Could See Strong Rally

- Analysts cited strong network activity and lower funding costs in BTC futures contracts

According to VanEck’s monthly report on Bitcoin (BTC)The world’s largest digital asset has shown remarkable resilience in recent times. In fact, it is now mirroring its previous market recoveries, he said.

VanEck analysts Mathew Sigel and Nathan Frankovitz, note that strong BTC network activity and lower future funding costs could be signs of a likely strong recovery.

“Bitcoin network activity remained robust with an 83% increase in Ordinal registrations, while Bitcoin futures funding costs fell, reflecting an appetite for risk seen in previous market rallies.”

BTC funding cost reflects May and July rallies

It is worth noting that BTC funding rates (fees paid by traders to hold perpetual futures contracts) fell to similar levels during the May and July rallies.

“Over the past 30 days, the annualized cost of funding for Bitcoin futures contracts over the 7-DMA period has declined from ~11.6% to ~8.8%, a relative decline of ~24%. These levels indicate a risk appetite similar to that seen during market rallies following BTC price declines of over 20% in early May and July of this year.”

Despite the positive situation of BTC, the recent drop in August reduced addresses with profits by about 9%. Overall, BTC users with unrealized profits were 84%, according to the report. The rest of the users in losses were mainly short-term investors.

However, analysts noted that the recent declines were normal retracements during BTC bull markets.

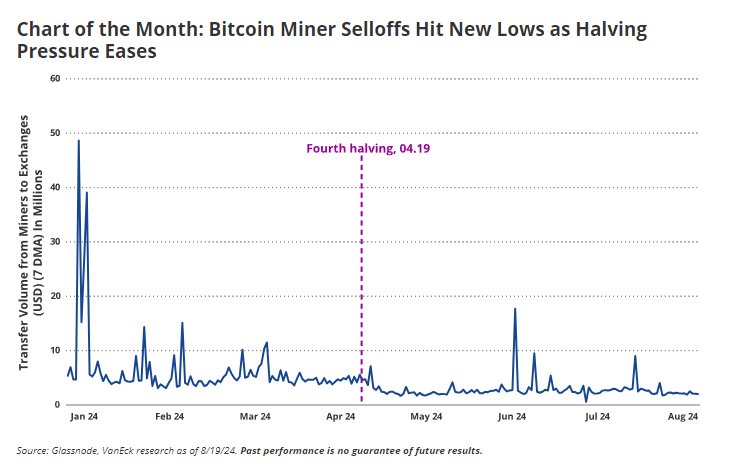

Additionally, the pressure from BTC miners has eased, as evidenced by the decline in miner sales.

“Miner transfer volumes to exchanges have fallen 21% over the past 30 days, suggesting a stabilization on the part of miners after their post-halving sales increased significantly in June and July.”

Source: VanEck

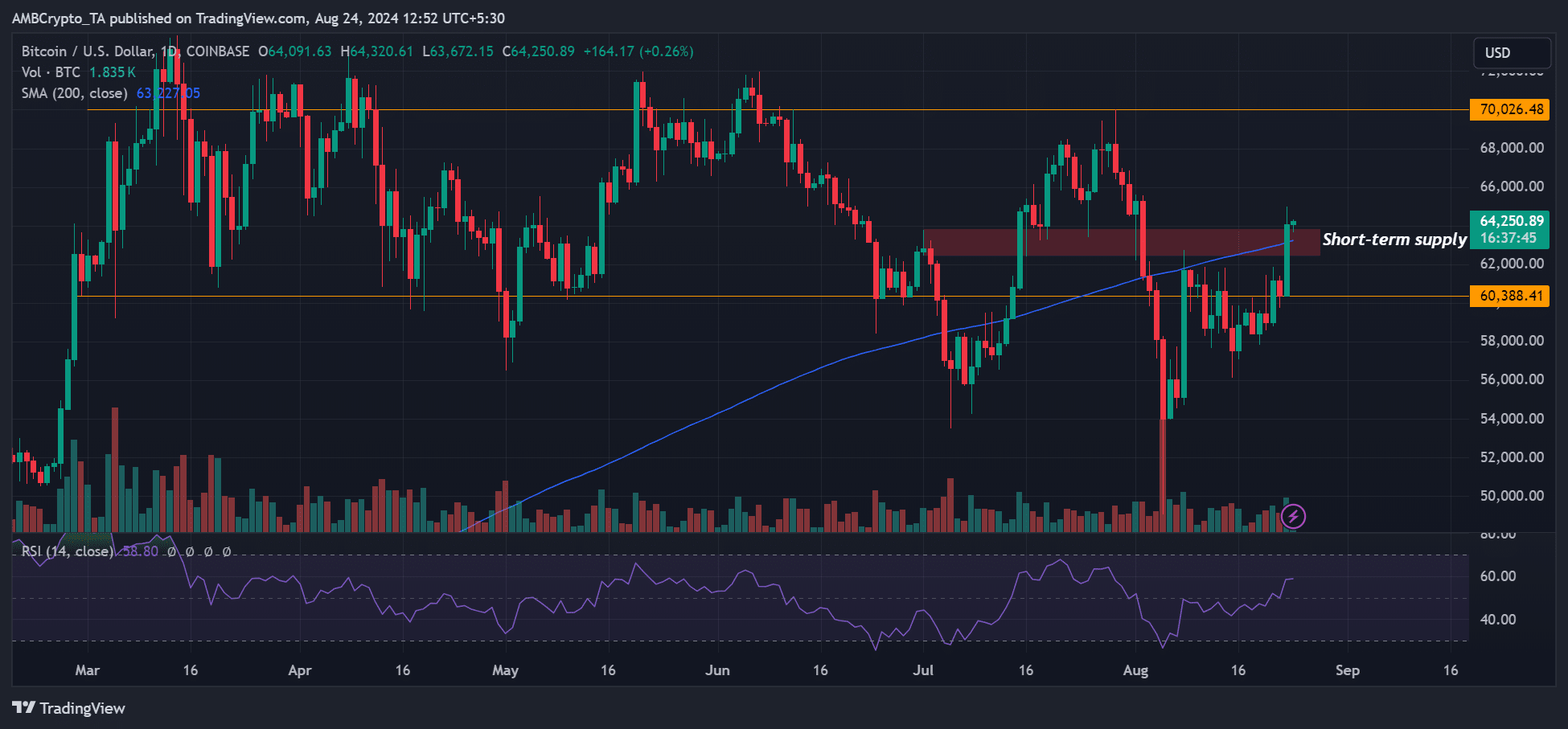

At the time of writing, Bitcoin’s higher time frame chart was bullish after breaking above the short-term supply zone at $63,000 and reclaiming the 200-day simple moving average (SMA).

Source: BTC/USD, TradingView